When artificial intelligence (AI) shares with market caps of lower than $10 billion, two distinguished names are SoundHound AI (NASDAQ: SOUN) and BigBear.ai (NYSE: BBAI). Though each began the yr with market caps of lower than $1 billion, the approximate eightfold enhance in SoundHound’s inventory worth thus far in 2024 (as of this writing) has pushed its market cap to virtually $7 billion.

The query wanting forward is whether or not traders ought to persist with SoundHound or if BigBear.ai could make an identical run in 2025. Let us take a look at some essential traits of every inventory to assist decide which is able to outperform in 2025.

The place to take a position $1,000 proper now? Our analyst workforce simply revealed what they imagine are the 10 greatest shares to purchase proper now. See the 10 stocks »

Voice vs. imaginative and prescient

In terms of smaller shares, one of the essential components in how they carry out is the chance in entrance of them.

SoundHound AI is making an attempt to develop into the chief in AI voice as a result of its expertise permits for extra pure, conversational interactions by utilizing speech-to-deep-meaning-understanding expertise to assist acknowledge a person’s intent earlier than they’re even completed speaking. The corporate has carved out a powerful early area of interest within the car and restaurant business markets.

It lately acquired an organization referred to as Amelia that runs an AI conversational platform centered on serving to organizations with duties corresponding to customer support, worker onboarding, and back-office work. The deal helped SoundHound get into extra industries, together with retail, healthcare, insurance coverage, and monetary establishments.

SoundHound nonetheless has lots of development alternatives in its most important auto and restaurant business segments, and the inventory received a lift earlier this month after asserting that Torchy’s Tacos was deploying its AI telephone ordering system throughout all 130 of its areas.

Nonetheless, the most important alternative lies with the corporate changing into a whole AI commerce voice platform that may reply difficult questions throughout numerous industries which have their very own jargon and several types of interactions. On that entrance, market researchers Frost & Sullivan lately named SoundHound’s Amelia Conversational AI Platform the chief within the healthcare subject, a promote it thinks can be a $2.34 billion alternative by the tip of 2027. However there are numerous markets past these that SoundHound can get into, and collectively, these make up an enormous alternative.

SoundHound has been seeing sturdy income development, together with final quarter when it surged 89%.

BigBear.ai, in the meantime, is targeted on the U.S. authorities protection business. The corporate was created via the merger of analytics firm BigBear and techniques integrator NuWave by non-public fairness agency AI Industrial Companions. Two different analytic firms have been later added to the combo, and the corporate went public through a particular function acquisition firm (SPAC) again in 2021.

The corporate derives a lot of its income from the federal authorities, though it additionally has prospects within the manufacturing, life sciences, and logistics industries. It has a lot of provide chain and logistics options in addition to options within the cybersecurity, digital id, automation, and knowledge assortment markets.

The corporate has been a blended bag operationally. Income plunged by 21% in Q1, harm by the chapter of buyer Virgin Orbit and the tip of an Air Power contract. Nonetheless, it regained its income momentum in Q3, up 22%, because of its current acquisition of Pangiam.

The acquisition of Pangiam, whose techniques typically are utilized in locations like airports, is anticipated to convey expertise to BigBear.ai within the areas of facial recognition, image-based anomaly detection, and superior biometrics. With the deal, the corporate is trying to have the business’s most complete imaginative and prescient AI portfolio.

Picture supply: Getty Photos.

Margins

Along with current income development, one other huge distinction between SoundHound and BigBear.ai is their gross margins. Software program and AI firms usually have fairly sturdy gross margins as a result of as soon as their merchandise are developed, they have an inclination to have low prices for producing and distributing the merchandise.

SoundHound tends to promote its options both via a royalty association or via subscriptions. When there’s a product concerned, such because the sale of an car with its resolution included in it, then it will get a royalty. In the meantime, options like its AI ordering system for eating places are bought via subscriptions. Each of those are typically high-margin income streams as soon as they scale.

Final quarter, SoundHound’s gross margin was 49%, whereas its adjusted gross margin was 60%. Nonetheless, final yr, its gross margin was 75% for the complete yr. The corporate’s aim is to have sustained gross margins of greater than 70%.

BigBear.ai, nonetheless, solely had a gross margin of 25.9% final quarter. Via the primary 9 months of the yr, its gross margin was 25.2%.

The corporate’s gross margins are very low for the kind of enterprise it’s in. This seems to stem from its historical past as a authorities contractor, as its engineers and knowledge scientists throughout the authorities vertical typically should co-locate and be on-premise. This provides lots of price in comparison with simply operating a pure software program resolution.

Nonetheless, the corporate is trying to proceed to develop its gross margins because it will increase its proportion of income from software program in comparison with companies and expands extra into the industrial sector.

Verdict

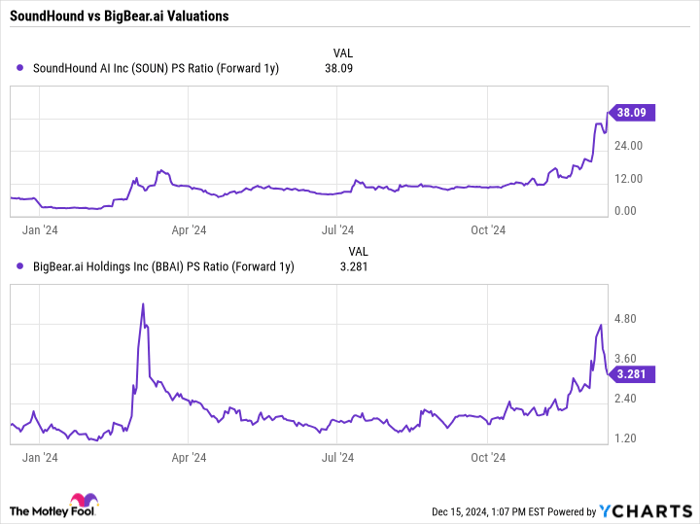

With stronger income development and way more sturdy margins, SoundHound AI seems to have a bigger alternative in entrance of it in comparison with BigBear.ai. Nonetheless, the one space the place BigBear.ai’s inventory does have an enormous benefit over SoundHound Ai is valuation. At a ahead price-to-sales (P/S) ratio of simply over 3, it’s a fraction of the valuation of SoundHound, which is buying and selling at 38 instances 2025 analyst estimates after an enormous year-end rally.

SOUN PS Ratio (Forward 1y) knowledge by YCharts

I like SoundHound’s enterprise extra, however the big surge within the inventory worth would have me transferring to the sidelines at current. Each shares are a bit speculative, however with the Virgin Orbit chapter behind it and BigBear.ai displaying self-discipline in slicing bills, I feel it’s the higher choice for 2025, as SoundHound has simply gotten a bit forward of itself.

Do you have to make investments $1,000 in SoundHound AI proper now?

Before you purchase inventory in SoundHound AI, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and SoundHound AI wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $808,966!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 16, 2024

Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.