The 2024 This fall earnings cycle is starting to lose a little bit of steam, with a large majority of S&P 500 firms already delivering their quarterly outcomes. The interval has remained constructive, underpinned by sturdy earnings development and favorable commentary.

Among the many bunch this week are a number of well-known restaurant operators, a listing that features Cheesecake Manufacturing facility CAKE and Texas Roadhouse TXRH. However what ought to buyers anticipate from the pair? Let’s take a better take a look at expectations and outcomes from a restaurant peer, McDonald’s MCD, to get a greater really feel.

McDonald’s

Regarding headline figures in its launch, MCD posted EPS that met our consensus estimate and reported gross sales modestly under expectations. EPS fell 4% year-over-year, whereas gross sales of $6.4 billion fell -0.3% year-over-year.

Whereas the highest and backside line outcomes weren’t nice, the actual thorn within the aspect of MCD stays its same-store gross sales. U.S. comparable gross sales fell 2% year-over-year, seemingly reflective of customers turning into cautious about their spending habits given the menu’s continued value will increase over current years.

Nonetheless, different areas have helped ease the U.S. drag, with international comparable gross sales general rising 0.4% year-over-year. As proven under, the outcomes helped snap a streak of damaging surprises on the metric, lastly exceeding our consensus estimate.

Picture Supply: Zacks Funding Analysis

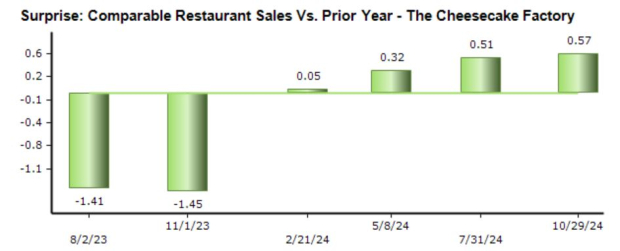

Cheesecake Manufacturing facility

Analysts have proven a sliver of positivity for CAKE’s upcoming print, with the $0.92 Zacks Consensus EPS estimate up marginally over the past a number of months and suggesting 15% development year-over-year. The consensus gross sales estimate has remained unchanged over current months, with the corporate anticipated to see 4% gross sales development year-over-year.

Just like MCD, comparable restaurant gross sales will probably be a key metric to look at within the launch, which have usually exceeded our consensus expectations as of late. Comparable restaurant gross sales elevated 1.4% year-over-year all through its newest interval, undoubtedly a constructive growth.

Picture Supply: Zacks Funding Analysis

David Everton, CEO, delivered positivity following the most recent print, stating, “We’re capturing market share as evidenced by the continued sturdy outperformance in comparable gross sales and visitors at The Cheesecake Manufacturing facility eating places versus the broader informal eating business. Execution inside our eating places was distinctive with our operators delivering vital enhancements in labor productiveness, hourly workers and supervisor retention, and visitor satisfaction scores.”

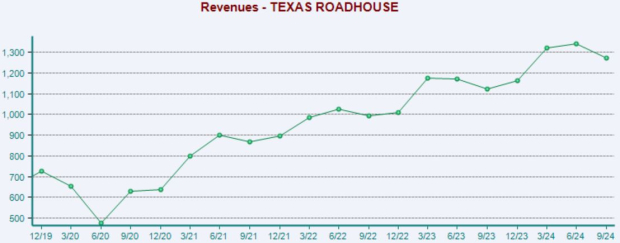

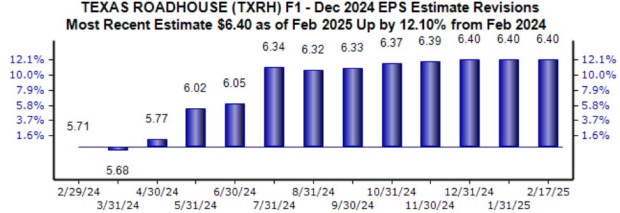

Texas Roadhouse

Analysts have remained silent for TXRH’s upcoming launch, with prime and backside line revisions remaining stagnant over current months. Massive development is anticipated, with present estimates alluding to 53% EPS development on 21% increased gross sales.

The corporate’s prime line has proven persistently sturdy development over the previous 5 years, as proven under.

Picture Supply: Zacks Funding Analysis

As well as, TXRH’s newest set of quarterly outcomes have been crammed with positivity, with the corporate seeing 8.5% comparable gross sales development year-over-year. Enlargement has additionally aided the corporate properly, with Texas Roadhouse anticipating to develop its footprint even additional all through 2025.

Analysts have taken word of its momentum, elevating its present yr outlook bullishly and serving to land the inventory right into a Zacks Rank #2 (Purchase).

Picture Supply: Zacks Funding Analysis

Wrapping Up

We’ve obtained a number of well-known restaurant operators on the reporting docket this week, a listing that features Cheesecake Manufacturing facility CAKE and Texas Roadhouse TXRH.

A peer, McDonald’s MCD, has already revealed its quarterly outcomes, with U.S. comparable gross sales remaining weak. International comparable gross sales did take a small step increased relative to the prior interval, however U.S. customers have seemingly shifted preferences following menu value will increase.

Comparable retailer gross sales will probably be key for each CAKE and TXRH, primarily telling us whether or not their established places are nonetheless seeing development. Each CAKE and TXRH posted favorable outcomes regarding the metric of their newest releases, with TXRH’s momentum a lot clearer.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the overall sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there should be a catch. Sure, we do have a cause. We wish you to get acquainted with our portfolio providers like Shock Dealer, Shares Beneath $10, Know-how Innovators,and extra, that closed 256 positions with double- and triple-digit features in 2024 alone.

McDonald’s Corporation (MCD) : Free Stock Analysis Report

The Cheesecake Factory Incorporated (CAKE) : Free Stock Analysis Report

Texas Roadhouse, Inc. (TXRH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.