When thinking about dividend-paying supplies, targeted fields commonly consist of energies, financing, or customer staples.

Nonetheless, it might shock some that innovation firms additionally award their capitalists handsomely.

Income-focused capitalists do not typically target innovation supplies, as it prevails for these firms to make use of money to sustain development. Furthermore, innovation supplies often tend to be unpredictable naturally, one more element that guides income-focused capitalists away.

Still, for those that do not mind a little additional danger on the table and also still look for cash advances, dividend-paying innovation supplies fit the standards well.

3 technology supplies– Cisco Equipments CSCO, ASML ASML, and also Broadcom AVGO– have no concern paying their capitalists. For those looking for cash advances, allow’s take a more detailed check out each.

Cisco Solution

Cisco Equipments is an IP-based networking business offering services and products to company, firms, industrial individuals, and also people. Experts have actually taken a favorable position on the business’s profits overview, touchdown it right into a Zacks Ranking # 2 (Buy).

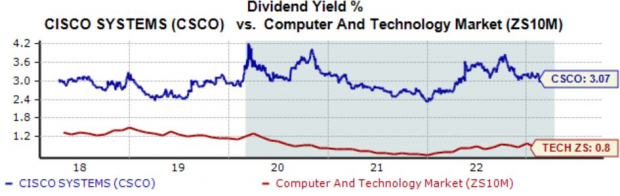

Photo Resource: Zacks Financial Investment Research Study

Cisco’s yearly returns return stands high at 3.1%, squashing the Zacks Computer system and also Modern technology field standard. Furthermore, the business’s 50% payment proportion continues to be lasting.

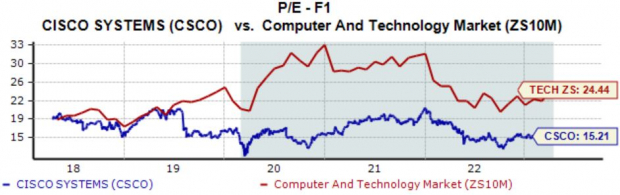

Photo Resource: Zacks Financial Investment Research Study

Furthermore, CSCO shares aren’t pricey on a family member basis, with the existing 15.2 X ahead profits numerous resting well underneath the 16.5 X five-year mean and also the Zacks field standard.

Photo Resource: Zacks Financial Investment Research Study

Broadcom

Broadcom is a top developer, programmer, and also international distributor of a wide variety of semiconductor gadgets. The supply currently sporting activities a desirable Zacks Ranking # 2 (Buy).

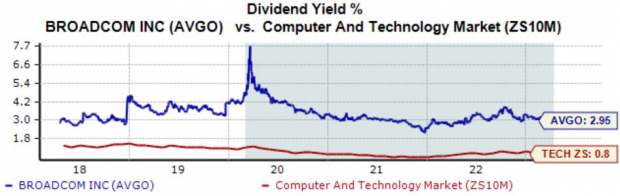

Photo Resource: Zacks Financial Investment Research Study

Broadcom’s yearly returns currently produces a strong 2.9%, greater than three-way that of the Zacks Computer system and also Modern technology field standard.

And also to cover it off, the business’s 21% five-year annualized returns development price shows a dedication to significantly fulfilling investors.

Photo Resource: Zacks Financial Investment Research Study

ASML

ASML is a globe leader in producing innovative innovation systems for the semiconductor sector. The business has actually seen its profits overview inch greater throughout almost all durations, aiding land it right into a Zacks Ranking # 2 (Buy).

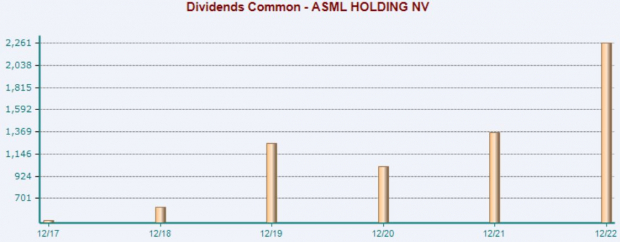

Photo Resource: Zacks Financial Investment Research Study

While the business’s 0.7% yearly returns return continues to be on the reduced end, ASML’s 34% five-year annualized returns development price grabs the slack in a large method. As we can see in the graph below, ASML has actually completely shown a shareholder-friendly nature.

Photo Resource: Zacks Financial Investment Research Study

Profits

Modern technology supplies can additionally come to be easy earnings resources, probably unexpected some income-focused capitalists that normally target the energies, customer staples, or financing fields.

And also all 3 innovation supplies above– Cisco Equipments CSCO, ASML ASML, and also Broadcom AVGO– award their investors by means of returns.

Furthermore, all 3 sporting activity a desirable Zacks Ranking presently, showing positive near-term organization potential customers.

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

ASML Holding N.V. (ASML) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always show those of Nasdaq, Inc.