Reporting spectacular third-quarter outcomes after market hours on Thursday, Amazon’s AMZN inventory has jumped greater than +7% in Friday’s buying and selling session.

To the delight of traders, the e-commerce large has prioritized its likelihood amid its profitable enlargement into different enterprise ventures. This makes it a worthy subject of whether or not it’s time to purchase into the post-earnings rally in Amazon’s inventory with AMZN buying and selling close to its 52-week excessive of $201 a share.

Picture Supply: Zacks Funding Analysis

AWS Boosts Amazon’s Q3 Outcomes

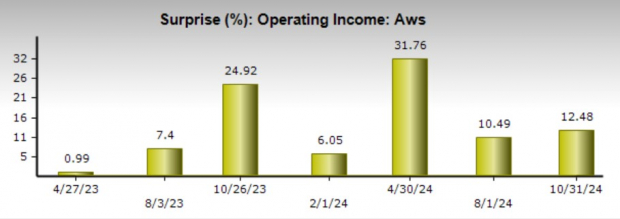

Because the world’s largest cloud supplier, Amazon Internet Providers (AWS) was a major catalyst for Amazon’s robust Q3 outcomes. AWS phase gross sales got here in at $27.45 billion, spiking 19% yr over yr regardless of lacking estimates of $27.57 billion.

That stated, Amazon’s working earnings for AWS beat estimates of $9.28 billion by 12% and soared almost 50% from $6.97 billion in Q3 2023 to a whopping $10.44 billion.

Picture Supply: Zacks Funding Analysis

General, Amazon’s Q3 gross sales rose 11% to $158.87 billion whereas Q3 EPS of $1.43 popped 68% from $0.85 per share within the comparative quarter. This surpassed the Zacks Gross sales Consensus of $157.07 billion by 1% and crushed the EPS Consensus of $1.14 by 25%.

Amazon has exceeded gross sales estimates in three of the final 4 quarters it has reported and has surpassed earnings expectations for eight consecutive quarters. Even higher, Amazon has posted a median EPS shock of 25.85% in its final 4 quarterly stories.

Picture Supply: Zacks Funding Analysis

Monitoring Amazon’s Valuation (P/E)

With Amazon’s Q3 outcomes serving to to reconfirm projections of double-digit high and backside line progress in fiscal 2024 and FY25, monitoring the tech behemoths’ valuation could also be crucial when gauging extra upside.

At present ranges, AMZN trades at 39.3X ahead earnings which isn’t a very stretched premium to the benchmark S&P 500’s 24.2X. Amazon’s ahead P/E valuation is above 4 of its Magnificent 7-themed massive tech friends however does commerce beneath Nvidia NVDA and Tesla TSLA at 47.1X and 109.9X respectively.

Picture Supply: Zacks Funding Analysis

Backside Line

For now, Amazon’s inventory lands a Zacks Rank #3 (Maintain). Regardless of a pointy post-earnings rally, traders should be rewarded for holding Amazon’s inventory at present ranges, particularly these with long-term positions.

Moreover, earnings estimate revisions might definitely pattern greater for Amazon within the coming weeks which might greater than seemingly result in a purchase ranking among the many Zacks Rank.

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our workforce of consultants has simply launched the 5 shares with the best likelihood of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This high decide is among the many most progressive monetary corporations. With a fast-growing buyer base (already 50+ million) and a various set of innovative options, this inventory is poised for large beneficial properties. After all, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.