Traders will get a glimpse at how the buyer discretionary sector is fairing with Nike NKE set to launch outcomes for its fiscal third quarter after-market hours on Thursday, March 20.

Whereas the broader market selloff hasn’t prompted an additional nostril dive in Nike’s inventory in latest weeks, NKE is barely 7% above its 52-week low of $68 in mid-February and nonetheless nicely off its one-year excessive of $101 final March. Wall Road will likely be eying the retail attire big’s efficiency in China amid tariff issues, and searching for a sign {that a} return to significant gross sales development is forward.

Temporary Overview of Nike’s Struggles

Nike has grappled with the necessity to innovate its product line outdoors of traditional fashions just like the Jordan model, whereas dealing with elevated competitors from Adidas ADDYY, Below Armour UAA, and New Steadiness with regard to shoe attire. Moreover, Lululemon LULU has taken vital market share from Nike because it pertains to athletic clothes attire.

Halting the decline in Nike inventory and resulting in a pleasant bounce off its February lows was the announcement of a collaboration with Kim Kardashian’s Skims model. The partnership, referred to as NikeSkims, will concentrate on creating progressive and inclusive activewear for ladies and will assist Nike compete with Lululemon on this regard.

Nike’s Q3 Expectations

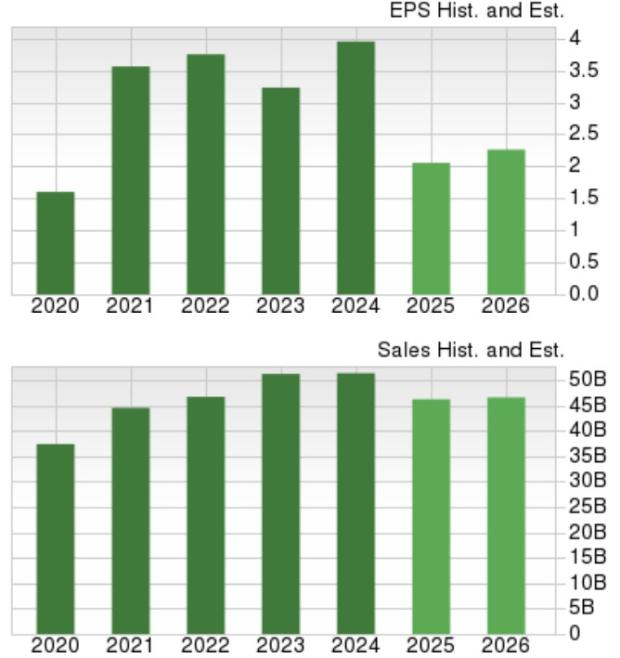

Based mostly on Zacks estimates, Nike’s Q3 gross sales are thought to have decreased 10% to $11.12 billion in comparison with $12.43 billion within the comparative quarter. Notably, gross sales in Nike’s Larger China phase are anticipated to be down 13% to $1.81 billion versus $2.08 billion within the prior-year interval.

On the underside line, Nike’s Q3 EPS is slated to drop to $0.28 from $0.98 per share a yr in the past. That mentioned, Nike has exceeded the Zacks EPS Consensus for six consecutive quarters with a median earnings shock of 29.82% in its final 4 quarterly reviews.

Picture Supply: Zacks Funding Analysis

Monitoring Nike’s Outlook

Total, Nike’s complete gross sales are actually anticipated to say no 10% this yr however are projected to stabilize and rise 1% in fiscal 2026 to $46.59 billion. Annual earnings are anticipated to drop to $2.04 per share from EPS of $3.95 in FY24. Optimistically, FY26 EPS is projected to rebound and rise 10% to $2.25.

Picture Supply: Zacks Funding Analysis

Monitoring NKE Inventory Efficiency

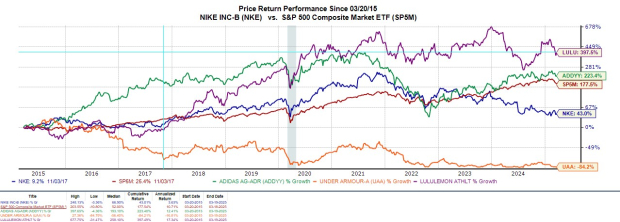

Nike inventory is down 3% in 2025 with the benchmark S&P 500 seeing declines of -5%. Nonetheless, over the past yr, NKE has now plummeted 27% to largely path the broader market‘s +7% and Adidas’ +11% with Below Armour and Lululemon shares falling 8% and 30% respectively.

Picture Supply: Zacks Funding Analysis

By way of historic efficiency, NKE has positive factors of +43% over the past decade which has outperformed Below Armour’s -84% however has trailed the blazing performances of the benchmark, Adidas, and Lululemon.

Picture Supply: Zacks Funding Analysis

NKE Valuation Comparability

At present ranges, NKE trades at a 35.6X ahead earnings a number of, a noticeable premnium to the benchmark’s 21.1X and its Zacks Sneakers & Retail Attire Trade common of 11X. Nonetheless, it is noteworthy that NKE does commerce nicely under its decade-long excessive of 51.1X ahead earnings and is nearer to the median of 29.3X throughout this era.

Picture Supply: Zacks Funding Analysis

Backside Line

For now, Nike inventory lands a Zacks Rank #3 (Maintain). It might be too quickly to say NKE is in retailer for an prolonged rebound as extra upside will largely rely on the power to achieve or exceed its Q3 expectations. Extra importantly, Nike might want to supply steerage that begins to reconfirm a return to development sooner or later.

7 Finest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present record of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Probably for Early Worth Pops.”

Since 1988, the total record has overwhelmed the market greater than 2X over with a median acquire of +24.3% per yr. So you’ll want to give these hand picked 7 your fast consideration.

NIKE, Inc. (NKE) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Adidas AG (ADDYY) : Free Stock Analysis Report

Under Armour, Inc. (UAA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.