With a development possibility that’s testing to gauge, the electrical lorry (EV) market is most certainly among one of the most interesting tales unraveling over the last a number of years.

As well as it do without stating that capitalists have an enormous possibility to benefit from the market’s development trajectory over the following years.

Nonetheless, as opposed to purchasing business creating EVs, capitalists can take advantage of the market from a totally various angle by purchasing business that produce the products needed for EV manufacturing.

One product depended on greatly is lithium, an essential part of EV batteries.

As well as 3 business with direct exposure to the product– Albemarle ALB, Sociedad Quimica y Minera SQM, as well as Livent LTHM– can all be factors to consider for those wanting to take advantage of the product side of the EV market.

Allow’s take a better consider each.

Albemarle

Albemarle is a leading manufacturer of highly-engineered specialized chemicals with 3 reportable sections: Lithium, Bromine, as well as Stimulants.

The firm’s income development has actually been helped by boosted lithium costs, with the firm uploading year-over-year quarterly sales development of virtually 200% in its newest quarter. As we can see in the graph below, the stamina has actually been indisputable.

Picture Resource: Zacks Financial Investment Study

Experts have actually remembered of the positive operating atmosphere, elevating their incomes assumptions throughout almost all durations over the last a number of months.

Picture Resource: Zacks Financial Investment Study

Watch out for ALB’s upcoming quarterly launch set up for Might 3 rd; the Zacks Agreement EPS Price Quote of $7.15 suggests a large 200% year-over-year uptick in incomes.

Sociedad Quimica y Minera

SQM, a Chilean chemical firm, is the globe’s biggest lithium manufacturer. Presently, the supply is a Zacks Ranking # 3 (Hold).

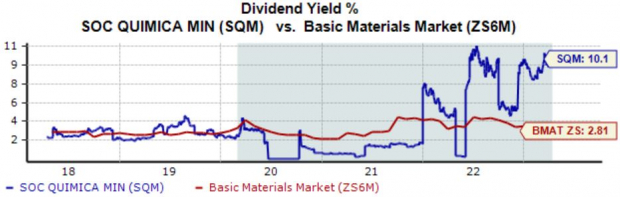

SQM shares give lithium direct exposure coupled with an easy revenue stream; SQM’s yearly reward presently produces a large 10.1%, squashing the Zacks Basic Products field standard.

Remarkably, the firm’s payment has actually expanded by virtually 60% over the last 5 years, showing a dedication to significantly fulfilling investors.

Picture Resource: Zacks Financial Investment Study

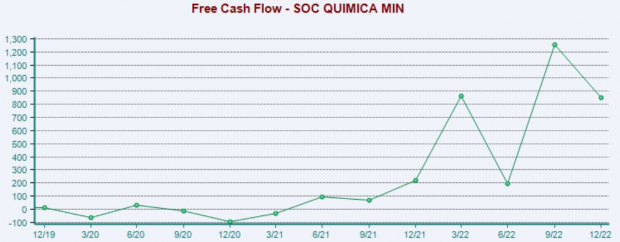

Additionally, SQM’s cash-generating capabilities have actually seen an increase many thanks to boosted lithium costs; SQM created approximately $850 million in complimentary capital throughout its newest quarter, boosting 280% year-over-year.

Picture Resource: Zacks Financial Investment Study

Livent

Livent is a fully-integrated lithium firm making lithium for applications in batteries, agrochemicals, aerospace alloys, polymers, as well as numerous commercial applications.

The firm sporting activities durable development quotes, with incomes anticipated to skyrocket 33% in its present (FY23) as well as a more 30% in FY24. The forecasted incomes development is based upon anticipated Y/Y income upticks of 35% in FY23 as well as 28% in FY24.

Livent shares currently trade at a 3.4 X onward price-to-sales proportion, not low-cost however well listed below the 4.9 X five-year average as well as highs of 10.6 X in 2022.

Picture Resource: Zacks Financial Investment Study

Additionally, the firm’s tracking twelve-month return on equity (ROE) has actually gotten on a solid uptrend over the last a number of years, suggesting enhanced effectiveness in producing benefit from existing properties.

Picture Resource: Zacks Financial Investment Study

Profits

With the EV landscape anticipated to expand dramatically, capitalists can take advantage of the marketplace by targeting business giving the required products required for manufacturing.

That’s specifically what all 3 business above– Albemarle ALB, Sociedad Quimica y Minera SQM, as well as Livent LTHM– give, as all 3 lug a high degree of lithium direct exposure.

Zacks Names “Solitary Best Choose to Dual”

From countless supplies, 5 Zacks specialists each have actually picked their favored to escalate +100% or even more in months to find. From those 5, Supervisor of Research study Sheraz Mian hand-picks one to have one of the most eruptive benefit of all.

It’s an obscure chemical firm that’s up 65% over in 2015, yet still economical. With unrelenting need, skyrocketing 2022 incomes quotes, as well as $1.5 billion for buying shares, retail capitalists can enter at any moment.

This firm can measure up to or go beyond various other current Zacks’ Supplies Ready To Dual like Boston Beer Firm which skyrocketed +143.0% in little bit greater than 9 months as well as NVIDIA which grew +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Albemarle Corporation (ALB) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Livent Corporation (LTHM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.