Goal TGT reported favorable This autumn outcomes yesterday however has seen its inventory dip 3% after the omnichannel retail big issued cautious steerage.

Nevertheless, Goal shares proceed to commerce at a big low cost to opponents akin to Walmart WMT when it comes to P/E valuation and traders could also be questioning if now is an efficient time to purchase TGT.

Picture Supply: Zacks Funding Analysis

Goal’s This autumn Outcomes

Goal’s This autumn gross sales of $30.91 billion edged estimates of $30.76 billion regardless of declining from $31.91 billion within the comparative quarter. Comparable gross sales for pre-existing shops grew 1.5%, pushed by sturdy site visitors and digital efficiency. Highlighting its e-commerce endeavors, Goal acknowledged its digital comparable gross sales grew 8.7% throughout This autumn with identical day deliveries spiking 25%. ‘

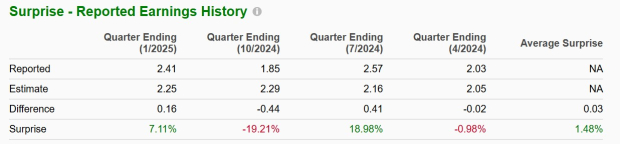

On the underside line, This autumn EPS got here in at $2.41, beating expectations of $2.25 by 7%. This in comparison with earnings of $2.94 per share in a harder to compete in opposition to interval. Goal has exceeded the Zacks EPS Consensus in two of its final 4 quarterly stories with a mean EPS shock of 1.48%.

Picture Supply: Zacks Funding Analysis

Goal’s Full Yr Outcomes

Rounding out its fiscal 2025, Goal’s whole gross sales dipped roughly 1% to $106.57 billion. Annual earnings additionally decreased 1% to $8.86 per share versus EPS of $8.94 in FY24.

Goal’s Steerage & Outlook

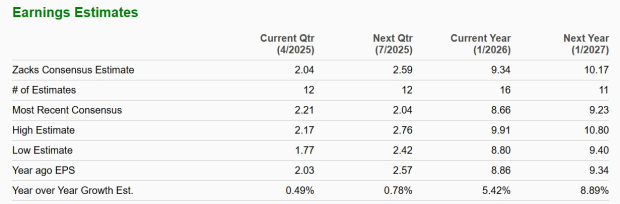

Attributed to ongoing client uncertainty and tariff considerations, Goal anticipates significant year-over-year revenue stress in Q1. Goal expects full-year EPS for its present FY26 at $8.80-$9.80, which did fall in vary of the present Zacks Consensus of $9.34 per share or 5% development. Primarily based on Zacks estimates, Goal’s EPS is projected to extend one other 9% in FY27.

Picture Supply: Zacks Funding Analysis

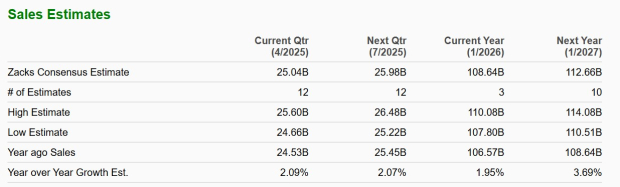

Goal forecasts internet gross sales development of 1% in FY26, which was beneath present projections of $108.64 billion or almost 2% development. Zacks projections name for Goal’s gross sales to rise over 3% in FY27 to $112.66 billion.

Picture Supply: Zacks Funding Analysis

Conclusion & Closing Ideas

Touchdown a Zacks Rank #3 (Maintain), Goal inventory might actually be engaging to long-term traders at round $116 a share and 12.5X ahead earnings in comparison with Walmart’s 36X. Moreover, Goal’s on-line gross sales development is promising and may begin to stage the taking part in subject with Walmart whereas taking a chunk of the market share from e-commerce behemoth Amazon AMZN.

That mentioned, extra upside for TGT will possible depend upon the pattern of earnings estimate revisions within the coming weeks. For now, higher shopping for alternatives may nonetheless be forward given Goal’s refined warning of client purchasing pressures amid tariff considerations.

Zacks Names #1 Semiconductor Inventory

It is only one/9,000th the scale of NVIDIA which skyrocketed greater than +800% since we beneficial it. NVIDIA remains to be sturdy, however our new prime chip inventory has far more room to increase.

With sturdy earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Target Corporation (TGT) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.