House Depot ( HD) as well as Walmart’s ( WMT) Q4 profits records on Tuesday, February 21, will certainly offer financiers a wider glance of just how the economic climate is presently impacting customers.

Allow’s have a look at these 2 retail titans’ supplies prior to their quarterly launches following week.

HD Q4 Sneak Peek & & Expectation

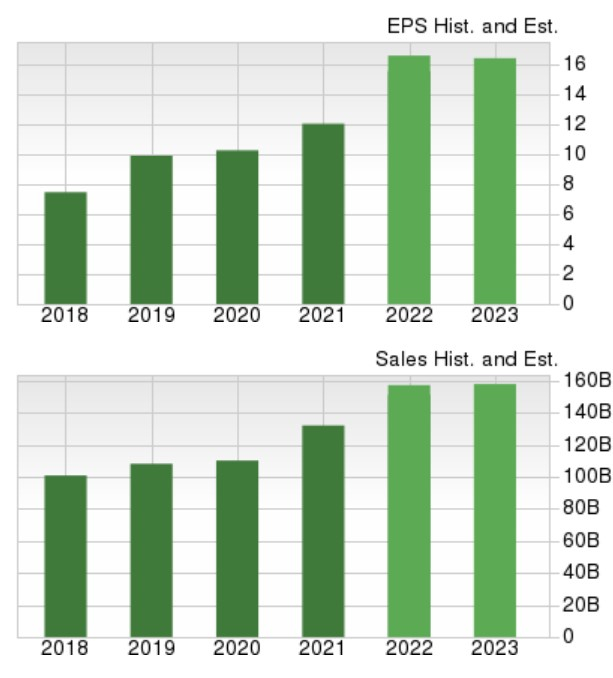

House Depot’s Q4 profits are predicted at $3.26 per share, which would certainly be up 1% year over year. Sales for the quarter are anticipated to be $35.91 billion as well as essentially level from a year back.

House Depot Profits ESP: The Zacks Shock Forecast shows House Depot must get to quarterly assumptions on its profits with the Zacks Agreement for Q4 EPS on the same level with one of the most Exact Agreement of $3.26.

Picture Resource: Zacks Financial Investment Research Study

Completing its monetary 2023, House Depot’s profits are currently anticipated to be up 7% to $16.64 a share contrasted to EPS of $15.53 in 2022. Profits are anticipated to increase one more 1% in FY24. Nevertheless, profits quote alterations are down over the last quarter.

On the leading line, sales are anticipated to be up 4% in FY23 as well as be essentially level in FY24 at $158.51 billion. A lot more remarkable, Financial 2024 sales would certainly stand for 46% development from pre-pandemic degrees with 2019 sales at $108.20 billion.

Picture Resource: Zacks Financial Investment Research Study

WMT Q4 Sneak Peek & & Expectation

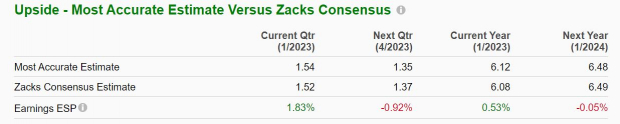

Looking To Walmart, Q4 profits are anticipated at $1.52 per share which is approximately on the same level with the previous year quarter. Fourth-quarter Sales are predicted at $159.66 billion, up 4% YoY.

Walmart Profits ESP: Walmart is anticipated to somewhat leading fundamental assumptions with one of the most Exact Agreement at $1.54 per share as well as the Zacks Agreement having EPS at $1.52.

Picture Resource: Zacks Financial Investment Research Study

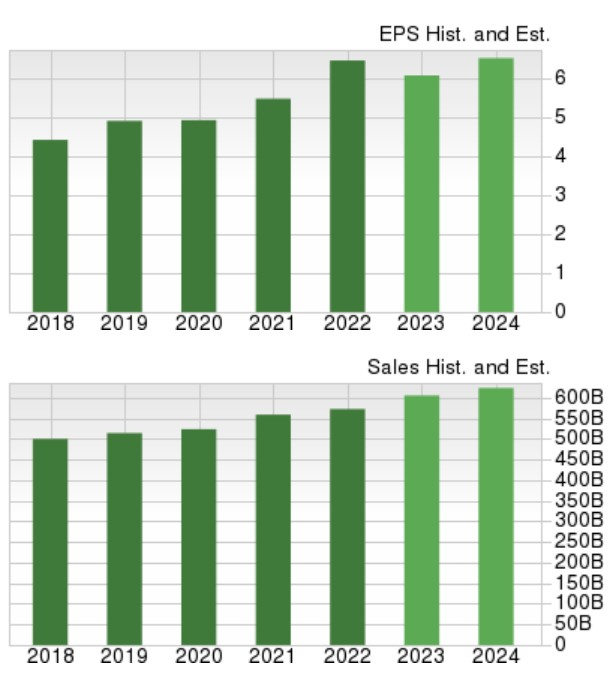

Walmart is currently anticipated to complete monetary 2023 with EPS of $6.08 which would approximately be a -6% decrease from FY22 profits of $6.46 a share. Financial 2024 profits are anticipated to rebound as well as increase 6% at $6.49 per share. Nevertheless, profits price quotes have actually additionally decreased for Walmart throughout the quarter.

Walmart sales are currently predicted to be up 6% in FY23 as well as increase one more 3% in FY24 to $627.30 billion. Financial 2024 would certainly be a 22% boost from pre-pandemic degrees with 2019 sales at $514.40 billion.

Picture Resource: Zacks Financial Investment Research Study

Efficiency & & Appraisal

Over the in 2014, Walmart’s +6% has actually outmatched the S&P 500’s -7% as well as House Depot’s -8% efficiency. Nevertheless, over the last years, House Depot’s +505% overall return consisting of rewards has actually quickly covered the criteria as well as Walmart’s +159%.

Picture Resource: Zacks Financial Investment Research Study

From an evaluation perspective, both supplies profession wonderfully about their previous however House Depot shows up to have a mild side.

Shares of House Depot profession at $317 per share as well as 18.9 X ahead profits which is over its sector standard of 12.2 X. Nevertheless, House Depot is a tested sector leader as well as professions 33% listed below its years high of 28.1 X as well as 11% underneath the typical of 21.2 X.

In contrast, Walmart trades at $146 a share as well as 22.5 X ahead profits, well over its sector standard of 11.7 X although it’s additionally a leader. Shares of WMT profession 20% listed below its very own decade-long high of 28.1 X however 23% over the typical of 18.3 X.

Picture Resource: Zacks Financial Investment Research Study

Rewards

Rewards are constantly attracting financiers, as well as both House Depot as well as Walmart stand out hereof. Walmart is presently a Reward Aristocrat, increasing its return for greater than 25 successive years (49 Years) with the business introducing the other day that it will certainly increase its returns by 2% in 2023 to $2.24 per share.

Picture Resource: Zacks Financial Investment Research Study

While Walmart gets on the cusp of being a Reward King upon increasing its returns once again in 2024 (50 Successive years) House Depot’s return is pleasing also. House Depot’s 2.37% yearly returns return tops Walmart’s 1.55% with both over the S&P 500’s 1.18%.

Takeaway

Both Walmart as well as House Depot supply land a Zacks Ranking # 3 (Hold) heading right into their profits records next week. Much of the benefit in their supplies will certainly rely on the support they can use which will certainly additionally offer a wider understanding right into the present habits of the customer.

Walmart will certainly stand to profit if a larger target market of customers remains to select the merchant as a choice to conserve or invest much less amidst financial unpredictability as well as greater rising cost of living. This together with ongoing enhancement in supply as well as operating expense.

Efficient administration of expenses throughout an extensively harder operating atmosphere will certainly additionally be vital for House Depot together with rising cost of living ideally having a much less miserable result on customers’ need for residence enhancement items.

4 Oil Supplies with Enormous Benefits

Worldwide need for oil is via the roofing … as well as oil manufacturers are battling to maintain. So although oil costs are well off their current highs, you can anticipate huge benefit from the business that provide the globe with “black gold.”

Zacks Financial investment Study has actually simply launched an immediate unique record to assist you rely on this pattern.

In Oil Market ablaze, you’ll find 4 unforeseen oil as well as gas supplies placed for huge gains in the coming weeks as well as months. You do not wish to miss out on these referrals.

Download your free report now to see them.

Walmart Inc. (WMT) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.