DeepSeek’s menace resulted in a pointy drop in NVIDIA Company’s NVDA inventory final month. Though many of the losses have since recovered, the inventory is now awaiting the fiscal 2025 fourth-quarter and full-year outcomes announcement on Feb. 26, after market shut.

Is it even handed to purchase NVIDIA inventory earlier than the earnings report, or is it wiser to attend and observe? Let’s see –

NVIDIA Inventory – Constructive Earnings Expectation

Within the reporting quarter, NVIDIA launched its most awaited cutting-edge Blackwell structure. CEO Jensen Huang has already stated that the demand for the Blackwell chips has been insane on account of their better effectivity, sooner synthetic intelligence (AI) interface, and extra safety.

The likes of Microsoft Company MSFT and Alphabet Inc. GOOGL have ordered Blackwell chips, whereas the older Hopper chips are nonetheless in demand for his or her superior high quality in comparison with rival Intel Company INTC.

So, it’s evident that clients have lined up for the present and next-generation chips, main the corporate to surpass its income projections for the fiscal fourth quarter and full yr. Likewise, NVIDIA’s robust common four-quarter earnings shock of 9.8% implies potential earnings progress within the upcoming launch, probably boosting its inventory worth.

Picture Supply: Zacks Funding Analysis

NVIDIA Inventory – Promising Future

DeepSeek’s menace is overstated and mustn’t have a long-term affect on NVIDIA inventory. DeepSeek launched a cheap massive language mannequin that may disrupt the AI panorama. In spite of everything, NVIDIA’s graphic processing models (GPUs) wanted for AI infrastructure buildout are far more costly.

Nonetheless, decrease bills will ultimately drive extra use of computing energy and profit NVIDIA inventory. The tech big, anyhow, has the assets to introduce extra cost-friendly merchandise and enrich the AI ecosystem (learn extra: Buy NVIDIA Stock, DeepSeek’s Threat is Exaggerated).

NVIDIA’s dominant place within the GPU market has already given the corporate a aggressive benefit. Lest we overlook, NVIDIA’s CUDA software program platform is extra in style amongst builders than Superior Micro Gadgets, Inc.’s (AMD) ROCm software program platform. The change is unbelievable because of the cumbersome infrastructure transitions. Thus, NVIDIA’s robust moat bolsters its inventory outlook (learn extra: Which Is the Superior AI Investment Now: NVIDIA or AMD?).

Purchase Extra NVDA Shares Now

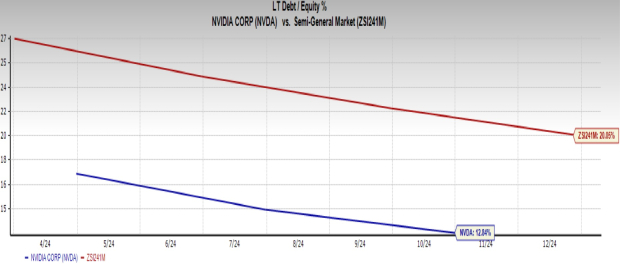

NVIDIA’s shares are anticipated to rise steadily on account of robust earnings from excessive Blackwell chip demand, declining DeepSeek worries and GPU dominance, making NVDA inventory a compelling purchase now. Moreover, NVIDIA’s 12.8% debt-to-equity ratio is decrease than the Semiconductor – General trade’s common of 20.1%, which reduces funding threat.

Picture Supply: Zacks Funding Analysis

To prime it off, NVIDIA inventory stays fairly priced. It’s because, per the value/earnings ratio, NVDA trades at 30.9X ahead earnings. Compared, the trade’s ahead earnings a number of is 36.06.

Picture Supply: Zacks Funding Analysis

Therefore, NVIDIA rightfully has a Zacks Rank #2 (Purchase). You’ll be able to see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the whole sum of solely $1. No obligation to spend one other cent.

1000’s have taken benefit of this chance. 1000’s didn’t – they thought there should be a catch. Sure, we do have a purpose. We would like you to get acquainted with our portfolio companies like Shock Dealer, Shares Underneath $10, Expertise Innovators,and extra, that closed 256 positions with double- and triple-digit positive aspects in 2024 alone.

Intel Corporation (INTC) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.