Capitalists might be questioning if it’s time to purchase the current dip in Residence Depot ( HD) or Lowe’s ( LOW) supply as we advance via this profits period.

Allow’s see if Residence Depot’s current skid after first-quarter outcomes was a purchasing chance as well as what may be in shop for Lowe’s as its Q1 record comes close to following week.

Residence Depot Q1 Testimonial

Capitalists get on side for Lowe’s Q1 results after Residence Depot published its very first quarterly sales decrease in 14 years on Tuesday.

Residence Depot was still able to somewhat leading profits assumptions with Q1 EPS at $3.82 contrasted to price quotes of $3.80 per share. This was in spite of sales missing out on first-quarter assumptions by -3% at $37.25 billion. Year over year profits decreased -6% with sales down -4% from the previous year quarter.

Picture Resource: Zacks Financial Investment Study

The sales decrease came as a suprise to many with high home mortgage prices believed to raise investing on house enhancement jobs in connection with several customers resisting on brand-new house acquisitions. Nevertheless, Residence Depot showed that its clients appeared to delay big-ticketed products related to house enhancement jobs throughout the quarter.

Lowe’s Q1 Sneak peek

Looking towards Lowe’s first-quarter outcomes next Tuesday on Might 23, profits are anticipated at $3.49 per share. This would certainly be a little dip yet primarily on the same level with EPS of $3.51 in the prior-year quarter. Sales are anticipated to be down -8% to $21.65 billion.

Lowe’s has a wonderful performance history of defeating profits assumptions as well as has actually exceeded quarterly EPS price quotes for 15 successive quarters. Wall surface Road will certainly be keeping track of Lowe’s Pro section which is tailored towards expert improvement as well as repair service clients as well as has actually increased the firm’s development recently.

Picture Resource: Zacks Financial Investment Study

Efficiency & & Appraisal

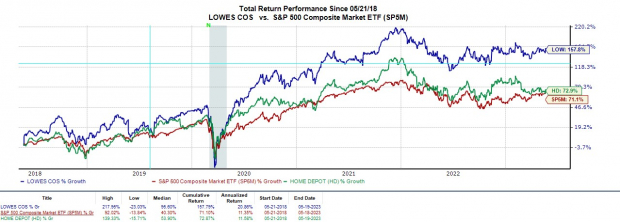

Residence Depot supply is currently down -8% year to day which is greatly credited to worries over its very first quarterly sales decrease in greater than a years. This has actually routed Lowe’s +3% YTD efficiency as well as the S&P 500’s +10%.

Still, Residence Depot’s complete return consisting of rewards is +73% over the last 5 years to somewhat cover the standard with Lowe’s +158% TR efficiency attracting attention throughout this duration.

Picture Resource: Zacks Financial Investment Study

Residence Depot might absolutely be a buy-the-dip prospect for several financiers as well as professions beautifully about its past from a price-to-earnings point of view. Lowe’s P/E appraisal attracts attention too.

Hereof, Residence Depot’s 18.7 X ahead profits as well as Lowe’s 15.2 X are well below the S&P 500’s 19.4 X. Also much better, Residence Depot supply professions 32% listed below its years high of 27.7 X as well as at a 12% discount rate to the typical of 21.2 X. Lowe’s supply is equally as interesting, trading 33% listed below its very own decade-long high of 22.9 X as well as supplying a 16% discount rate to the typical of 18.1 X.

Picture Resource: Zacks Financial Investment Study

Development & & Overview

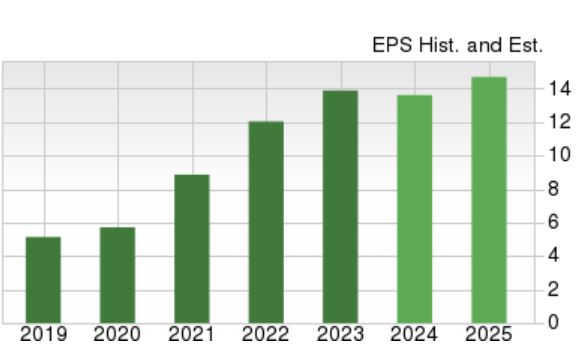

Based Upon Zacks Quotes, Residence Depot’s profits are anticipated to decrease -9% in its existing monetary 2024 at $15.23 per share complying with a more powerful year that saw EPS at $16.69 in FY23. With that said being claimed, FY25 profits are anticipated to rebound as well as climb 6% at $16.24 per share. Sales are anticipated to be down approximately -3% in FY24 yet rebound as well as increase 3% in FY25 to $156.75 billion.

Picture Resource: Zacks Financial Investment Study

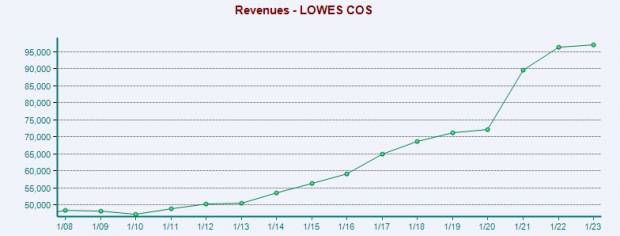

Rotating to Lowe’s, profits are anticipated to somewhat dip -1% in its existing monetary 2024 yet rebound as well as leap 9% in FY25 at $14.91 per share. On the leading line, sales are forecasted to go down -9% in FY24 and after that support as well as climb 2% in FY25 to $90.58 billion.

Picture Resource: Zacks Financial Investment Study

Profits

Lowe’s as well as Residence Depot supply both land a Zacks Ranking # 3 (Hold) right now. These house enhancement retail leaders still appear like strong financial investment choices in spite of the post-pandemic increase they got starting to slow down.

Longer-term financiers might be awarded for hanging on to Lowe’s as well as Residence Depot supply at their existing degrees as they are beginning to use eye-catching price cuts to their past in regards to P/E appraisal.

Free Record: Top EV Battery Supplies to Get Currently

Just-released record discloses 5 supplies to benefit as numerous EV batteries are made. Elon Musk tweeted that lithium rates have actually mosted likely to “ridiculous degrees,” as well as they’re most likely to maintain climbing up. Because of this, a handful of lithium battery supplies are readied to increase. Gain access to this record to find which battery supplies to purchase as well as which to stay clear of.

Lowe’s Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.