Walmart WMT shares have been standout performers this 12 months, handily outperforming not simply the broader market indexes and friends like Goal TGT but in addition the likes of Amazon AMZN and a lot of the Magnificent 7 group members.

With the corporate on deck to report quarterly outcomes on Thursday, February 20th, it will likely be fascinating if the inventory can preserve its efficiency momentum after the outcomes. Walmart shares reacted favorably to every of the final 4 quarterly outcomes, with the top off greater than +20% for the reason that final launch on November 19th.

The chart under spotlights Walmart’s spectacular efficiency. The chart tracks the one-year efficiency of Walmart shares (up +84.9%) relative to the S&P 500 index (+22.6%), Amazon (+34.8%) and Goal (-12.5%).

Picture Supply: Zacks Funding Analysis

Walmart will kick off the This autumn reporting cycle for the ‘standard’ retailers this week, with the remainder of the group popping out from the next week onwards.

The Walmart report will set the tone for the remainder of the retail area, as it’s going to give us sense of the well being of family funds and client spending developments.

For instance, one persistent spending development within the post-Covid interval has been shoppers prioritizing spending on discretionary providers like journey, leisure, eating out, and hospitality and spending far much less on discretionary items classes, together with big-ticket objects like home equipment, furnishings, and so forth.

The very notable underperformance of Goal shares within the first chart we shared is a direct results of this weak demand for discretionary merchandise, a product class to which Goal is closely uncovered to.

In contrast to Goal, Walmart has a a lot heavier indexing to groceries and different staple and must-have product classes that take pleasure in a comparatively extra secure demand backdrop by way of the financial cycle. Walmart’s worth orientation and well-executed digital technique have been key to gaining grocery market share by attracting higher-income households.

Walmart’s rising share of higher-income grocery spending however, the retailer nonetheless has substantial publicity to lower-income shoppers who’ve been beneath quite a lot of monetary stress because of the cumulative results of inflation. Walmart has so far been capable of offset weak point from lower-income shoppers by attracting extra higher-income households by way of its environment friendly digital choices.

Walmart’s rising e-commerce isn’t only a means to draw higher-income households, because it additionally opens up avenues for different higher-margin income streams like promoting and third-party achievement.

Walmart is anticipated to report $0.64 in EPS on $179.3 billion in revenues, representing year-over-year modifications of +6.7% and +3.4%, respectively. Developments in Walmart’s non-grocery enterprise have been anemic currently, although administration had pointed to some early indicators of stabilization in a number of discretionary product classes on the final two earnings calls. Any indicators of strengthening inside discretionary merchandise may also have constructive read-throughs for Goal.

With respect to the Retail sector 2024 This autumn earnings season scorecard, we now have outcomes from 17 of the 33 retailers within the S&P 500 index. Common readers know that Zacks has a devoted stand-alone financial sector for the retail area, which is not like the location of the area within the Shopper Staples and Shopper Discretionary sectors within the Customary & Poor’s normal trade classification.

The Zacks Retail sector contains not solely Walmart, Goal, and different conventional retailers but in addition on-line distributors like Amazon AMZN and restaurant gamers. The 17 Zacks Retail corporations within the S&P 500 index which have reported This autumn outcomes already belong primarily to the e-commerce and restaurant industries, although we’ve many restaurant corporations on deck to report outcomes this week as effectively.

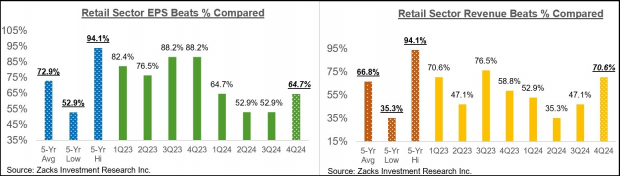

Complete This autumn earnings for these 17 retailers which have reported are up +47.1% from the identical interval final 12 months on +8.6% greater revenues, with 64.7% beating EPS estimates and solely 70.6% beating income estimates.

The comparability charts under put the This autumn beats percentages for these retailers in a historic context.

Picture Supply: Zacks Funding Analysis

As you may see above, the EPS beats percentages for these on-line gamers and restaurant operators are monitoring above what we had seen within the final two quarters for this similar group of corporations, however the This autumn EPS beats proportion of 64.7% is monitoring under the 20-quarter common of 72.9% for this group of corporations. The group’s efficiency on the revenues facet is so much higher, with the This autumn income beats proportion not solely monitoring above what we had seen in different current intervals but in addition above the historic common.

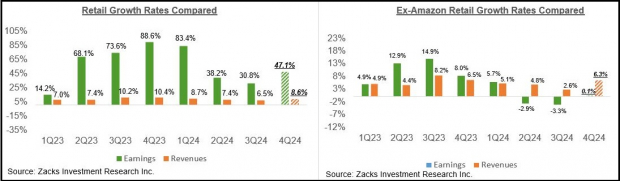

With respect to the elevated earnings development charge at this stage, we like to indicate the group’s efficiency with and with out Amazon, whose outcomes are among the many 17 corporations which have reported already. As we all know, Amazon’s This autumn earnings had been up +86.9% on +10.5% greater revenues, beating EPS and top-line expectations.

As everyone knows, the digital and brick-and-mortar operators have been converging for a while now, with Amazon now a decent-sized brick-and-mortar operator after Entire Meals and Walmart being a rising on-line vendor. As we famous within the context of discussing Walmart’s coming outcomes, the retailer is steadily changing into an enormous promoting participant because of its rising digital enterprise. This long-standing development bought an enormous increase from the Covid lockdowns.

The 2 comparability charts under present the This autumn earnings and income development relative to different current intervals, each with Amazon’s outcomes (left facet chart) and with out Amazon’s numbers (proper facet chart).

Picture Supply: Zacks Funding Analysis

As you may see above, earnings for the group exterior of Amazon are primarily flat on a +6.3% top-line achieve, which factors to margin pressures for the group.

This autumn Earnings Season Scorecard

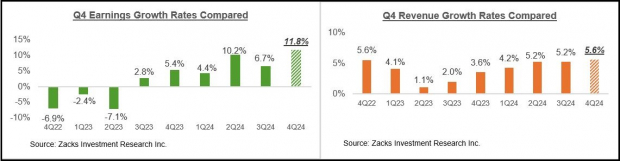

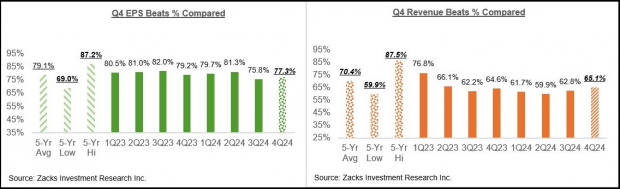

By way of Friday, February 14th, we’ve seen This autumn outcomes from 384 S&P 500 members, or 76.8% of the index’s whole membership. Complete earnings for these corporations are up +11.8% from the identical interval final 12 months on +5.6% greater revenues, with 77.3% beating EPS estimates and 65.1% beating income estimates.

The comparability charts under put the This autumn earnings and income development charges relative to different current intervals for a similar group of index members.

Picture Supply: Zacks Funding Analysis

The comparability charts under put the This autumn EPS and income beats percentages relative to different current intervals for a similar group of corporations.

Picture Supply: Zacks Funding Analysis

Key Earnings Studies This Week

We’ve nearly 400 corporations on deck to report outcomes this week, together with 43 S&P 500 members. Along with the aforementioned Walmart launch, we’ve plenty of the most important Chinese language Tech gamers on deck to report outcomes this week, together with Alibaba, Baidu, and Sohu.com. We even have many restaurant operators reporting outcomes this week, together with Cheesecake Manufacturing facility, Shake Shack, Texas Roadhouse, and others.

The Earnings Huge Image

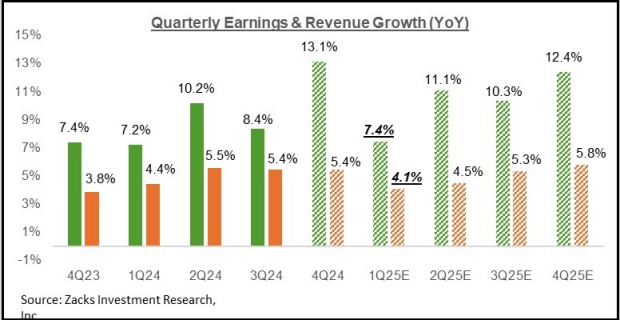

The chart under reveals the This autumn earnings and income development expectations within the context of the place development has been within the previous 4 quarters and what’s anticipated within the coming 4 quarters.

Picture Supply: Zacks Funding Analysis

Excluding the contribution from the Magazine 7 corporations, This autumn earnings for the remainder of the S&P 500 index could be up +8.3% on +4.5% greater revenues.

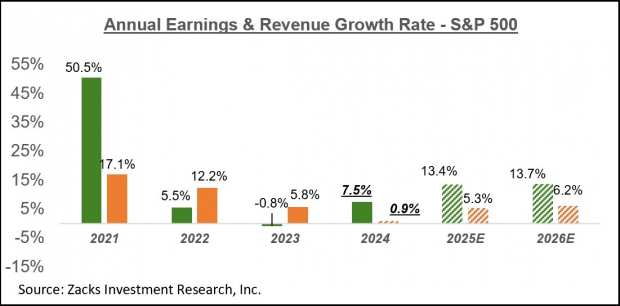

The chart under reveals the general earnings image on a calendar-year foundation, with double-digit earnings development anticipated in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

For an in depth have a look at the general earnings image, together with expectations for the approaching intervals, please take a look at our weekly Earnings Developments report >>>> Breaking Down the Current Earnings Outlook

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Specialists distill 7 elite shares from the present listing of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Probably for Early Value Pops.”

Since 1988, the complete listing has overwhelmed the market greater than 2X over with a median achieve of +24.3% per 12 months. So remember to give these hand picked 7 your quick consideration.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.