Shaking up their administration groups, Nike NKE and Starbucks SBUX hope to return to glory after experiencing slower progress in recent times.

Nike lately introduced its CEO John Donahoe will retire on October 13 after taking up the helm in 2020 and serving on the board of administrators since 2014. Donahoe will probably be changed by longtime govt Elliot Hill who joined Nike in 1998 as a gross sales intern.

In the meantime, Starbucks appointed Brian Niccol as its new CEO final month who beforehand served as the pinnacle of Chipotle Mexican Grill CMG and is credited for the restaurant chain’s immense likelihood.

NKE Inventory Falls After Earnings

Regardless of exceeding earnings expectations for its fiscal first quarter after hours on Monday, Nike’s inventory fell over -5% in Tuesday’s buying and selling session as the enduring sneakers and attire retailer withdrew its full-year steering. Nike posted Q1 earnings per share (EPS) of $0.70 which crushed estimates of $0.52 a share by 34% though this was a drop from $0.94 per share within the comparative quarter.

Gross sales of $11.58 billion barely missed estimates of $11.65 billion and decreased -10% from Q1 gross sales of $12.93 billion a yr in the past.

Picture Supply: Zacks Funding Analysis

Equally, Starbucks had combined outcomes for its most up-to-date fiscal third quarter report in July. Starbucks was in a position to attain EPS expectations of $0.93 however missed gross sales estimates of $9.22 billion by -1%. Moreover, Starbucks registered a slight lower on its high and backside traces from the prior yr quarter as effectively with its subsequent quarterly report scheduled for Nov. 7.

Picture Supply: Zacks Funding Analysis

NKE vs. SBUX Inventory Efficiency Comparability

Yr to this point, Nike’s inventory is down greater than -20% with Starbucks shares nearly flat. Each have noticeably underperformed the broader indexes with it noteworthy that NKE is -46% from its 52-week excessive of $123 a share final December whereas SBUX is -11% from its 52-week peak of $107 seen final November.

Picture Supply: Zacks Funding Analysis

China Optimism for Each Firms

Optimistically, Nike and Starbucks’ giant presence in China could also be interesting to long-term buyers. To that time, China’s newly applied stimulus package deal consists of the injection of over one trillion yuan ($142 billion) into its monetary sector, reducing reserve necessities for banks, and lowering key rates of interest which ought to improve client spending.

NKE & SBUX EPS Outlook

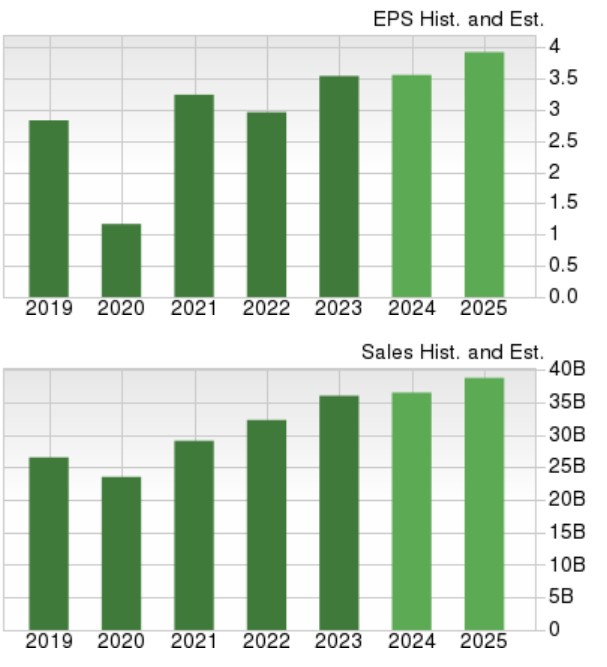

Based mostly on Zacks estimates, Nike’s whole gross sales are anticipated to dip -5% in its present fiscal 2025 however are forecasted to stabalize and rise 4% in FY26 to $50.7 billion. Nike’s annual earnings are anticipated to drop -23% in FY25 to $3.04 per share versus EPS of $3.95 in FY24. Nonetheless, FY26 EPS is projected to rebound and rise 13% to $3.45.

Picture Supply: Zacks Funding Analysis

Pivoting to Starbucks, its high line is anticipated to extend 1% this yr and is projected to broaden one other 6% in FY25 to $38.72 billion. Starbucks’ EPS is slated to be flat in FY24 however is anticipated to extend 10% in FY25 to $3.92.

Discover the most recent EPS estimates and surprises on Zacks Earnings Calendar.

Picture Supply: Zacks Funding Analysis

Backside Line

Whereas the storied manufacturers of Nike and Starbucks don’t look like damaged there may definitely be higher shopping for alternatives though affected person buyers may even see worth at their present ranges. That stated, Nike’s inventory lands a Zacks Rank #3 (Maintain) with Starbucks touchdown a Zacks Rank #4 (Promote) after a string of consecutive earnings misses previous to its most up-to-date quarterly report.

7 Finest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present listing of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Seemingly for Early Value Pops.”

Since 1988, the total listing has crushed the market greater than 2X over with a mean achieve of +23.7% per yr. So you should definitely give these hand picked 7 your quick consideration.

NIKE, Inc. (NKE) : Free Stock Analysis Report

Starbucks Corporation (SBUX) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.