SVB echos proceed. In the United States, the FRA/OIS spread goes to an oblique factor and also requires to relax to aid create broader tranquility. United States monetary problems have actually tightened up significantly therefore of every one of this. This works for the Fed, yet the Fed would certainly no question like the system to feel and look much safer. United States is much less appropriate – the system is essential in the meantime

The FRA/OIS Spread Goes To a Factor of Susceptability; Punctuation Problem if it Does not Tranquil

The United States 3mth FRA/OIS spread increased bent on 60bp the other day, it’s best given that the pandemic. However it is no place near as vast as it reached throughout the Great Financial Situation a years and also a fifty percent earlier, therefore much there is no significant panic below. The FRA/OIS spread has actually remained in the 40-50bp location on lots of events over the previous years as a matter of fact. Still it’s a market inconsistency versus the really limited FRA/OIS spread seen in current looks for. We mentioned as such a limited spread suggested that the Fed can certainly supply a 50bp at the March conference, as the system was taking it rather comfortably. That’s plainly altered following the Silicon Valley Financial institution collapse.

Currently the FRA/OIS spread remains in region where the system is under some stress and anxiety, or a minimum of under viewed stress and anxiety

Currently the FRA/OIS spread remains in region where the system is under some stress and anxiety, or a minimum of under viewed stress and anxiety. It stays to be seen whether there is a product broader virus in the tiny and also local financial industry in the United States. Absolutely there was a highly associated tumble in the efficiency of supplies because industry the other day, consisting of some outsized relocate specific names. Until now there has actually not been one more real collapse, neither worldly proof there’s one coming. However its very early days. Re-scrutiny of quarterly outcomes is continuous currently, particularly offered the clear knowledge proof from the SVB results that there were prospective problems there.

On The Other Hand, the Federal Home Mortgage Financial institution System is readied to elevate over US$ 80bn in temporary financial obligation, normally used as a way to aid fortify down payment deficiencies for United States financial institutions. The anxiety is that the genesis of this is down payment discharge stress for some financial institutions; the smaller sized ones specifically. Over the weekend break, the Fed, Treasury and also regulatory authorities handled to stem this threat by shielding depositors, a minimum of in SVB and also Trademark Financial Institution, and also there is a ramification that all down payments remain in truth secure, particularly offered the covering remarks made by Head of state Biden.

Component of the marketplace panic is counterproductive

Component of the marketplace panic is counterproductive, and also most likely shows a suggested problem originating from the really quick and also considerable activity originating from the Treasury and also Fed. The reasoning below is they have to have been stressed sufficient to require activity taken. If we experience the remainder of this week and also there is absolutely nothing else to see, after that this entire point will likely cool down. Enjoy the FRA/OIS spread as a recurring scale of system threat. Conversely, must the FRA/OIS spread stay raised it recommends that the system stays delicate and also prone, also if still practical.

The Collapse in 2Y Treasury Returns Emphasizes the Significant Change in Fed Walking Assumptions

Resource: Refinitiv, ING

Monetary Problems Have Actually Tightened Up Substantially; Much Less Immediate Stress to Trek

Significantly, the largest influence up until now has actually been a product firm in monetary problems. Although market prices have actually dropped substantially, which loosens up monetary problems, the widening in debt spreads and also the similarity the FRA/OIS spread has the contrary result, which has actually controlled. United States monetary problems are currently as limited as they have actually been throughout the price treking cycle up until now. In a manner this is even more impactful than the distribution of a huge rates of interest walk.

No requirement for a walking today if the weak system is revealing susceptability

The marketplace has undiscounted walks in the coming months. A 25bp walk in March is marked down with a 60% possibility, yet in truth not totally marked down till the May conference. From there, the marketplace is marking down cuts, beginning with a minimum of a 25bp cut from the July conference. The return is back listed below 4% in tandem. Incredibly this had actually damaged over 5% just a week earlier. It’s currently at it’s least expensive given that September in 2015, yet the fed funds price is greater by 150bp ever since. Much less remarkable is the, which is back in the 3.5% location we went to just a month earlier.

The positive side is that the remarkable dis-inversion of the contour (currently -40 bp, mored than -100 bp) can indicate much less future discomfort for the economic situation. The reasoning below is that less walks can imply much less discomfort, and also earlier cuts aid support the economic situation.

This might hold true, yet we require to survive the system emphasizes initially.

Far From the Financial Industry, Indicators of Virus Have Actually Until Now Been Restricted

Source: Refinitiv, ING

EUR Rates See a Sharp (OTC:) Repricing of ECB Policy Outlook…

The risk-off move in the US paired with an extraordinary shift in policy expectations has also gripped European markets. This comes just a few days ahead the European Central Bank meeting where the bank plans to brandish its inflation-fighting credentials. The ECB had managed to firmly anchor expectations for a 50bp this week, and just last Thursday markets were seeing a good chance that the ECB could take the deposit rate from 2.5% currently to above 4% this year.

Now, markets are on the edge between 25bp or 50bp this Thursday, seeing the overall tightening to be delivered this year at just below 90bp – the ECB might just reach 3.5% after summer. The magnitude of the interest rate moves are mind-boggling, with yields dropping 40bp and the still 25bp just yesterday. In outright terms, we are back to where we were just a few days after the last ECB meeting at the start of February.

… Although Stress Indicators Themselves Look More Contained

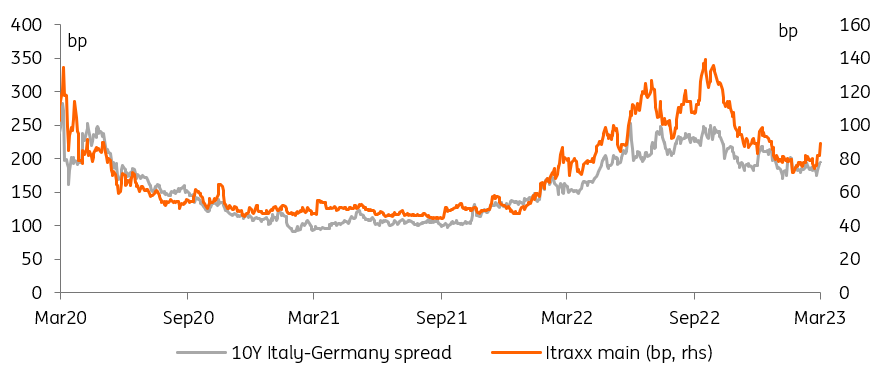

The question the ECB will ask itself is how bad is it? The ECB of course will always have an eye on sovereign spreads. The key spread of widened by 11bp to just over 191bp – we have seen wider spreads in February.

One will be more inclined to look at market measures related to systemic stress in the banking system and short-term funding markets. The European stress measures are still well below peaks seen in the latter half of 2022. The Itraxx senior financials CDS spread is 26bp wider from last Thursday. At 112bp, it is the widest since November, but still below the c.150bp peak of last September. In money markets the forward 3m Euribor/OIS for June widened to 18bp yesterday, up from just below zero at the start of last week. But it is also just 5bp over the average where the market saw the spread one quarter out over the course of 2022.

News stories citing ECB sources suggest that it will stick to its plan with regards to the 50bp hike

News stories citing ECB sources over the course of yesterday suggest that the ECB will stick to its plan with regards to the 50bp hike this week. But the outlook beyond March has become increasingly uncertain, considering financial stability fears. Our economists have stuck to the view that the ECB will only get to 3.50% in the depo rate, citing the lagged impact of monetary policy. A tightening of financial conditions via systemic stress might just be that, but it also still implies more tightening and likely higher market rates again.

***

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more