The Q3 earnings season is simply across the nook, with the large banks’ outcomes coming subsequent Friday. However earlier than we get to them, a shopper staples favourite, PepsiCo PEP, is on the reporting docket for subsequent week (Tuesday, October 8th) earlier than the market opens.

Keep up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Let’s take a more in-depth have a look at expectations for the buyer staples titan.

PepsiCo Expectations

PEP shares have largely been disappointing in 2024, up a modest 1.2% and primarily buying and selling sideways all 12 months. It’s value noting right here that buyers have more and more decreased publicity to Client Staples shares total in 2024 due to the risk-on atmosphere that’s been led by red-hot Expertise.

Under is a chart illustrating the year-to-date efficiency of PEP shares relative to the Zacks Client Staples sector and the S&P 500.

Picture Supply: Zacks Funding Analysis

Analysts have taken their earnings expectations decrease for the quarter to be reported over current months, with the $2.30 Zacks Consensus EPS estimate down 2% since mid-July however suggesting 2.2% progress from the year-ago interval.

Picture Supply: Zacks Funding Analysis

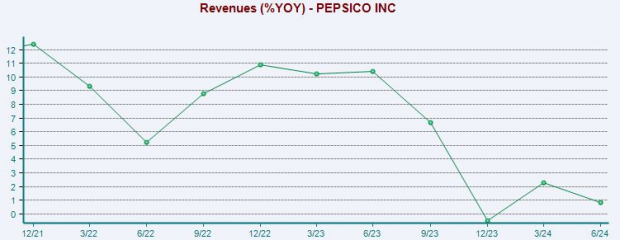

Income expectations have adopted the same path, with the $23.9 billion anticipated down a modest 1% over the identical timeframe and reflecting a 1.9% enhance from the year-ago interval. It’s vital to notice that the corporate’s income progress tempo has seen a notable decline over current durations, as proven under.

Please word that the chart under tracks the YOY share change, not precise gross sales numbers.

Picture Supply: Zacks Funding Analysis

Shares aren’t costly on a historic foundation, with the present 19.6X ahead 12-month earnings a number of properly beneath the 23.6X five-year median and five-year highs of 27.8X. The decrease a number of displays buyers’ slowing progress expectations, as talked about above.

Are Shares a Purchase?

The outlook heading into PepsiCo’s PEP quarterly launch isn’t overly optimistic, with analysts modestly revising their earnings and gross sales expectations downwards. Shares have largely been disappointing in 2024, however a optimistic information would seemingly breathe life again into shares.

This appears to be like to be a ‘wait and see’ scenario, significantly because of the downwards revisions. Nonetheless, being a extra defensive inventory, PEP shares seemingly gained’t endure a deep downwards transfer if outcomes don’t match expectations.

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our group of specialists has simply launched the 5 shares with the best likelihood of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime choose is among the many most modern monetary companies. With a fast-growing buyer base (already 50+ million) and a various set of leading edge options, this inventory is poised for large features. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.