Investing in dividend shares is an effective way to construct wealth over the long run. Nonetheless, revenue buyers typically face a tricky alternative: Ought to they spend money on actual property funding trusts (REITs), which regularly supply excessive yields however much less capital appreciation, or conventional dividend shares, which pay decrease yields however have extra development potential?

What are REITs?

REITs function a simple business model. They buy properties, lease them out, and cut up the rental revenue with their buyers. They’re required to pay out no less than 90% of their taxable revenue as dividends to their buyers.

Most REITs fall into both of two classes: gross lease and web lease. The gross lease REITs supply all-inclusive rental agreements, through which the owner pays a lot of the working bills (taxes, insurance coverage, and utilities) related to the property. Internet lease REITs cost decrease lease however do not cowl the working bills.

Picture supply: Getty Photos.

There are presently 13 classes of REITs: workplace, retail, industrial, residential, accommodations and resorts, healthcare amenities, information facilities, self-storage, timber, infrastructure, mortgage, specialty, and diversified REITs.

A few of these sectors are extra resilient in financial downturns than others, whereas others — like information middle REITs — can profit from the secular development of other markets. So when buyers decide a REIT, they should fastidiously assess the monetary well being of its core tenants and see if it is maintained excessive occupancy charges over the previous few a long time.

For instance, Realty Revenue (NYSE: O) — one of many best-known web lease REITs within the nation — has saved its occupancy fee comfortably above 96% over the previous three a long time. It has additionally paid out consecutive month-to-month dividends ever since its founding in 1969 and has raised its dividend 124 instances since its public debut in 1994.

What are conventional dividend shares?

Corporations that are not REITs need not pay out most of their earnings as dividends. As an alternative, they will select to pay out a proportion of their earnings or free money movement (FCF) as dividends.

However they often will not do this until their enterprise is maturing. That is as a result of rising corporations will normally reinvest their earnings and FCF into increasing as an alternative of merely giving that money again to their buyers.

That is why you will discover lots of the highest-yielding dividend shares within the slower-growth sectors like client staples, banking, vitality, utility, and prescribed drugs. Nonetheless, it may be difficult for even the perfect corporations to lift their dividends yearly by way of financial downturns. So to search out probably the most resilient corporations, buyers ought to take a more in-depth take a look at Dividend Kings, which have raised their payouts yearly for no less than 50 years.

Many corporations will even repurchase their very own shares — which will increase the worth of their remaining shares — as an alternative of paying dividends. By comparability, REITs normally dilute their very own shares to lift additional cash and purchase extra properties.

The perfect dividend-paying corporations will persistently develop their income and earnings, purchase again their very own shares, and improve their annual dividends. A dependable revenue play that checks all of these containers is Procter & Gamble (NYSE: PG), the patron staples large that has raised its dividend yearly for 67 straight years.

Are REITs or dividend shares higher investments?

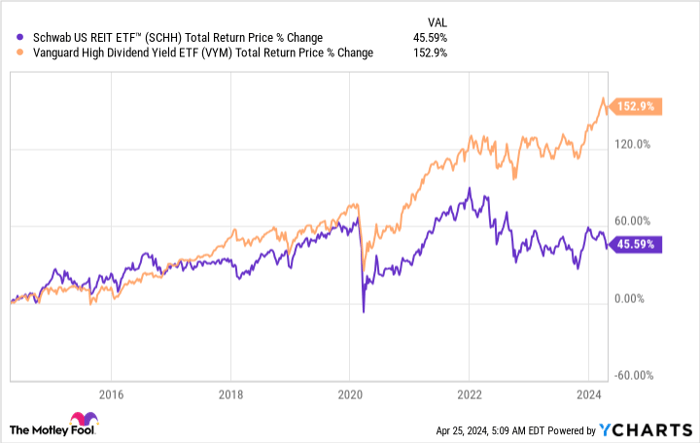

Over the long run, a basket of high dividend shares can outperform a basket of REITs for 3 easy causes: REITs dilute their very own shares to lift additional cash, they’re designed to generate regular revenue as an alternative of capital appreciation, they usually’re extra delicate to rates of interest than extra diversified corporations. The highest dividend-paying corporations will persistently develop their earnings per share to assist their payouts, and that cycle ought to drive their shares greater.

To see that distinction, let’s evaluate the 10-year complete returns of the Schwab U.S. REIT ETF (NYSEMKT: SCHH), which owns greater than 100 of the highest REITs in America, and the Vanguard Excessive Dividend Yield ETF (NYSEMKT: VYM), which holds over 500 of the market’s high dividend-paying shares.

Supply: YCharts.

So for a lot of youthful buyers, it’d make extra sense to spend money on a basket of lower-yielding dividend development shares than higher-yielding REITs. However for older buyers who’re in search of passive revenue and do not plan to reinvest their dividends, REITs may supply greater yields than fixed-income investments like CDs and bonds.

Due to this fact, the selection between REITs and different dividend shares relies upon by yourself danger tolerance and funding horizon. I personally have a mixture of REITs, dividend shares, and CDs in my very own income-generating portfolio, and I feel buyers ought to merely perceive the variations as an alternative of fixating on one as the only option.

Must you make investments $1,000 in Realty Revenue proper now?

Before you purchase inventory in Realty Revenue, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Realty Revenue wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 22, 2024

Leo Sun has positions in Realty Revenue. The Motley Idiot has positions in and recommends Realty Revenue and Vanguard Whitehall Funds – Vanguard Excessive Dividend Yield ETF. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.