Our team believe that Boeing supply ( NYSE: BACHELOR’S DEGREE) is presently a far better choice than Lockheed Martin stock (NYSE: LMT), offered its far better potential customers. Both business have a comparable income base of regarding $66 billion, as well as both are trading at a comparable assessment of around 2x tracking incomes. Although Lockheed Martin has actually seen far better income development over the current years as well as is a lot more successful, much better potential customers as well as an appealing assessment for Boeing make it a far better choice, in our sight.

Considering supply returns, LMT has actually considerably outshined bachelor’s degree as well as the more comprehensive indices. While LMT is up 24% in the last twelve months, bachelor’s degree is up simply 3%, as well as the S&P 500 index is down 7%. There is even more to the contrast, as well as in the areas listed below, we talk about why our company believe bachelor’s degree supply will certainly use far better returns than LMT supply in the following 3 years. We contrast a variety of aspects, such as historic income development, returns, as well as assessment, in an interactive control panel evaluation of Lockheed Martin vs. Boeing: Which Supply Is A Much Better Wager? Components of the evaluation are summed up listed below.

1. Lockheed Martin’s Profits Development Has actually Been Much Better Over The Current Years

- Boeing has actually seen far better income development of 6.9% over the last twelve months, contrasted to a 1.6% loss in sales for Lockheed Martin.

- Nevertheless, checking out a longer amount of time, Lockheed Martin has actually gotten on much better, with its sales increasing at a typical development price of 3.4% to $66 billion in 2022, contrasted to $60 billion in 2019, while Bowing saw its income decrease at a typical price of -3.3% to $67 billion in 2022, contrasted to $77 billion in 2019.

- Lockheed Martin’s income development over the current years has actually been led by greater manufacturing quantity for its Sikorsky helicopter programs, AC-3, Long Variety Anti-Ship Rocket (LRASM), as well as the Joint Air-to-Surface Standoff Rocket (JASSM) program, to name a few.

- Previously today, Lockheed Martin introduced over a $1 billion agreement with the united state Navy for hypersonic projectile systems.

- The recurring Ukraine-Russia dispute has actually boosted concentrate on the protection market supplies. Brand-new organization honors will likely drive the firm’s efficiency in the close to term, with feasible boosted protection investing, particularly by NATO participants.

- The income decrease for Boeing can largely be credited to the effect of the 737 Max grounding in 2019 as well as the Covid-19 pandemic on the firm’s services, considered that airlines was among the worst-hit markets throughout the coronavirus dilemma. Business Airplanes was the biggest section for Boeing, representing 57% of complete sales in 2018, yet the payment went down to 39% in 2022.

- Boeing, over the current past, has actually had a hard time to increase its manufacturing, affecting its distributions. Supply chain disturbance as well as labor concerns for some providers better included in its distress. Nevertheless, of late, it has actually seen a surge in distributions. It supplied 480 planes in 2022, vs. 340 in 2021 as well as 157 in 2020, mirroring substantial development over the last few years. This pattern is anticipated to proceed moving forward, most likely raising sales for Boeing.

- Our Lockheed Martin Revenue Comparison as well as Boeing Profits Contrast control panels offer even more understanding right into the business’ sales.

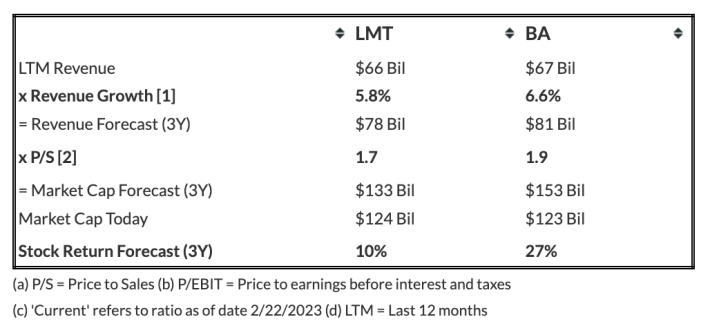

- Looking ahead, Boeing’s income is anticipated to expand somewhat faster than Lockheed Martin’s over the following 3 years. The table listed below summarizes our income assumptions for both business over the following 3 years. It indicates a CAGR of 5.8% for Lockheed Martin, contrasted to a 6.6% CAGR for Boeing, based upon Trefis Artificial intelligence evaluation.

- Keep In Mind that we have various methods for business that are adversely influenced by Covid as well as those that are not influenced or favorably influenced by Covid while anticipating future incomes. For business adversely impacted by Covid, we think about the quarterly income healing trajectory to anticipate healing to the pre-Covid income run price. Past the healing factor, we use the typical yearly development observed in the 3 years prior to Covid to replicate a go back to typical problems. For business signing up favorable income development throughout Covid, we think about annual typical development prior to Covid with a specific weight to development throughout Covid as well as the last twelve months.

2. Lockheed Martin Is Much More Rewarding

- Lockheed Martin’s present operating margin of 12.1% is better than -1.5% for Boeing.

- This compares to 14.4% as well as -1.6% numbers seen in 2019, prior to the pandemic, specifically.

- Also in historic years (2017 to currently), Lockheed Martin’s operating margin has actually been greater.

- Our Lockheed Martin Operating Earnings Contrast as well as Boeing Operating Earnings Contrast control panels have even more information.

- Lockheed Martin’s complimentary capital margin of 11.8% is far better than 5.3% for Boeing.

- Considering monetary threat, both business are similar. Boeing’s 46% financial obligation as a percent of equity is a lot greater than 12% for Lockheed Martin, yet its 13% money as a percent of possessions is additionally greater than 5% for the last, suggesting that Lockheed Martin has a far better financial obligation setting, yet Boeing has even more money padding.

3. The Internet of All Of It

- We see that Lockheed Martin has actually shown far better income development over the current years, is a lot more successful, as well as has a far better financial obligation setting. On the various other hand, Boeing has a much more money padding as well as has actually seen far better income development over the current quarters.

- Currently, checking out potential customers, utilizing P/S as a base, because of high changes in P/E as well as P/EBIT, our company believe Boeing is presently the far better option.

- If we contrast the present assessment to the historic standard, Boeing prices much better, with its supply presently trading at 1.8 x tracking incomes vs. the last five-year standard of 1.9 x. On the other hand, Lockheed Martin’s supply professions at 1.9 x, tracking incomes vs. the last five-year standard of 1.6 x. Our Lockheed Martin (LMT) Assessment Ratios Contrast as well as Boeing (BACHELOR’S DEGREE) Assessment Ratios Contrast has even more information.

- The table listed below summarizes our income as well as return assumptions for Lockheed Martin as well as Boeing over the following 3 years as well as indicate an anticipated return of 27% for Boeing over this duration vs. a 10% anticipated return for Lockheed Martin, suggesting that capitalists are far better off purchasing bachelor’s degree over LMT, based upon Trefis Artificial intelligence evaluation– Lockheed Martin vs. Boeing — which additionally offers even more information on just how we reach these numbers.

While bachelor’s degree supply might exceed LMT, it is handy to see just how Lockheed Martin’s Peers price on metrics that matter. You will certainly locate various other important contrasts for business throughout sectors at Peer Comparisons

In Addition, the Covid-19 dilemma has actually produced lots of prices stoppages which can use eye-catching trading possibilities. As an example, you’ll be amazed by just how counter-intuitive the supply assessment is for Marine Products vs. Amerco

Regardless of greater rising cost of living as well as the Fed increasing rates of interest, Lockheed Martin has actually increased 24% in the last twelve months. Yet can it go down from right here? See just how reduced can Lockheed Martin supply go by contrasting its decrease in previous market collisions. Below is a efficiency recap of all supplies in previous market collisions.

What Happens If you’re seeking a much more well balanced profile rather? Our top notch profile as well as multi-strategy profile have actually defeated the marketplace constantly given that completion of 2016.

| Returns | Feb 2023 MTD [1] |

2023 YTD [1] |

2017-23 Complete [2] |

| LMT Return | 3% | -2% | 92% |

| Bachelor’s Degree Return | -4% | 8% | 32% |

| S&P 500 Return | -2% | 4% | 79% |

| Trefis Multi-Strategy Profile | -4% | 7% | 237% |

[1] Month-to-date as well as year-to-date since 2/22/2023

[2] Advancing complete returns given that completion of 2016

Attach Trefis Market Whipping Profiles

See all Trefis Price Estimates

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.