Salesforce CRM, the client partnership administration software application titan reported profits on Thursday after the marketplace close. Although CRM defeated profits easily, elevated assistance, as well as returned cash money to investors the supply liquidated, nevertheless.

After rallying near to 60% YTD, finishing a significant restructuring, as well as significantly enhancing earnings, it appears Salesforce might have been valued to excellence. With a lot excellent information marked down in the supply rate, it might be time for CRM to pause.

- Revenues: $ 1.69 per share, changed, vs. $1.61 per share as anticipated by experts

- Income: $ 8.25 billion, vs. $8.18 billion as anticipated by experts

- Returned $2.1 Billion in First Quarter to Stockholders with Share Buybacks

Salesforce belongs to the Software program market, which presently places in the leading 46% of the Zacks Market Ranking. It has actually been very solid YTD, so we understand there are various other supplies capitalists can turn right into if they prepare to take earnings in CRM.

Photo Resource: Zacks Financial Investment Study

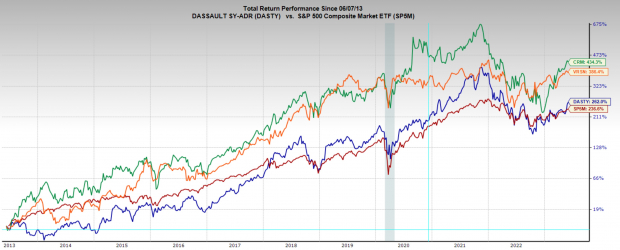

2 supplies that flaunt solid long-lasting efficiency, that additionally presently have exceptional profits alteration fads are VeriSign VRSN as well as Dassault Systemes DASTY VeriSign has actually balanced an annualized return of 15.7% over the last two decades, as well as Dassault Systemes 14.4% over that exact same duration.

Photo Resource: Zacks Financial Investment Study

VeriSign

VeriSign is a leading company of domain computer registry solutions as well as net facilities remedies. With a concentrate on taking care of the security as well as protection of the DNS facilities, VeriSign makes certain the reputable operating of.com and.net domain. By leveraging innovative modern technologies as well as providing extra solutions like DDoS security, VeriSign plays an important duty in keeping a safe on the internet atmosphere as well as allowing smooth net ease of access.

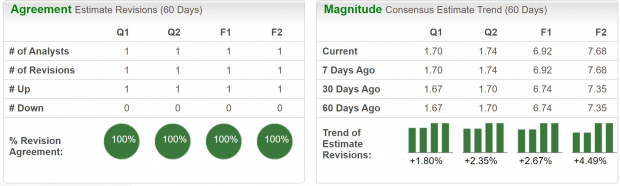

VeriSign has a Zacks Ranking # 2 (Buy), showing higher trending profits alterations. Present quarter profits have actually been modified greater by almost 2% as well as are anticipated to expand 10.4% YoY as well as FY23 profits have actually been updated by 2.7%, with quotes of 10.9% YoY development.

Photo Resource: Zacks Financial Investment Study

You can see in the graph listed below the VRSN has actually done practically absolutely nothing over the last 5 years, trading in a huge array. The supply made a significant add from 2011 to 2019, greater than 10′ xing over that time.

Since VRSN has actually had a long time to cool down, as well as turn into its appraisal, it ought to await an additional bull run quickly. Furthermore, the existence of stimulants driving favorable profits alterations as well as an appealing appraisal better add to the outbreak possibility.

Photo Resource: TradingView

VRSN is trading at a 1 year forward profits multiple of 32x, which is over the market standard of 30x, as well as listed below its five-year average of 37x. This below par appraisal can reel in customers searching for underestimated technology supplies.

Photo Resource: Zacks Financial Investment Study

Dassault Systemes

Dassault Systemes is a prominent international leader in 3D style, design, as well as collective software application remedies. The business, established in 1981 as well as headquartered in France, provides a thorough profile of cutting-edge services and products that accommodate different markets, consisting of aerospace, auto, production, as well as life scientific researches.

Dassault Systemes’ front runner software application, CATIA, is commonly acknowledged as a leading style as well as modeling device, while its various other offerings, such as SOLIDWORKS as well as SIMULIA, give innovative simulation as well as online screening capacities. With a solid concentrate on electronic change as well as lasting technology, Dassault Systemes equips companies to boost their item advancement procedures, boost effectiveness, as well as drive significant client experiences.

Via its innovative modern technologies as well as market experience, DASTY remains to form the future of style as well as design, allowing firms to remain at the center of their particular industries.

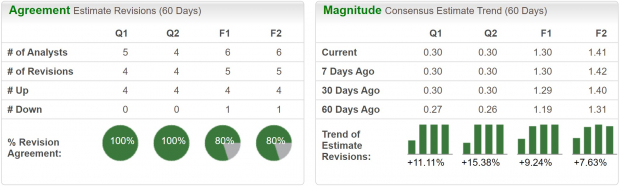

Dassault Systemes has actually seen near consentaneous upgrades in its profits quotes, making it a Zacks Ranking # 1 (Solid Buy). Present quarter profits have actually been updated by 11% as well as are anticipated to expand 7% YoY. FY23 profits have actually been modified 9% greater as well as are anticipated to climb up 9% YoY.

In addition, present quarter sales are anticipated to expand 8.8% YoY as well as FY23 sales are predicted to expand 10% YoY. These are very constant numbers for a $60 billion business.

Photo Resource: Zacks Financial Investment Study

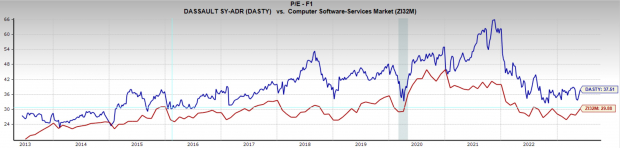

DASTY is trading at a 1 year forward profits multiple of 37.5 x, which is over the market standard, as well as in accordance with its 10-year average. Dassault Systemes plainly trades at a costs appraisal; nevertheless, it is permanently factor.

Dassault Systemes’ applications are the leader in PLM (Item Lifecycle Administration) as well as Design software application. It is approximated that it has the biggest share in the marketplace at 17% as well as boosted that share by 8.3% over the in 2014. DASTY has more than 300,000 consumers in greater than 140 nations.

Photo Resource: Zacks Financial Investment Study

Profits

There is no question that Salesforce is a giant in the securities market, yet with the unbelievable run it has actually taken place, it might be time to try to find worth in other places. With its blended profits alterations, as well as minimal favorable stimulants, capitalists might intend to wage care in holding the software application titan.

Zacks Discloses ChatGPT “Sleeper” Supply

One obscure business goes to the heart of a particularly dazzling Expert system industry. By 2030, the AI market is forecasted to have a web as well as iPhone-scale financial effect of $15.7 Trillion.

As a solution to visitors, Zacks is giving an incentive record that names as well as discusses this eruptive development supply as well as 4 various other “have to acquires.” Plus much more.

Download Free ChatGPT Stock Report Right Now >>

Salesforce Inc. (CRM) : Free Stock Analysis Report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Dassault Systemes SA (DASTY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.