Residence Depot HD is on observe to kick off the Q3 earnings season for the standard brick-and-mortar retailers this week, with the corporate on deck to report outcomes earlier than the market’s open on Tuesday, November 12th. Lowe’s LOW comes out every week afterward Tuesday, November 19th.

Lowe’s shares have outperformed Residence Depot this yr (+21.6% vs. +16.8%), although each have lagged the Zacks Building sector (+26.4%) in addition to the S&P 500 index (+25.7%), because the chart beneath exhibits.

Picture Supply: Zacks Funding Analysis

The working surroundings for Residence Depot and Lowe’s stays troublesome, because the rate of interest backdrop continues to be unfavorable regardless of the U.S. Fed’s easing coverage. The energy in treasury yields in current weeks doubtless mirrored the bond market’s early learn on the U.S. elections and the incoming administration’s pro-growth coverage posture.

With the Ate up observe to proceed easing, as reconfirmed by the Fed Chair’s press convention, buyers would count on treasury yields to finally come down. That mentioned, the yield curve is unlikely to shift down in parallel, with the shorter finish of the curve reflecting the central financial institution’s easing coverage and the longer finish proving to be considerably ‘sticky’ to mirror expectations of a extra sturdy progress surroundings.

The read-through for Residence Depot and Lowe’s of this rate of interest dialogue is that mortgage charges could not come down as a lot or as quick as would usually be anticipated in a Fed easing cycle. What this implies is that developments within the present house gross sales house are unlikely to meaningfully enhance over the close to time period, although one would count on the medium- to long-term outlook on the prevailing house gross sales entrance to be constructive on financial and demographic grounds.

We don’t count on any main surprises in Residence Depot’s Q3 outcomes, although the numbers could have benefited on the margin from the lively storm exercise within the U.S. Southeast. The expectation is for Residence Depot’s Q3 earnings to be down -5% from the year-earlier stage on +4.1% increased revenues. Estimates for the interval are down from three months again, reflecting administration’s steerage following the August 13th quarterly report, however they’ve modestly ticked up in current days.

With respect to the Retail sector’s 2024 Q3 earnings season scorecard, we now have outcomes from 23 of the 34 retailers within the S&P 500 index. Common readers know that Zacks has a devoted stand-alone financial sector for the retail house, which is in contrast to the position of the house within the Shopper Staples and Shopper Discretionary sectors within the Customary & Poor’s customary trade classification.

The Zacks Retail sector consists of not solely Residence Depot, Lowe’s, and different conventional retailers, but in addition on-line distributors like Amazon AMZN and restaurant gamers. The 23 Zacks Retail firms within the S&P 500 index which have reported Q3 outcomes already belong to the e-commerce and restaurant industries.

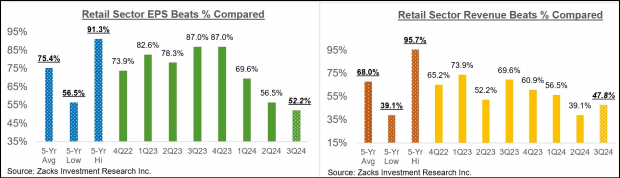

Complete Q3 earnings for these 23 retailers which have reported are up +17.3% from the identical interval final yr on +6.3% increased revenues, with 52.2% beating EPS estimates and 47.8% beating income estimates.

The comparability charts beneath put the Q3 beats percentages for these retailers in a historic context.

Picture Supply: Zacks Funding Analysis

As you possibly can see above, the web gamers and restaurant operators have struggled to beat EPS and income estimates in Q3. In reality, the Q3 EPS beats proportion for these gamers represents a brand new low over the previous 20 quarters (5 years), whereas the income beats proportion is simply modestly above the 20-quarter low and considerably beneath the 20-quarter common.

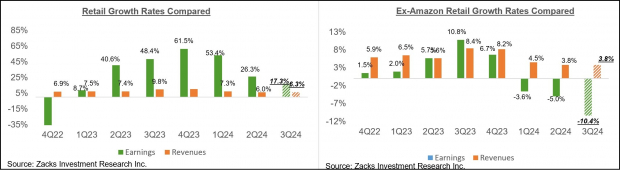

Regarding the elevated earnings fee at this stage, we like to indicate the group’s efficiency with and with out Amazon, whose outcomes are among the many 23 firms which have reported already. As we all know, Amazon’s Q3 earnings have been up +71.6% on +11% increased revenues, beating EPS and income expectations.

As everyone knows, the digital and brick-and-mortar retail areas have been converging for a while now, with Amazon now a decent-sized brick-and-mortar operator after Complete Meals and Walmart remaining a rising on-line vendor. As we’ll see within the days forward, as Walmart releases quarterly outcomes, the retailer is steadily changing into an enormous promoting participant, because of its rising digital enterprise. This long-standing pattern received an enormous increase from the Covid lockdowns.

The 2 comparability charts beneath present the Q3 earnings and income progress relative to different current durations, each with Amazon’s outcomes (left facet chart) and with out Amazon’s numbers (proper facet chart)

Picture Supply: Zacks Funding Analysis

As you possibly can see above, the entire earnings progress at this stage for the Retail sector is coming from Amazon, with Q3 earnings for the remainder of the group which have reported down -10.4% on +3.8% increased revenues. You may see that the top-line progress successfully displays headline inflationary developments within the economic system.

Q3 Earnings Season Scorecard

By means of Friday, November 8th, we now have seen Q3 outcomes from 452 S&P 500 members, or 90.4% of the index’s complete membership. Now we have one other 9 S&P 500 members on deck to report outcomes this week, together with Disney, Utilized Supplies, Shopify, Residence Depot, and others.

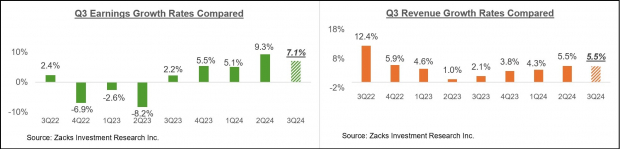

Complete earnings for these 452 firms which have reported are up +7.1% from the identical interval final yr on +5.5% increased revenues, with 73.5% of the businesses beating EPS estimates and 61.5% beating income estimates.

The proportion of those 452 index members beating each EPS and income estimates is 50.7%.

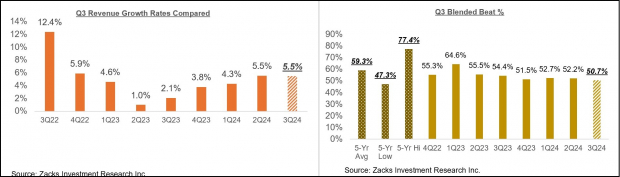

The comparability charts beneath put the Q3 earnings and income progress charges and the EPS and income beats percentages in a historic context. The primary set of comparability charts present the earnings and income progress charges.

Picture Supply: Zacks Funding Analysis

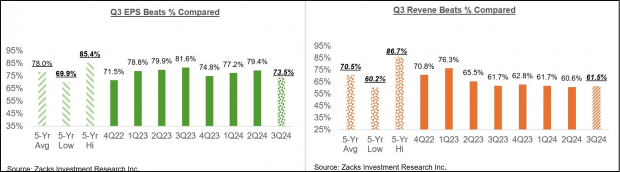

The second set of comparability charts evaluate the Q3 EPS and income beats percentages in a historic context.

Picture Supply: Zacks Funding Analysis

The comparability charts beneath highlight the income efficiency and the blended beats proportion for this group of 452 index members.

Picture Supply: Zacks Funding Analysis

As you possibly can see above, the expansion pattern seems to be stable-to-positive, although fewer firms are in a position to beat consensus estimates relative to different current durations. In reality, each the EPS and income beats percentages are monitoring beneath the 20-quarter averages for this group of firms.

The Earnings Large Image

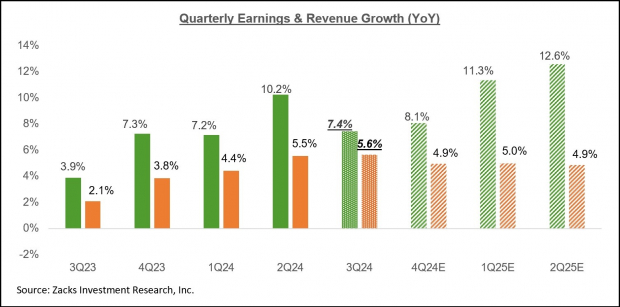

Taking a look at Q3 as a complete, combining the outcomes which have come out with estimates for the still-to-come firms, complete earnings for the S&P 500 index are anticipated to be up +7.4% from the identical interval final yr on +5.6% increased revenues.

The chart beneath exhibits the Q3 earnings and income progress tempo within the context of the place progress has been within the previous 4 quarters and what’s anticipated within the coming three quarters.

Picture Supply: Zacks Funding Analysis

The Vitality and Tech sectors are having the alternative results on the Q3 earnings progress tempo, with the Vitality sector dragging it down and the Tech sector pushing it increased.

Had it not been for the Vitality sector drag, Q3 earnings for the S&P 500 index can be up +9.9% as a substitute of +7.4%. Excluding the Tech sector’s substantial contribution, Q3 earnings progress for the remainder of the index can be up solely +2.6% as a substitute of +7.4%.

Excluding the contribution from the Magazine 7 group, Q3 earnings for the remainder of the 493 S&P 500 members can be up solely +2.1% as a substitute of +7.4%.

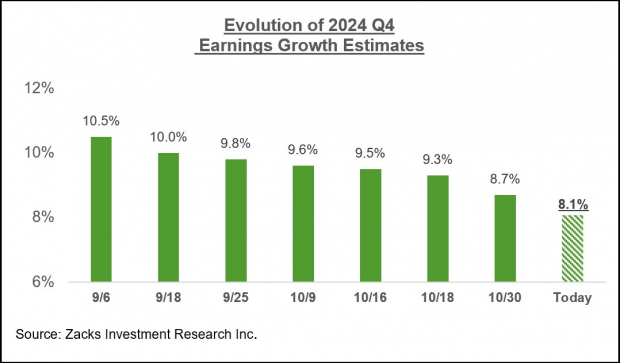

For the final quarter of the yr (2024 This autumn), complete S&P 500 earnings are anticipated to be up +8.1% from the identical interval final yr on +4.9% increased revenues.

Not like the unusually excessive magnitude of estimate cuts that we had seen forward of the beginning of the Q3 earnings season, estimates for This autumn are holding up rather a lot higher, because the chart beneath exhibits.

Picture Supply: Zacks Funding Analysis

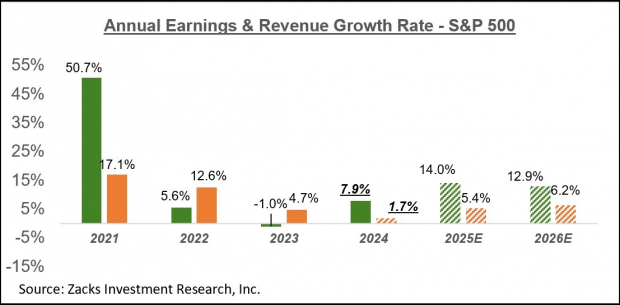

The chart beneath exhibits the general earnings image on a calendar-year foundation, with the +7.9% earnings progress this yr adopted by double-digit good points in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

Please be aware that this yr’s +7.9% earnings progress improves to +9.8% on an ex-Vitality foundation.

For an in depth have a look at the general earnings image, together with expectations for the approaching durations, please take a look at our weekly Earnings Tendencies report >>>> Breaking Down the Q3 Earnings Season Scorecard

Free: 5 Shares to Purchase As Infrastructure Spending Soars

Trillions of {dollars} in Federal funds have been earmarked to restore and improve America’s infrastructure. Along with roads and bridges, this flood of money will pour into AI information facilities, renewable vitality sources and extra.

In, you’ll uncover 5 shocking shares positioned to revenue essentially the most from the spending spree that’s simply getting began on this house.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Lowe’s Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.