Regardless of lacking prime and bottom-line expectations, Greenback Tree (DLTR) shares have soared +13% since reporting its This autumn outcomes on Wednesday.

The rally comes as traders have applauded Greenback Tree’s announcement to promote its ailing Household Greenback enterprise to Brigade Capital Administration and Macellum Capital Administration for $1.01 billion.

Greenback Tree’s This autumn Outcomes

Greenback Tree reported This autumn gross sales of $4.99 billion which dropped from $8.63 billion within the comparative quarter and largely missed estimates of $8.23 billion. Nonetheless, CEO Mike Creedon said the sale of Household Greenback will enable for the dedication of long-term development, profitability, and returns on capital.

On the underside line, Greenback Tree posted This autumn EPS of $2.11 lacking expectations of $2.18 and falling from $2.55 per share a 12 months in the past.

Picture Supply: Zacks Funding Analysis

Full-Yr Outcomes & Outlook

Rounding its working 12 months for fiscal 2025, Greenback Tree’s complete gross sales fell 10% to $27.56 billion in comparison with $30.6 billion in FY24. Annual earnings had been down 13% to $5.10 per share from EPS of $5.89 in FY24.

Greenback Tree expects Q1 gross sales within the vary of $4.5-$4.6 billion in comparison with $7.63 billion within the prior 12 months quarter. The corporate initiatives Q1 EPS to be between $1.10-$1.25 which got here in beneath the present Zacks Consensus of $1.46 (Present QTR Beneath) or 2% development.

Offering full-year steerage for its present FY26, Greenback Tree initiatives complete gross sales at $18.5-$19.1 billion and EPS of $5.00-$5.50 which additionally got here in beneath the Zacks Consensus of $5.94 a share or 16% development. Based mostly on Zacks estimates, Greenback Tree’s annual earnings are forecasted to rise one other 11% in FY27 to $6.62 per share.

Picture Supply: Zacks Funding Analysis

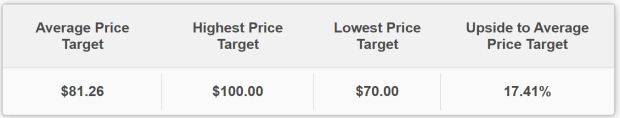

Analyst Upgrades & Common Zacks Worth Goal

With the sale of Household Greenback anticipated to cut back Greenback Tree’s working price, it is noteworthy that many analysts have began to boost their worth targets for DLTR together with these of Bernstein, Evercore ISI, and Deutsche Financial institution.

Notably, the present Common Zacks Worth Goal of $81.26 suggests 17% upside for DLTR and is predicated on the short-term worth targets supplied by 23 analysts.

Picture Supply: Zacks Funding Analysis

Backside Line

Following a really sharp post-earnings rally, Greenback Tree inventory lands a Zacks Rank #3 (Maintain). Whereas the corporate’s income will definitely decline following the sale of Household Greenback, decrease working prices ought to ultimately result in a big enhance in chance, and DLTR trades at a really cheap 11.6X ahead earnings a number of.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the overall sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there should be a catch. Sure, we do have a cause. We would like you to get acquainted with our portfolio providers like Shock Dealer, Shares Beneath $10, Know-how Innovators,and extra, that closed 256 positions with double- and triple-digit beneficial properties in 2024 alone.

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.