Current market worries have actually been focused around possible problems in the united state financial system, specifically amongst local financial institutions.

Nevertheless, with volatility spilling over to more comprehensive markets financiers might be obtaining their watchlists with each other for acquire the dip prospects.

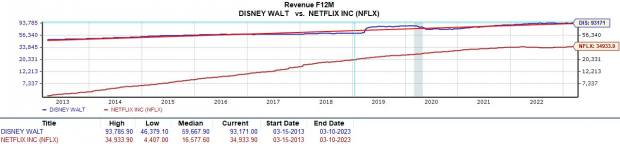

2 prominent supplies that financiers might take into consideration are Disney ( DIS) and also Netflix ( NFLX), allow’s see if it’s time to acquire either of these customer optional titans after recently’s selloff.

Current Efficiency

Adhering to recently’s selloff, Disney supply is down -7% this month Vs. Netflix’s -9% with both underperforming the S&P 500’s -2%. Disney supply is up +6% year to day to leading Netflix and also the criteria’s basically level efficiencies.

Additionally, after an unpredictable 2022, Disney and also Netflix are 2 supplies that lots of think can have considerable rebounds this year as inflationary worries begin to decrease. To that note, Disney and also Netflix supply sill profession 36% and also 26% from their 52-week highs specifically.

Disney might specifically stand apart to financiers in regards to recuperation hopes. Disney supply is still down -28% over the in 2015 to greatly underperform Netflix’s -11% and also the more comprehensive indexes.

Photo Resource: Zacks Financial Investment Study

Appraisal

Checking the appraisal of Disney and also Netflix will certainly remain to be essential in evaluating their benefit and also rebound leads.

Hereof, both supplies profession beautifully about their past from a price-to-earnings point of view. Netflix specifically attracts attention trading at $294 and also 26.1 X onward profits which is well listed below its years high of 513.4 X and also a 75% discount rate to the average of 107.3 X.

In contrast, Disney trades at $92 per share and also 23.5 X onward profits, substantially below its very own years high of 134.4 X and also closer to the average of 19.9 X.

Also much better, the cost to sales that financiers are spending for both firms is much more practical. Disney’s cost to sales of 1.8 X is 63% listed below its years high of 5.1 X and also provides a 35% discount rate to the average of 2.9 X. Taking A Look At Netflix, its P/S multiple of 3.8 X is 65% listed below its decade-high of 11X and also 36% below the average of 6X.

Photo Resource: Zacks Financial Investment Study

Development & & Clients

With the appraisal of both firms ending up being a lot more eye-catching, financiers will certainly intend to see Disney and also Netflix’s development proceed.

Following their newest monetary quarters, Netflix stood at 230.75 million customers which covered Disney And also at 161.8 million customers. Netflix customers expanded by 7.66 million throughout the quarter while Disney shed 2.4 million individuals its initially reported decrease because introducing in 2019.

Remarkably, when including its ESPN+ and also Hulu solutions, Disney’s complete customers have actually exceeded Netflix at 234.7 million. Disney profits are anticipated to climb 13% in monetary 2023 and also rise an additional 36% in FY24 at $5.42 per share. Sales are anticipated to be up 9% this year and also surge an additional 7% in FY24 to $96.12 billion.

When It Comes To Netflix, profits are predicted to be up 12% this year and also climb an additional 28% in FY24 at $14.29 per share. Sales are anticipated to climb 8% in FY23 and also dive an additional 11% in FY24 to $38.12 billion.

Photo Resource: Zacks Financial Investment Study

Takeaway

Disney and also Netflix supply both land a Zacks Ranking # 3 (Hold) currently. In the meantime, a lot of the volatility bordering recently’s selloff is beginning to be included within the economic market.

There might still be much better purchasing chances in advance for Disney and also Netflix supply yet hanging on to shares at their existing degrees can be fulfilling as they seem returning to development complying with a harsh 2022 for a lot of firms.

Free Record Discloses Exactly How You Can Make money from the Expanding Electric Car Sector

Internationally, electrical vehicle sales proceed their impressive development also after exceeding in 2021. High gas rates have actually sustained his need, yet so has developing EV convenience, attributes and also innovation. So, the eagerness for EVs will certainly be about long after gas rates stabilize. Not just are suppliers seeing record-high revenues, yet manufacturers of EV-related innovation are bring in the dough too. Do you recognize exactly how to money in? Otherwise, we have the best record for you– and also it’s FREE! Today, do not miss your possibility to download and install Zacks’ leading 5 supplies for the electrical lorry change at no charge and also without any responsibility.

>>Send me my free report on the top 5 EV stocks

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.