The semiconductor market is making an attempt to stage a comeback after struggling for many of 2023. Greater demand for semiconductors throughout a lot of industries and the continuing enthusiasm surrounding synthetic intelligence (AI), particularly generative, has been boosting gross sales.

Given this example, investing in semiconductor shares like Taiwan Semiconductor Manufacturing Firm Restricted TSM, NVIDIA Company NVDA Utilized Supplies, Inc. AMAT, and Semtech Company SMTC will probably be a clever choice.

Semiconductor Shares to Acquire as Gross sales Soar

The Semiconductor Trade Affiliation (SIA) mentioned on Tuesday that international semiconductor gross sales totaled $51.3 billion in July 2024, leaping 18.7% from July 2023’s complete of $43.2 billion. Month over month, semiconductor gross sales rose 2.7% from June’s complete of $50.0 billion.

John Neuffer, SIA president and CEO, mentioned, “The worldwide semiconductor market continued to develop considerably on a year-to-year foundation in July, and month-to-month gross sales elevated for the fourth consecutive month.”

“The Americas market skilled significantly sturdy development in July, with a year-to-year gross sales enhance of 40.1%,” he added.

Regionally, year-over-year gross sales grew 40.1% within the Americas, 19.5% in China and 16.7% in Asia Pacific/All Different.

Cooling Inflation, AI Craze Enhance Semiconductor Inventory Demand

Cooling inflation is lastly serving to increase semiconductor gross sales. Easing worth pressures have seen demand rebound. Additionally, the tech rally this yr has largely been pushed by NVIDIA Company. The semiconductor chief has been on the forefront of the generative AI sector, driving the surge in curiosity and improvement on this space.

Consultants imagine that AI has appreciable untapped potential, with a lot nonetheless to be witnessed by the world. This rising curiosity is prone to increase demand much more as extra semiconductor producers are exploring the sector. The AI market is predicted to blow up within the coming days with demand for AI chipsets already surging.

In accordance with the World Semiconductor Commerce Statistics (“WSTS”), the semiconductor business is predicted to develop by 16% this yr, up from a earlier forecast of 13.1%. International semiconductor gross sales are projected to achieve $611.2 billion this yr. Gross sales within the Americas are anticipated to guide with an estimated enhance of over 25%. Waiting for 2025, WSTS expects international gross sales to develop by 12.5%, reaching $687.4 billion.

Additionally, the Federal Reserve is gearing as much as begin its easing cycle, with the primary price minimize doubtless coming in September. Market members are anticipating a 25-basis- level price minimize this month. Decrease rates of interest sometimes assist development belongings as they cut back the chance value of holding belongings that don’t present yields, resembling tech and semiconductor shares.

Semiconductors Shares Poised to Develop

We now have chosen 4 semiconductor shares which have a powerful potential for 2024 and the approaching yr.

Taiwan Semiconductor Manufacturing Firm

Taiwan Semiconductor Manufacturing Firm Restricted is the world’s largest devoted built-in circuit foundry. As a foundry, TSM manufactures ICs for its prospects based mostly on their proprietary IC designs utilizing its superior manufacturing processes. Taiwan Semiconductor Manufacturing Firm Restricted’s objective is to determine itself as one of many world’s main semiconductor firms by constructing upon the strengths which have made it the main IC foundry on the earth.

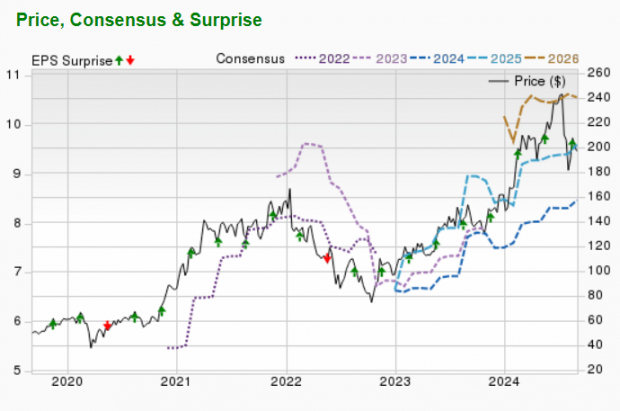

Taiwan Semiconductor Manufacturing Firm Restricted’s anticipated earnings development price for the present yr is 24.5%. The Zacks Consensus Estimate for current-year earnings has improved 5.2% over the previous 60 days. TSM presently carries a Zacks Rank #2 (Purchase). You may see the complete list of today’s Zacks #1 Rank stocks here.

Picture Supply: Zacks Funding Analysis

NVIDIA Company

NVIDIA Company is the worldwide chief in visible computing applied sciences and the inventor of the graphic processing unit, or GPU. Through the years, NVDA’s focus has advanced from PC graphics to AI-based options that now help high-performance computing, gaming and digital actuality platforms.

NVIDIA Company’s anticipated earnings development price for the present yr is greater than 100%. The Zacks Consensus Estimate for current-year earnings improved 0.4% over the previous 60 days. NVDA presently has a Zacks Rank #3 (Maintain).

Picture Supply: Zacks Funding Analysis

Utilized Supplies

Utilized Supplies, Inc. is among the world’s largest suppliers of apparatus for the fabrication of semiconductors, flat panel liquid crystal shows, and photo voltaic photovoltaic cells and modules. AMAT additionally presents deployment and help companies associated to the gear provided.

Utilized Supplies’ anticipated earnings development price for the present yr is 5.2%. The Zacks Consensus Estimate for current-year earnings has improved 1.7% over the previous 60 days. AMAT at the moment carries a Zacks Rank #3.

Picture Supply: Zacks Funding Analysis

Semtech Company

Semtech Company designs, manufactures and markets a variety of analog and mixed-signal semiconductors for business functions. SMTC’s product line includes Sign Integrity Merchandise, Safety Merchandise, Energy and Excessive-Reliability Merchandise, Wi-fi and Sensing Merchandise, and Programs Innovation Group.

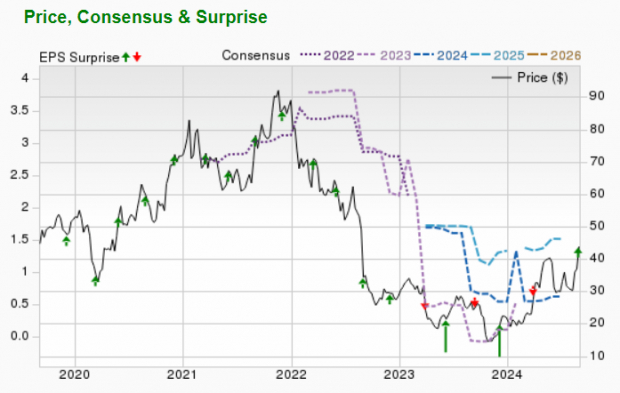

Semtech’s anticipated earnings development price for the present yr is greater than 100%. The Zacks Consensus Estimate for current-year earnings improved 6.3% over the previous 60 days. SMTC presently carries a Zacks Rank #3.

Picture Supply: Zacks Funding Analysis

Analysis Chief Names “Single Greatest Decide to Double”

From hundreds of shares, 5 Zacks specialists every have chosen their favourite to skyrocket +100% or extra in months to come back. From these 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

This firm targets millennial and Gen Z audiences, producing practically $1 billion in income final quarter alone. A latest pullback makes now a super time to leap aboard. In fact, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Semtech Corporation (SMTC) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.