It’s been a risky couple of weeks out there, with tariff talks spooking traders and inflicting damaging value motion in lots of the main shares.

However traders may also help steadiness out their danger profiles by focusing on low-beta shares, serving to throughout intense volatility spikes like we’ve lately witnessed.

A number of low-beta shares, specifically The Progressive Corp. PGR and American Water Works AWK, might be seen as ‘defensive’ additions.

As well as, each at the moment sport favorable Zacks Ranks, reflecting constructive EPS revisions amongst analysts. Let’s take a more in-depth take a look at every.

PGR Retains Impressing

PGR shares have been rockstar performers in 2025 to date, up greater than 20% and broadly outperforming relative to the S&P 500. Robust quarterly outcomes helped assist the transfer, with its subsequent set anticipated within the coming weeks.

Earlier quarterly releases have been overwhelmingly constructive, with PGR exceeding the Zacks Consensus EPS estimate by a mean of 18.5% throughout its final 4 releases. The inventory is a Zacks Rank #2 (Purchase), with earnings expectations transferring increased throughout the board.

Picture Supply: Zacks Funding Analysis

Shares additionally present a small degree of passive revenue, with PGR shares at the moment yielding a modest 0.2% yearly. In contrast to different insurers, PGR shares aren’t generally focused amongst income-focused traders, however the uncooked share efficiency helps bridge that hole properly.

AWK Shares Stay Robust

AWK shares have additionally proven relative power in 2025, gaining 14% in comparison with the S&P 500’s 14% decline. Its newest set of quarterly ends in mid-February perked shares up properly, with the corporate exceeding each consensus EPS and gross sales expectations.

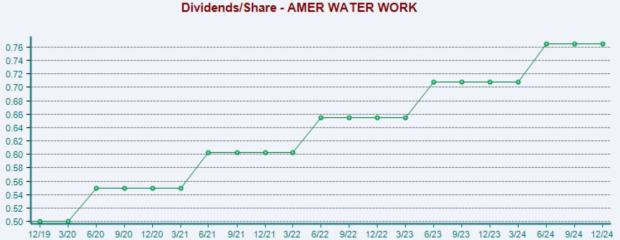

The corporate additionally reaffirmed earlier steering, including to the positivity. Shares replicate the strongest play from an revenue standpoint, with the present 2.2% annual yield crushing that of the S&P 500. AWK has upped its payout 5 occasions over the previous 5 years, translating to an 8.8% five-year annualized dividend development fee.

Under is a chart illustrating the corporate’s dividends paid/share.

Picture Supply: Zacks Funding Analysis

Backside Line

In periods of heightened volatility, low-beta shares can present a invaluable layer of protection and a extra balanced danger profile.

And over latest months, a number of low-beta shares – The Progressive Corp. PGR and American Water Works AWK – have loved constructive earnings estimate revisions, touchdown them into favorable Zacks Ranks.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the full sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there should be a catch. Sure, we do have a cause. We wish you to get acquainted with our portfolio companies like Shock Dealer, Shares Underneath $10, Know-how Innovators,and extra, that closed 256 positions with double- and triple-digit positive factors in 2024 alone.

The Progressive Corporation (PGR) : Free Stock Analysis Report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.