2024 was one other nice yr for buyers. The S&P 500 and Nasdaq Composite gained 24% and 30%, respectively, thanks largely to tailwinds fueled by synthetic intelligence (AI), blockbuster weight reduction medicine, and even some shopper resiliency given a steadily bettering macroeconomic image.

One firm that quietly had a milestone yr in 2024 is streaming platform Netflix (NASDAQ: NFLX), which gained 85% and is at the moment buying and selling close to all-time highs.

The place to speculate $1,000 proper now? Our analyst group simply revealed what they imagine are the 10 greatest shares to purchase proper now. See the 10 stocks »

I will break down why 2024 was such a pivotal yr for Netflix. Extra importantly, I will even be detailing why buyers ought to control the inventory as Jan. 6 quick approaches.

2024 was a transformational yr for Netflix

Netflix is greatest recognized for its huge content material library — spanning each style from comedies and thrillers to cartoons and anime, and way more. During the last a number of years, Netflix has invested important capital into its personal authentic content material, hanging offers with Hollywood’s greatest stars and creating new tv collection and flicks which can be unique to the Netflix platform.

For a while, this technique helped Netflix separate itself from different streaming platforms, whereas additionally giving the corporate new methods to enchantment to viewers who could also be uninterested in watching reruns of outdated, syndicated content material.

Nevertheless, creating authentic content material is a blueprint that is straightforward to observe. Different streaming services provided by Amazon, Apple, Paramount, and Disney have adopted go well with. Consequently, Netflix has been confronted with the daunting activity of differentiating itself from different streamers, whereas additionally sustaining an acceptable degree of buyer acquisition prices.

During the last yr, Netflix swiftly moved into its subsequent huge class: Stay sporting occasions. To be truthful, Amazon and Apple additionally provide a point of stay sports activities with the NFL and Main League Baseball. Nevertheless, Netflix’s strategy is a bit completely different, and under I will define simply how profitable this marketing campaign has been to this point.

Right here is how stay occasions have carried out on the platform

In 2024, Netflix’s two high-profile stay sporting occasions included a boxing match between YouTube star Jake Paul and boxing legend Mike Tyson, and streaming the NFL video games on Christmas Day.

Based on knowledge compiled by TVision, the Paul-Tyson match was probably the most streamed sporting occasion in historical past, reaching an estimated 108 million stay viewers all over the world. Nielsen estimates that every of the NFL video games on Christmas reached a median of 24 million viewers, making them two of probably the most streamed video games in NFL historical past.

Whereas Netflix’s expertise in sporting occasions is proscribed, early outcomes are indicating that the corporate’s ambitions in stay broadcasting are paying off. On Jan. 6, Netflix might be unveiling its newest venture in stay leisure — this time that includes wrestling content material from WWE Uncooked.

Picture supply: Getty Photographs.

Is Netflix inventory a purchase earlier than Jan. 6?

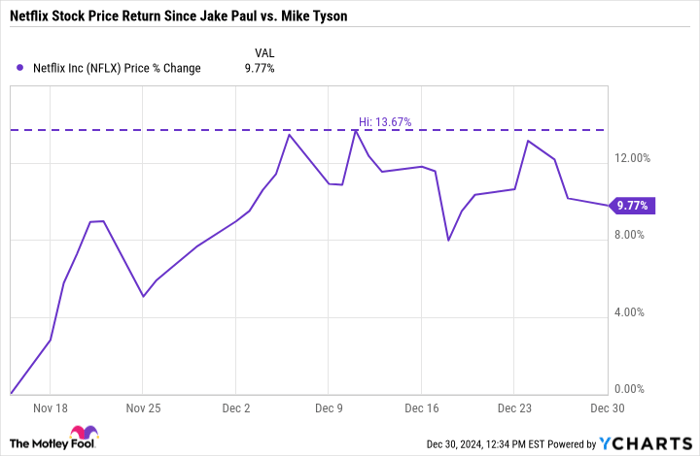

The Jake Paul-Mike Tyson match came about on Friday, Nov. 15, 2024. Because the chart under illustrates, shares of Netflix popped as excessive as 14% following the occasion, and have gained a web of 10% by means of Dec. 30.

Curiously, within the days main as much as the Christmas Day NFL video games, Netflix inventory skilled a fleeting pop. Nevertheless, as I write this, shares of Netflix have dropped by roughly 3% following the video games.

Given these two knowledge factors, I feel it is truthful to say that Netflix inventory has witnessed some pronounced momentum across the occasions of its stay occasions. Usually, I are inclined to discourage investing in momentum stocks given their irregular ranges of volatility.

To me, shopping for Netflix inventory earlier than Jan. 6 shouldn’t be so essential. The extra essential concept right here is that Netflix’s stay occasions have to this point been record-setting broadcasts. Whereas there isn’t a assure that the WWE Uncooked marketing campaign will observe the identical path because the Paul-Tyson match or NFL video games, I feel there is a good likelihood that wrestling might turn out to be one other tailwind for Netflix.

I see stay occasions changing into an infinite alternative for Netflix, and I’m bullish on the corporate’s capability to strike extra partnerships throughout sports activities and leisure in the long term.

Don’t miss this second likelihood at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? You then’ll need to hear this.

On uncommon events, our professional group of analysts points a “Double Down” stock suggestion for corporations that they assume are about to pop. When you’re apprehensive you’ve already missed your likelihood to speculate, now’s the perfect time to purchase earlier than it’s too late. And the numbers converse for themselves:

- Nvidia: should you invested $1,000 once we doubled down in 2009, you’d have $348,216!*

- Apple: should you invested $1,000 once we doubled down in 2008, you’d have $47,425!*

- Netflix: should you invested $1,000 once we doubled down in 2004, you’d have $480,681!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable corporations, and there is probably not one other likelihood like this anytime quickly.

*Inventory Advisor returns as of December 30, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon and Apple. The Motley Idiot has positions in and recommends Amazon, Apple, Netflix, and Walt Disney. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.