Technology’s Solid 2023

I created a post labelled “5 Reasons to be Long Tech”, in mid-March. Twenty days later on, much of the forecasts happened. Mega-cap technology supplies have actually radiated, while little caps have actually delayed. The factors offered within the write-up consisted of:

Favorable technological arrangements as well as cost activity: At the time of the writing, the Nasdaq 100 Index was drawing back to its 50-day relocating standard for the very first time because bursting out. Additionally, the 50-day relocating standard had actually simply gone across over the 200-day relocating standard, creating a favorable “gold cross”.

Picture Resource: Zacks Financial Investment Research Study

Fed Pivot Prospective: While the Fed has actually refrained a full 360, assumptions for the rest of the year indicate a stagnation in price walks or a time out.

Cash Spurt of Little Caps: Regional financial institutions have actually functioned as the typical “stone in the footwear” for the basic market. Nevertheless, cash has actually drained of small-caps as well as right into large-cap technology supplies such as Apple ( AAPL), Microsoft ( MSFT), as well as Alphabet ( GOOGL).

_______________________________________________________________

What currently?

2023’s market is just one of one of the most bifurcated markets in current memory. The Russell 2000 Little Cap Index ETF ( IWM) continues to be stuck listed below its 200-day relocating typical as well as remains to look at risk. At the same time, the Nasdaq 100 ETF ( QQQ) is coming off a scorching warm 20% very first quarter.

Regional Financial Institutions are At Risk

As long as local financial institutions have actually held constant, outdoors fields have actually had the ability to pick up speed. Nevertheless, whenever they damage down even more, they often tend to drag down the whole equities market. The SPDR Regional Financial Institution ETF ( KRE) is one of the most preferred proxy for smaller sized financial supplies in difficulty. If you take into consideration KRE’s technological photo, one more leg down might remain in the jobs. Initially, the index is reveals a lots of family member weak point– KRE was down 29% in March, while QQQ was up 10%. Second, it remains to delay as well as is damaging down from a traditional bear flag pattern.

Picture Resource: Zacks Financial Investment Research Study

Looking much deeper, private financial supplies are still revealing worrying cost activity in spite of experts doing their ideal to protect the supplies. As an example, financial as well as broker agent company Charles Schwab ( SCHW) saw a short-lived increase when chief executive officer Walter Bettinger determined to revealed that he has skin in the video game. Bettinger acquired 50,000 shares for almost $3 million. In spite of the ballot of self-confidence by the chief executive officer, shares are down 6 weeks straight as well as look positioned to retest the panic lows.

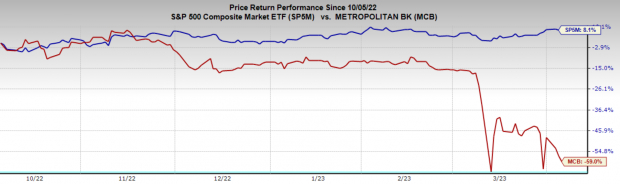

Metropolitan Commercial Financial Institution ( MCB) remains in a comparable circumstance to Schwab. The supply split wide open up a couple of weeks back. After that, experts attempted to protect the supply, however it remains to surrender.

Picture Resource: Zacks Financial Investment Research Study

The toughest financial institutions in the marketplace presently are the bigger, well-capitalized financial institutions such as JP Morgan (JPM), UBS ( UBS), as well as HSBC ( HSBC) Based upon the cost activity in local financial institutions, it would certainly not be a shock if even more financial institutions were to declare bankruptcy or obtain acquired for cents on the buck like Credit Score Suisse ( CS).

Technology Is Worthy Of a Relax

As I pointed out previously, technology has actually rejected the existing financial dilemma because local financial institutions have actually maintained. That claimed, one more leg lower in local financial institutions might drag down Nasdaq supplies also. Past local financial institution weak point, leading supplies such as Nvidia ( NVDA) are ending up being expanded from a technological basis. Previously today, NVDA’s family member toughness index (RSI) analysis blinked one of the most overbought degrees in greater than a year.

Picture Resource: Zacks Financial Investment Research Study

Profits

As epic investor Jesse Livermore when alerted, “There’s a time to go long, a time to go short, as well as a time to fish.” For investors, holding your horses as well as selecting places is a superpower. With technology supplies expanded as well as local financial institutions damaging down, currently might be an exceptional time to develop a watch checklist as well as wait on “your pitch”. While the marketplace might not require to pullback, a reset or a debt consolidation would certainly be a healthy and balanced advancement as well as would certainly offer a lot more eye-catching reward-to-risk areas.

Free Record Exposes Exactly How You Can Benefit from the Expanding Electric Car Sector

Around the world, electrical cars and truck sales proceed their exceptional development also after exceeding in 2021. High gas costs have actually sustained his need, however so has progressing EV convenience, attributes as well as modern technology. So, the eagerness for EVs will certainly be about long after gas costs stabilize. Not just are suppliers seeing record-high earnings, however manufacturers of EV-related modern technology are generating the dough too. Do you recognize exactly how to money in? Otherwise, we have the best record for you– as well as it’s FREE! Today, do not miss your possibility to download and install Zacks’ leading 5 supplies for the electrical car change at no charge as well as without commitment.

>>Send me my free report on the top 5 EV stocks

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Credit Suisse Group (CS) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

iShares Russell 2000 ETF (IWM): ETF Research Reports

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

SPDR S&P Regional Banking ETF (KRE): ETF Research Reports

Metropolitan Bank Holding Corp. (MCB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.