Walmart WMT shares have actually tracked the wider market year-to-date, with Target TGT shares decently on the weak side. However because the start of the local financial unpredictability complying with the Silicon Valley Financial institution failing in very early March, Walmart shares have actually been significant outperformers, up +4.9% because duration vs. an +0.8% gain for the S&P 500 index and also an -8.3% decrease for Target shares.

The graph listed below programs the year-to-date efficiency of Walmart and also Target shares vs. the S&P 500 index.

Picture Resource: Zacks Financial Investment Research Study

The security in Walmart shares makes instinctive feeling, as its core organization supplies a high level of protection throughout durations of financial instability and also unpredictability. Walmart’s ‘worth alignment’ permits it to obtain market share as reasonably better-off customers ‘trade down’ throughout times of ‘financial stress and anxiety.’

Walmart and also Target get on deck to report quarterly outcomes today. Walmart will certainly report on Thursday, May 18 th, and also Target will certainly report on Wednesday, May 17 th, with both quarterly records coming prior to the marketplace’s open. Walmart’s quarterly EPS assumptions entering this record have actually been really steady, with the present Zacks Agreement Price quote of $1.30 per share up by a dime over the previous 2 months and also unmodified over the previous month. Unlike Walmart, there has actually been some stress on Target price quotes, with numerous experts indicating near-term difficulties for the firm.

One bottom line of distinction in between these 2 retail titans is Walmart’s larger grocery store organization, which provides its outcomes higher security provided the ‘staply’ nature of that or else low-margin organization. That claimed, grocery stores drive foot website traffic and also are additionally in charge of the abovementioned ‘trade down’ sensation that is assisting Walmart obtain share.

Experts see reasonably higher energy in Walmart’s organization on the back of greater ordinary market price, foot website traffic, gains on the ecommerce side, and also far better margin results about what they reported last time on February 21 st Target is viewed as experiencing weak website traffic throughout the duration, with the rate fad just partially favorable.

Both business had problem with developing customer actions as the pandemic entered into the rearview mirror. We saw this in their April 2022 quarterly outcomes, for which they were penalized by the market. While both took radical actions to stable their stumbling ships, Walmart plainly did a far better task of getting used to the brand-new atmosphere contrasted to Target.

Relative to the Retail field 2023 Q1 profits period scorecard, we currently have arise from 20 of the 33 stores in the S&P 500 index. Routine visitors understand that Zacks has a specialized stand-alone private sector for the retail area, which differs the positioning of the area in the Customer Staples and also Customer Discretionary markets in the Requirement & & Poor’s common market category.

The Zacks Retail field consists of not just Walmart, Target, and also various other standard stores yet additionally on-line suppliers like Amazon.com AMZN and also dining establishment gamers. The 20 Zacks Retail business in the S&P 500 index that have actually reported Q1 outcomes currently come from the ecommerce and also dining establishment markets.

Complete Q1 profits for these 20 stores that have actually reported are up +11% from the very same duration in 2015 on +8.1% greater incomes, with 80% whipping EPS price quotes and also 70% whipping income price quotes.

The contrast graphes listed below placed the Q1 defeats percents for these stores in a historic context.

Picture Resource: Zacks Financial Investment Research Study

As you can see above, the on-line gamers and also dining establishment drivers quickly defeat profits and also income assumptions.

Relative to the profits and also income development prices, we such as to reveal the team’s efficiency with and also without Amazon.com, whose outcomes are amongst the 20 business that have actually reported currently. As we understand, Amazon.com’s Q1 profits were up +46.8% on +9.4% greater incomes, as it defeated leading and also fundamental assumptions.

As most of us understand, the electronic and also brick-and-mortar drivers have actually been merging for time currently. Amazon.com is currently a sizable brick-and-mortar driver after Whole Foods, and also Walmart is an expanding online supplier. This enduring fad obtained a substantial increase from the Covid lockdowns.

Both contrast graphes listed below reveal the Q1 profits and also income development about various other current durations, both with Amazon.com’s outcomes (left side graph) and also without Amazon.com’s numbers (appropriate side graph).

Picture Resource: Zacks Financial Investment Research Study

One repeating style in the Q1 profits period has actually been the ongoing durability and also security of the united state customer. We heard this from the financial institutions, the recreation and also friendliness gamers, and also consumer-facing electronic drivers.

There is unquestionably stress and anxiety at the reduced end of earnings circulation. Provided this growth, one can without effort predict small amounts in customer costs as the economic climate additionally reduces under the weight of tighter financial problems. We will certainly listen to a lot more concerning that on the Walmart and also Target profits telephone calls, likely in the context of their overviews for the coming durations. However overall, customer costs fads stayed undamaged in 2023 Q1, which’s what these outcomes will certainly reconfirm.

Q1 Revenues Period Scorecard

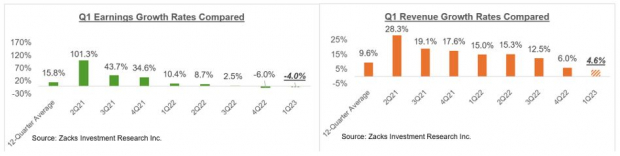

Consisting of all the quarterly records that appeared via Friday, May 10 th, we currently have Q1 profits from 459 S&P 500 participants, or 91.8% of the index’s overall subscription. Complete profits for these business are down -4% from the very same duration in 2015 on +4.6% greater incomes, with 77.6% whipping EPS price quotes and also 74.9% whipping income price quotes.

The percentage of these business defeating both EPS and also income price quotes is 62.7%.

Routine visitors of our profits discourse understand that we have actually been describing the general photo arising from the Q1 profits period as sufficient; not fantastic, yet tolerable either. With this reporting cycle currently greatly behind us, we can with confidence claim that business profits aren’t headed in the direction of the ‘high cliff’ that market births cautioned us of.

The means we see it, the ‘better-than-feared’ sight of the Q1 profits period at this phase might be a little bit unjust, provided exactly how resistant business productivity has actually ended up being. However the sight isn’t completely off the mark either.

We have concerning 300 business on deck to report outcomes, consisting of 15 S&P 500 participants. Along with the abovementioned Walmart and also Target records, today’s docket consists of House Depot, TJX Cos, Cisco Solutions, Applied Products, and also Deere & & Firm.

Listed below, we contrast the Q1 results so far from what we have actually seen from this very same team of 459 index participants in various other current durations.

The very first collection of graphes contrasts the profits and also income development prices for the 459 index participants that have actually reported with what we had actually seen from the team in various other current quarters.

Picture Resource: Zacks Financial Investment Research Study

The contrast graphes listed below placed the Q1 EPS and also income beats percents in a historic context.

Picture Resource: Zacks Financial Investment Research Study

The Revenues Broad View

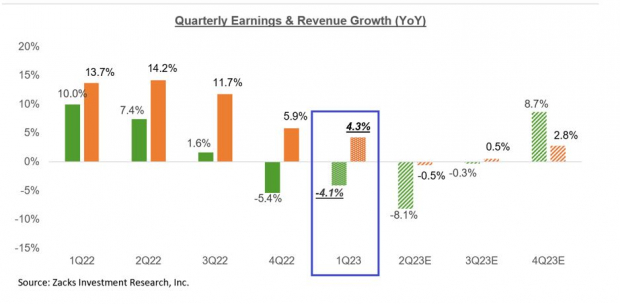

To obtain a feeling of what is presently anticipated, have a look at the graph listed below that reveals present profits and also income development assumptions for the S&P 500 index for 2023 Q1 and also the complying with 3 quarters.

Picture Resource: Zacks Financial Investment Research Study

As you can see right here, 2023 Q1 profits are anticipated to be down -4.1% on +4.3% greater incomes. This would certainly adhere to the -5.4% profits decrease in the previous duration (2022 Q4) on +5.9% greater incomes.

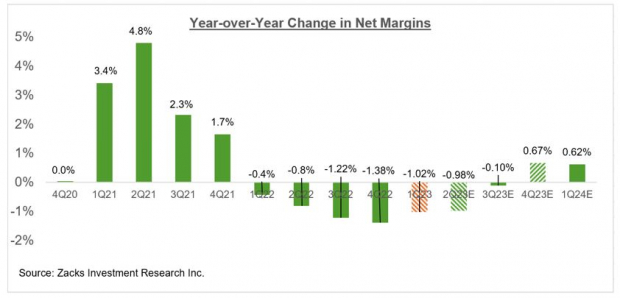

We reach down profits on favorable incomes when margins are pressed. That’s what we have actually been experiencing in the continuous profits period, which remains in line with the fad we have actually been seeing for time currently. As a matter of fact, 2023 Q1 is the 5 th quarter straight of decreasing margins.

The graph listed below programs the year-over-year modification in take-home pay margins for the S&P 500 index.

Picture Resource: Zacks Financial Investment Research Study

Real outcomes are verifying a great deal far better on the margins front about what was anticipated in advance of the launches.

The graph listed below programs the profits and also income development photo on a yearly basis.

Picture Resource: Zacks Financial Investment Research Study

One significant current growth on the profits front, which I flagged in the regular Revenues Fads report in higher information, is the turnaround on the alterations front, with full-year 2023 profits beginning to increase because the beginning of April. This follows practically a year of stable decreases in full-year 2023 profits, which came to a head in April 2022.

Given that the beginning of 2023 Q2, accumulated bottom-up S&P 500 profits have actually enhanced +0.3% all at once and also +0.6%, omitting the Power field, whose price quotes have actually been boiling down. As a matter of fact, approximates for 8 of the 16 Zacks markets are up because the beginning of Q2, with significant rises in the Building, Industrial Products, Autos, Retail, and also Technology markets. On the unfavorable side, price quotes are boiling down for the Power, Basic Products, Aerospace, and also Transport markets.

For a comprehensive take a look at the general profits photo, consisting of assumptions for the coming durations, please take a look at our regular Revenues Fads report >>>>> > > > Analyzing Recent Earnings Estimate Revisions

Free Record: Must-See Hydrogen Supplies

Hydrogen gas cells are currently utilized to give effective, ultra-clean power to buses, ships and also also health centers. This modern technology gets on the brink of a huge development, one that might make hydrogen a significant resource of America’s power. It might also entirely reinvent the EV market.

Zacks has actually launched an unique record exposing the 4 supplies specialists think will certainly provide the largest gains.

Download Cashing In on Cleaner Energy today, absolutely free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.