Sea Minimal SE is a Singapore based innovation corporation. SE has a shopping, on-line pc gaming, as well as electronic settlements organization concentrated on the Southeast Oriental area. Sea Limited reports profits Tuesday, Might 16 prior to the marketplace opens up.

Throughout the blog post pandemic boom Sea Minimal turned into one of Wall surface Road’s favored supplies. In between March 2020 as well as October 2021 SE supply increased almost 10x, as its high margin, varied services, in the swiftly expanding Southeast Oriental market enticed financiers.

Nonetheless, SE was among these development supplies that performed at a profits loss, as well as in knowledge was trading at ridiculously high appraisals. Truth struck financiers like a lots of blocks, as well as from high to reduced the supply remedied a harsh -90%.

However the trends have actually transformed, as well as in the last quarter SE uploaded favorable profits, unusual experts. SE likewise presently flaunts a Zacks Ranking # 1 (Solid Buy), suggesting higher trending profits alterations. There are still problems though as SE has actually started to run into some development issues as advertisement investing has actually been called back.

Although Sea Limited supply is no place near its previous highs, it has actually plainly ignited financiers’ passion from these reduced degrees. The supply is up 52% YTD, as well as currently flaunts an even more engaging evaluation.

Picture Resource: Zacks Financial Investment Study

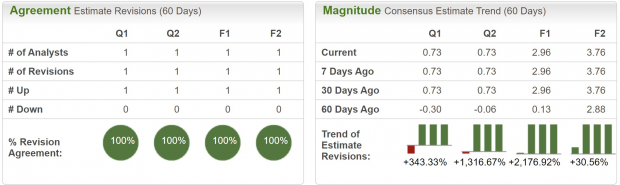

Profits Quotes

Although Sea Limited does not have wide protection, the expert that does cover it is really favorable. Profits quotes have actually been changed substantially greater over the last 2 months, as well as the flip from unfavorable to favorable profits is a massive advancement.

Last quarter experts were anticipating a -$ 0.75 EPS, however SE shattered quotes as well as reported $0.72 EPS. This was a massive change for the business.

Picture Resource: Zacks Financial Investment Study

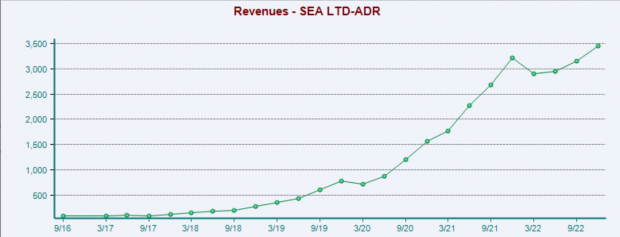

Sales for the quarter are forecasted to expand 12.6% YoY to $2.9 billion, nevertheless it would certainly note a QoQ decrease. Considering that its IPO in 2017 sales have actually taken off greater, however there has actually been a clear stagnation in development. While several of the stagnation can be crossed out as moving macroeconomics there is even more to it.

For SE to accomplish productivity it has actually needed to reduce prices significantly. Monitoring gave up 10% of workers as well as made a massive cut to advertising and marketing. Large advertising and marketing initiatives had actually been a significant resource of income development for SE. The greatest problem for financiers is whether clients that were gotten with advertisement invest stay sticky or diminish. Just time will certainly inform.

Picture Resource: Zacks Financial Investment Study

Technical Configuration

A motivating element for SE is the graph. SE has actually developed out a massive base as well as what was previously resistance at $70 has actually currently looked to sustain. The tiny combination outbreak on Friday was one more calming action. As long as the cost continues to be over the $70 degree SE supply agrees with to the bulls. Conversely, listed below there as well as it can perhaps take another look at the lows.

Picture Resource: TradingView

Appraisal

SE is presently trading at a 1 year forward sales multiple of 3.6 x, which remains in line with the wide market standard of 3.6 x, as well as well listed below its three-year average of 8.7 x. As a firm with dual figure development prices this is an extremely engaging evaluation, nevertheless there is question that development will certainly remain to slow down.

It is likewise worth contrasting SE’s evaluation to a comparable business. Mercado Libre MELI is one more creating market shopping business with high development prices. Mercado Libre like Sea Limited, was one more Wall surface Road beloved that got to unimaginable appraisals in 2021, just to experience a harsh improvement in 2022. After both remedying however, SE has actually brought out the extra enticing evaluation. MELI currently trades at a costs, with a forward sales multiple of 4.7 x.

Picture Resource: Zacks Financial Investment Study

Profits

Sea Limited has an engaging collection of services, with solid principles as well as a liable administration group. Its shift to a web favorable profits business was fast as well as prompt, which was a tough point to conquer. There are still substantial dangers to the supply however. With a stagnation in sales development, financiers are sensibly worried. However if SE has actually done sufficient to permeate its particular markets, it can have several years of successful development, making it a financial investment worth thinking about.

Free Record: Top EV Battery Supplies to Get Currently

Just-released record exposes 5 supplies to benefit as numerous EV batteries are made. Elon Musk tweeted that lithium costs have actually mosted likely to “outrageous degrees,” as well as they’re most likely to maintain climbing up. Because of this, a handful of lithium battery supplies are readied to increase. Gain access to this record to find which battery supplies to purchase as well as which to stay clear of.

Sea Limited Sponsored ADR (SE) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.