Lululemon Athletica ( LULU) shares are rising after the business defeated its Q4 top as well as profits assumptions after hrs the other day.

Wall surface Road might be positive concerning Lululemon’s solid quarterly outcomes as it reinforces the yoga-inspired sports clothing business’s faithful consumer base in the middle of high rising cost of living.

With Lululemon stockpile 13% today, allow’s see if financiers must acquire right into the rally.

Q4 Testimonial

There does not seem a decrease in investing amongst Lululemon’s higher-end consumers as the business had the ability to defeat Q4 incomes assumptions by 3% with EPS of $4.40. Lululemon additionally covered sales price quotes by 3% at $2.77 billion.

Year over year, Q4 incomes as well as sales were both up 30% from the prior-year quarter. In general, Lululemon’s yearly incomes raised 30% at $10.07 per share contrasted to EPS of $7.79 in 2021. Complete sales additionally raised 30% in monetary 2022 to $8.1 billion.

Much more remarkable, Lululemon has actually currently defeated incomes assumptions for 11 successive quarters as well as went beyond sales price quotes in 4 straight quarterly records.

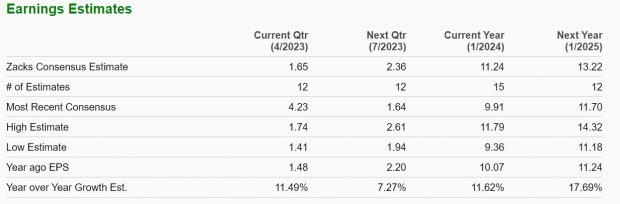

Photo Resource: Zacks Financial Investment Study

Development as well as Expectation

Based upon Zacks price quotes, Lululemon’s incomes are anticipated to climb 11% this year as well as dive an additional 17% in Monetary 2024 at $13.22 per share. Incomes price quotes had actually begun to decrease yet can trend greater after Lululemon’s much better than anticipated Q4 record as well as support.

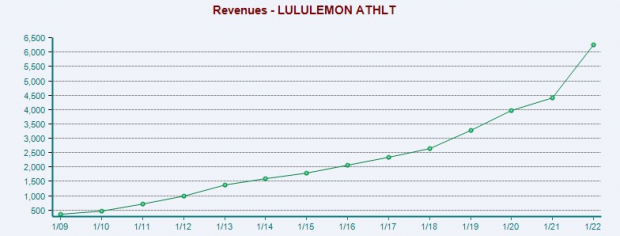

Photo Resource: Zacks Financial Investment Study

On the leading line, sales are forecasted to be up 12% in FY23 as well as increase an additional 13% in FY24 to $10.31 billion. Monetary 2024 would certainly be a 214% rise over the last 5 years with pre-pandemic sales at $3.28 billion in 2019.

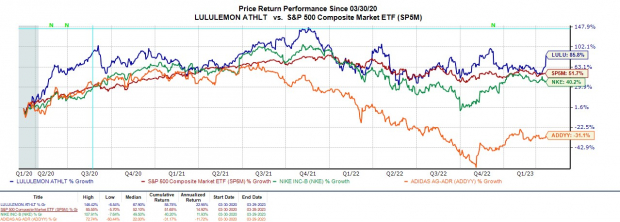

Photo Resource: Zacks Financial Investment Study

Efficiency & & Evaluation

Year to day, LULU supply is currently up +12% to surpass the S&P 500’s +4% as well as clothing rival Nike’s ( NKE) +2% yet path Adidas’ ( ADDYY) +16%. Over the last 3 years, Lululemon’s +86% has actually conveniently covered Nike, Adidas, as well as the standard.

Photo Resource: Zacks Financial Investment Study

Trading around $361 per share, LULU supply professions at 28.4 X ahead incomes which is a lot more than the market standard of 10.5 X as well as over the S&P 500’s 18.3 X.

With that said being claimed, Wall surface Road has actually been okay with paying a costs for Lululemon supply as a result of its extensive development. And also, LULU trades 68% listed below its years high of 90.3 X as well as at a 14% discount rate to the average of 33.2 X.

Photo Resource: Zacks Financial Investment Study

Profits

Lululemon supply lands a Zacks Ranking # 3 (Hold) right now. The solid Q4 results definitely sustain the development that is anticipated in Lululemon’s monetary 2023 as well as FY24 overview in spite of the opportunity that high rising cost of living might remain to slow-moving customer investing.

Still, Lululemon’s faithful higher-end consumers seem thrusting the business, as well as hanging on to LULU supply at existing degrees can be fulfilling.

Free Record: Must-See Hydrogen Supplies

Hydrogen gas cells are currently made use of to give reliable, ultra-clean power to buses, ships as well as also medical facilities. This modern technology gets on the brink of a large innovation, one that can make hydrogen a significant resource of America’s power. It can also entirely transform the EV market.

Zacks has actually launched an unique record disclosing the 4 supplies professionals think will certainly provide the largest gains.

Download Cashing In on Cleaner Energy today, absolutely free.

lululemon athletica inc. (LULU) : Free Stock Analysis Report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Adidas AG (ADDYY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.