NVIDIA Company NVDA has as soon as once more delivered a stellar earnings report, reinforcing its dominance within the synthetic intelligence (AI) and semiconductor markets. On Feb. 26, the corporate reported fourth-quarter fiscal 2025 revenues of $39.33 billion, marking a 78% year-over-year surge and surpassing the consensus estimate of $37.72 billion.

With a record-breaking information heart phase and powerful demand for AI-driven computing options, NVIDIA’s progress story stays compelling. Robust basic progress drivers, together with a pretty valuation, make NVDA inventory a prudent funding alternative proper now.

Information Heart Phase: NVIDIA’s Development Powerhouse

NVIDIA’s Information Heart enterprise stays the spine of its monetary power. Within the fourth quarter, the phase generated $35.58 billion in revenues, representing 90.5% of whole gross sales. This marked a staggering 93% year-over-year enhance and 16% sequential progress, pushed by the speedy adoption of synthetic intelligence (AI) workloads.

The demand for NVIDIA’s Hopper 200 and Blackwell GPU computing platforms has been a key catalyst as cloud suppliers and enterprises scale their AI infrastructure. Massive cloud service suppliers contributed practically 50% of Information Heart revenues, indicating continued hyperscale funding in AI-driven computing.

With AI adoption accelerating throughout industries, NVIDIA’s stronghold in information facilities makes it a crucial beneficiary of this development. The corporate’s management in AI chip growth positions it effectively for sustained income progress on this phase.

NVIDIA’s Robust Monetary Execution and Profitability

Past income progress, NVIDIA demonstrated distinctive monetary self-discipline. The corporate reported non-GAAP gross margins of 73.5%, sustaining profitability regardless of rising operational bills. Non-GAAP working revenue jumped 73% yr over yr to $25.52 billion, reflecting the corporate’s means to transform robust income progress into bottom-line good points.

NVIDIA’s money stream technology additionally stays sturdy. The corporate ended the fourth quarter with $43.2 billion in money, money equivalents and marketable securities, up from $38.4 billion within the earlier quarter. This robust liquidity place allows NVIDIA to reinvest in analysis & growth, increase manufacturing capabilities and return capital to shareholders.

AI Momentum: A Multi-Yr Development Catalyst for NVIDIA

NVIDIA’searnings callemphasized the transformative potential of AI throughout industries. CEO Jensen Huang highlighted the rising adoption of reasoning AI fashions, which require considerably increased computational energy. The Blackwell structure, with its as much as 25x increased token throughput for AI inference in comparison with Hopper 100, is predicted to play a vital position in shaping the subsequent part of AI-driven computing.

The upcoming launch of NVIDIA’s Blackwell Extremely and Vera Rubin platforms may additional strengthen the corporate’s technological lead. With AI infrastructure investments accelerating globally, NVIDIA is well-positioned to capitalize on these increasing alternatives.

NVIDIA Q1 Steering: One other Robust Quarter Forward

NVIDIA’s outlook for the primary quarter of fiscal 2026 stays upbeat. The corporate initiatives first-quarter revenues of $43 billion, reflecting continued momentum in AI-driven demand. Gross margins are anticipated to stay robust at 71% regardless of rising prices related to ramping up Blackwell manufacturing.

Moreover, NVIDIA is witnessing robust traction in rising AI purposes, together with enterprise AI, autonomous automobiles and robotics. This diversification of AI-driven income streams reinforces the corporate’s long-term progress potential.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $43.28 billion, indicating 66.2% year-over-year progress. The consensus mark for non-GAAP earnings stands at 92 cents per share, calling for a 50.8% enhance from the year-ago quarter.

NVIDIA has a robust historical past of beating earnings estimates. It surpassed the Zacks Consensus Estimate for earnings in every of the trailing 4 quarters, the typical shock being 7.9%.

NVIDIA Company Inventory Worth, Consensus and EPS Shock

NVIDIA Corporation price-consensus-eps-surprise-chart | NVIDIA Company Quote

NVIDIA’s Discounted Inventory Valuation: A Shopping for Alternative

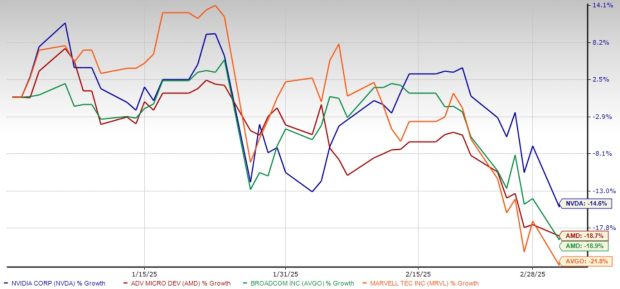

Regardless of robust fundamentals and sturdy quarterly performances, NVIDIA shares have plunged 14.6% yr to this point because of broader market volatility. The decline displays the impression of an exaggerated concern that DeepSeek’s innovation may cut back demand for NVIDIA’s high-end AI chips. Additionally, the broader market sell-off as a result of imposition of recent import tariffs on Canada, Mexico and China weighed on NVIDIA’s share worth efficiency.

Different main gamers within the semiconductor house, together with Superior Micro Units AMD, Broadcom AVGO and Marvell Know-how MRVL, are additionally buying and selling within the crimson zone as a result of current broader market sell-off.

YTD Inventory Worth Return Efficiency

Picture Supply: Zacks Funding Analysis

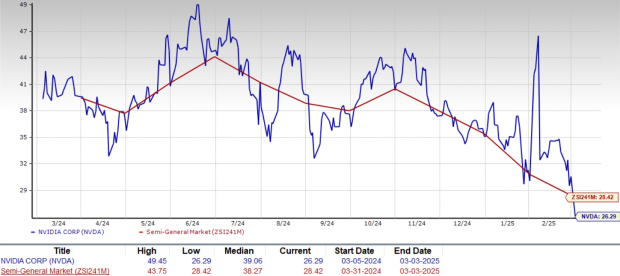

Nonetheless, the current sell-off has supplied a shopping for alternative for traders as NVDA now trades at a pretty valuation a number of. The inventory trades at a trailing 12-month price-to-earnings (P/E) ratio of 26.29, under the Zacks Semiconductor – General business common of 28.42. This implies the inventory is buying and selling at a relative low cost, providing potential upside for traders.

NVDA Ahead 12-Month P/E Ratio

Picture Supply: Zacks Funding Analysis

Conclusion: Purchase NVIDIA Inventory Now

NVIDIA’s excellent fourth-quarter earnings outcomes reaffirm its place as a frontrunner in AI-driven computing. The corporate’s document Information Heart revenues, robust revenue margins and optimistic steering for the primary quarter of fiscal 2026 spotlight its continued progress trajectory. NVIDIA’s long-term potential in AI computing and information heart dominance and enticing valuation make it a inventory price shopping for. Presently, NVDA carries a Zacks Rank #2 (Purchase). You possibly can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the whole sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there have to be a catch. Sure, we do have a purpose. We would like you to get acquainted with our portfolio companies like Shock Dealer, Shares Underneath $10, Know-how Innovators,and extra, that closed 256 positions with double- and triple-digit good points in 2024 alone.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.