It is an essential lesson in enterprise — corporations that fail to adapt fall behind. One acquainted instance is Blockbuster Video, which might have bought Netflix for $50 million, however the CEO did not see any worth within the concept. Netflix is now price almost $400 billion, whereas Blockbuster is historical past.

Intel (NASDAQ: INTC) is experiencing one thing related though not as everlasting. It is unlikely that Intel will exit of enterprise; nevertheless, lacking out on smartphones (extra on this beneath), the current failure to embrace artificial intelligence (AI), and different missteps have the corporate reeling. The proof is within the pudding. Nvidia inventory has skyrocketed, whereas Intel has crashed:

The place to speculate $1,000 proper now? Our analyst crew simply revealed what they consider are the 10 greatest shares to purchase proper now. See the 10 stocks »

Intel is present process a much-needed management change now, however turnarounds take time. In the meantime, these two AI shares beneath might outperform.

Arm Holdings

When Intel missed out on supplying the chips for the iPhone, it was a devastating blow and an enormous boon for Arm Holdings (NASDAQ: ARM). Arm-based chips are in additional than 99% of worldwide smartphones. Discuss dominating the market. Arm would not make the precise chips; it designs the framework (which it calls the structure) for the chips and licenses the designs to different corporations, notably the tech giants. Arm makes cash from licensing and royalties for merchandise containing its chip structure.

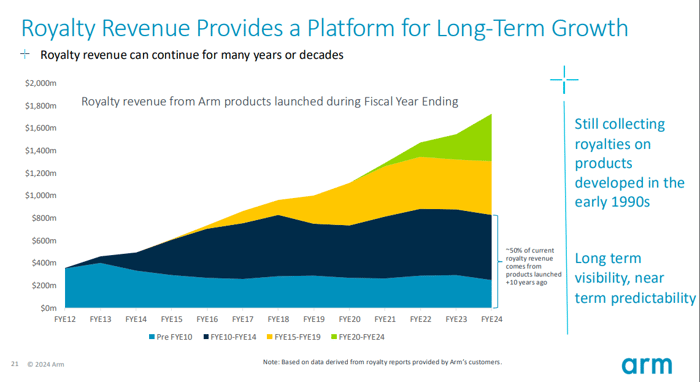

Arm’s income hit a file $844 million final quarter, the second quarter of fiscal 2025, ended Sept. 30, on 5% year-over-year development. Development was throttled because of the timing of some licensing income, so Arm expects 13% development subsequent quarter and 22% for the fiscal yr, based mostly on the midpoint of its steerage. Among the finest issues about Arm’s enterprise mannequin is lasting income. As proven beneath, the corporate nonetheless receives royalties for merchandise developed a long time in the past.

Picture supply: Arm Holdings.

This technique offers constant gross sales and boosts profitability since few prices are related to merchandise developed years in the past.

Arm has a number of gross sales verticals, together with cellular, cloud computing, automotive, and the Web of Issues (IoT). As of fiscal 2024, the corporate held 41% of the market share in automotive, 15% in cloud, 54% in IoT, and 99% in cellular. Arm’s market dominance in a number of sectors bodes properly for development.

As of this writing, Arm’s inventory value has appreciated 93% to date in 2024, giving it a $153 billion market cap. This implies it trades for 39 instances its midpoint gross sales steerage for this fiscal yr, fairly a steep value. Nonetheless, Arm will finally develop into its valuation. Interested investors ought to think about dollar-cost averaging to minimize the danger of shopping for at a near-term excessive and reap the benefits of potential dips within the inventory value.

Marvell Know-how

You’ve undoubtedly heard of Nvidia, the world’s data center beast with a $3 trillion-plus market worth. Nvidia offers high-powered graphic processing items (GPUs) that facilitate lightning-speed knowledge processing. However Nvidia would not act alone. Information facilities additionally want different infrastructure, just like the optical interconnects, switches, controllers, and extra that Marvell Know-how (NASDAQ: MRVL) produces.

Gigantic knowledge facilities are being constructed at a brisk tempo. As an illustration, Amazon simply introduced a $10 billion funding in an Ohio heart, Microsoft has damaged floor on billion-dollar tasks in a number of states, and Elon Musk’s xAI supercomputer is forecast to comprise 1 million GPUs. These huge builds are large tailwinds for Marvell, which expects a complete market alternative of $75 billion by 2028.

Marvell’s income hit $1.5 billion within the newest interval, the third quarter of its fiscal 2025, ended Nov. 2, on 7% development. The info heart accounted for $1.1 billion of complete gross sales, a 98% year-over-year improve. Marvell expects to speed up complete gross sales development subsequent quarter to 26% or $1.8 billion.

Marvell is not working profitably but; nevertheless, many vital bills are non-cash, like depreciation, restructuring expenses, and stock-based compensation. The corporate reported a formidable non-GAAP (adjusted) working margin of 30% final quarter.

On Wall Road, 33 of 36 analysts fee the inventory a purchase or robust purchase, but the typical value goal is $118 per share, barely decrease than the $123 value as of this writing. The analysts will in all probability start growing their targets as income accelerates. Nonetheless, buyers ought to think about using the identical danger mitigation shopping for methods talked about above.

Hopefully, Intel’s turnaround will probably be swift and profitable. But it surely has a protracted solution to go. Within the meantime, AI shares like Marvell and Arm Holding have rather more momentum and upside.

Don’t miss this second likelihood at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? Then you definitely’ll need to hear this.

On uncommon events, our professional crew of analysts points a “Double Down” stock advice for corporations that they suppose are about to pop. If you happen to’re nervous you’ve already missed your likelihood to speculate, now’s one of the best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Nvidia: if you happen to invested $1,000 once we doubled down in 2009, you’d have $334,266!*

- Apple: if you happen to invested $1,000 once we doubled down in 2008, you’d have $46,976!*

- Netflix: if you happen to invested $1,000 once we doubled down in 2004, you’d have $479,727!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable corporations, and there might not be one other likelihood like this anytime quickly.

*Inventory Advisor returns as of December 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Bradley Guichard has positions in Amazon. The Motley Idiot has positions in and recommends Amazon, Intel, Microsoft, Netflix, and Nvidia. The Motley Idiot recommends Marvell Know-how and recommends the next choices: lengthy January 2026 $395 calls on Microsoft, brief February 2025 $27 calls on Intel, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.