There are not any two methods about it. Amazon is among the fashionable period’s best-performing shares, up roughly 300,000% since its 1997 public providing. The following 30 years aren’t prone to be almost as rewarding, however due to the corporate’s foray into cloud computing, the e-commerce big remains to be one of many market’s most promising funding prospects at the moment.

There’s a greater development inventory to contemplate including to your portfolio right here, nonetheless. That is Uber Applied sciences (NYSE: UBER). Here is why.

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

Whether or not Uber is the trigger or the outcome, the developments are promising

Though founders Travis Kalanick and Garrett Camp did not precisely invent the premise of ride-hailing apps, they’re pretty credited with bringing the thought into the mainstream. It is nonetheless catching on with shoppers, too. Uber’s third-quarter income development of 20% extends well-established developments. And it is increasingly profitable.

UBER Revenue (Quarterly) knowledge by YCharts

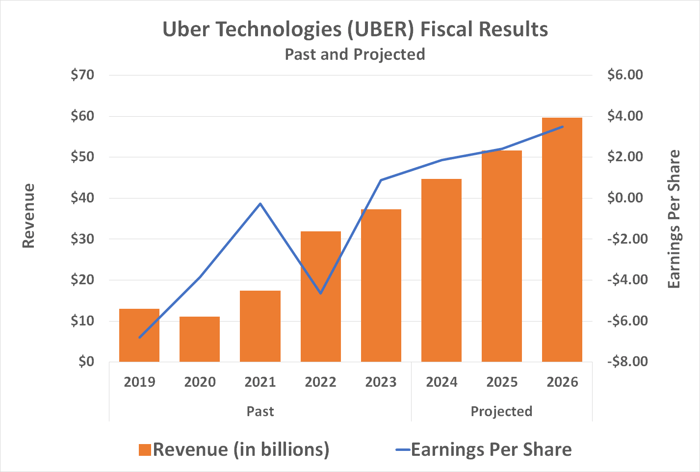

Analysts count on extra top- and bottom-line development nicely into the longer term, too.

Information supply: StockAnalysis.com. Chart by writer.

This ahead progress is barely a part of the bullish argument for proudly owning a stake in Uber, nonetheless, and never even a very powerful half. Much more necessary is the underlying cultural cause for this continued gross sales and earnings development. That’s, automobile possession is on the decline. Ditto for even getting a driver’s license.

Numbers from the U.S. Federal Freeway Administration reported by authorized data web site Client Protect flesh out the story, indicating that home automobile registrations have dwindled from 2001’s peak of 138 million to a multi-decade low of slightly below 100 million in 2022. The COVID-19 pandemic and its fallout are liable for at the least a few of the newer weak spot on this entrance. However this depend has been usually declining since nicely earlier than the contagion took maintain.

You may even see or hear differing knowledge. Significantly, a generally cited determine from the Federal Freeway Administration means that as of 2022 there have been truly 283.4 million registered autos on U.S. roads. This depend consists of buses and heavy-duty vehicles, nonetheless, that are usually owned by governments and companies for industrial or public-service functions.

The variety of autos sitting in peoples’ driveways can also be relatively stagnant…at the least as a proportion of U.S. households. Client Protect provides that as of 2022, the everyday American family owns 1.83 automobiles, extending a slight downtrend from 2001’s peak of 1.89.

An analogous dynamic is obvious outdoors of the U.S. as nicely, the place Uber is increasing.

Younger adults are normalizing an absence of automobile possession as they age

It appears unlikely this shallow downtrend is ready to reverse anytime quickly. A current ballot carried out by car-sharing community Zipcar signifies that multiple out of each three Individuals is contemplating not proudly owning any automobile by 2030. Practically one out of each 5 of those respondents, in actual fact, says they they’re very critical about eliminating their automobiles and utilizing various types of transportation as an alternative.

And different knowledge underscores this rising disinterest. As an illustration, Hedges Firm predicts the full gross sales of sunshine autos (sedans, SUVs, not industrial vehicles) inside the USA is on tempo to achieve a modest 15.9 million items this yr regardless of the first rate economic system and larger post-COVID stability. That is up from 2023’s depend of 15.5 million, however nonetheless markedly beneath 2016’s peak of 17.4 million.

Youthful shoppers are rising up with much less curiosity in automobile possession than their mother and father, too…and even getting a driver’s license. Numbers from the U.S. Division of Transportation point out that as of 2022 solely about one-fourth of the nation’s 16-year-olds held a license, versus half of this age group in 1983. Even the variety of 18-year-old drivers has tumbled from 80% again then to solely 60% now.

The chief causes for this once-unlikely dynamic? Price is one; the typical fee for a brand new automobile now stands at over $700 per thirty days. A scarcity of want is one other. Youthful generations are utterly comfy with discovering leisure and sustaining a social life by way of a pc. A ride-hailing service like Uber’s makes it doable to reside and performance in an atmosphere the place such a perspective is more and more the norm.

And once more, this dynamic is obvious in different elements of the world.

Each shares are good, however Uber inventory is healthier

None of this to counsel proudly owning Amazon inventory at this time limit is a mistake. It is nonetheless an ideal play. The truth is, in some ways Amazon advantages from the identical underlying dynamic that is driving Uber’s development. That is the rising variety of shoppers which can be content material with out proudly owning and even driving a automobile. These individuals are equally content material to buy on-line and let Amazon work out learn how to get merchandise to their doorstep. (In the meantime, Amazon’s cloud computing workhorse is using a special development pattern.)

Of the 2 tickers in query, although, Uber is arguably the extra promising prospect just because so many buyers nonetheless underestimate simply how sturdy its cultural tailwind is and the way lengthy it may persist. For perspective, market analysis outfit Future Market Perception believes the worldwide ride-hailing market is ready to develop at a mean annualized tempo of 15.4% by means of 2034.

Market chief Uber is poised to seize at the least its fair proportion of this development.

Don’t miss this second probability at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? You then’ll wish to hear this.

On uncommon events, our professional crew of analysts points a “Double Down” stock advice for firms that they suppose are about to pop. In the event you’re fearful you’ve already missed your probability to speculate, now’s the most effective time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Nvidia: in case you invested $1,000 once we doubled down in 2009, you’d have $374,613!*

- Apple: in case you invested $1,000 once we doubled down in 2008, you’d have $46,088!*

- Netflix: in case you invested $1,000 once we doubled down in 2004, you’d have $475,143!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable firms, and there will not be one other probability like this anytime quickly.

*Inventory Advisor returns as of December 30, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Uber Applied sciences. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.