Target TGT reported favorable Q4 results yesterday but has seen its stock dip 3% after the omnichannel retail giant issued cautious guidance.

However, Target shares continue to trade at a significant discount to competitors such as Walmart WMT in terms of P/E valuation and investors may be wondering if now is a good time to buy TGT.

Image Source: Zacks Investment Research

Target’s Q4 Results

Target’s Q4 sales of $30.91 billion edged estimates of $30.76 billion despite declining from $31.91 billion in the comparative quarter. Comparable sales for pre-existing stores grew 1.5%, driven by strong traffic and digital performance. Highlighting its e-commerce endeavors, Target stated its digital comparable sales grew 8.7% during Q4 with same day deliveries spiking 25%. ‘

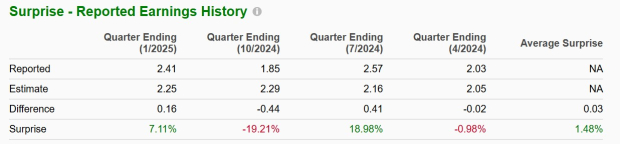

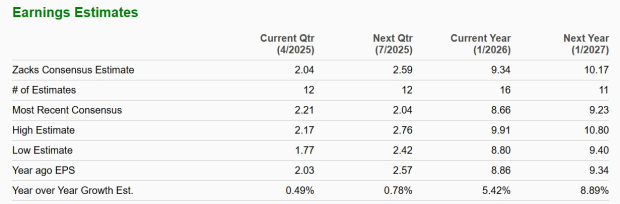

On the bottom line, Q4 EPS came in at $2.41, beating expectations of $2.25 by 7%. This compared to earnings of $2.94 per share in a tougher to compete against period. Target has exceeded the Zacks EPS Consensus in two of its last four quarterly reports with an average EPS surprise of 1.48%.

Image Source: Zacks Investment Research

Target’s Full Year Results

Rounding out its fiscal 2025, Target’s total sales dipped roughly 1% to $106.57 billion. Annual earnings also decreased 1% to $8.86 per share versus EPS of $8.94 in FY24.

Target’s Guidance & Outlook

Attributed to ongoing consumer uncertainty and tariff concerns, Target anticipates meaningful year-over-year profit pressure in Q1. Target expects full-year EPS for its current FY26 at $8.80-$9.80, which did fall in range of the current Zacks Consensus of $9.34 per share or 5% growth. Based on Zacks estimates, Target’s EPS is projected to increase another 9% in FY27.

Image Source: Zacks Investment Research

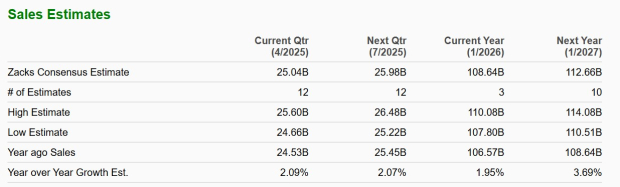

Target forecasts net sales growth of 1% in FY26, which was beneath current projections of $108.64 billion or nearly 2% growth. Zacks projections call for Target’s sales to rise over 3% in FY27 to $112.66 billion.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Landing a Zacks Rank #3 (Hold), Target stock may certainly be enticing to long-term investors at around $116 a share and 12.5X forward earnings compared to Walmart’s 36X. Furthermore, Target’s online sales growth is promising and should start to level the playing field with Walmart while taking a piece of the market share from e-commerce behemoth Amazon AMZN.

That said, more upside for TGT will likely depend on the trend of earnings estimate revisions in the coming weeks. For now, better buying opportunities could still be ahead given Target’s subtle warning of consumer shopping pressures amid tariff concerns.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Target Corporation (TGT) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.