For the majority of April, the premiere American supply indices have actually been embeded a slim array as financial information as well as Fed audio speakers provide combined signals. Volatility metrics go to or listed below 1 year lows, as well as some individuals check out 5%+ cash market returns as a much better financial investment than supplies.

VIX Accident

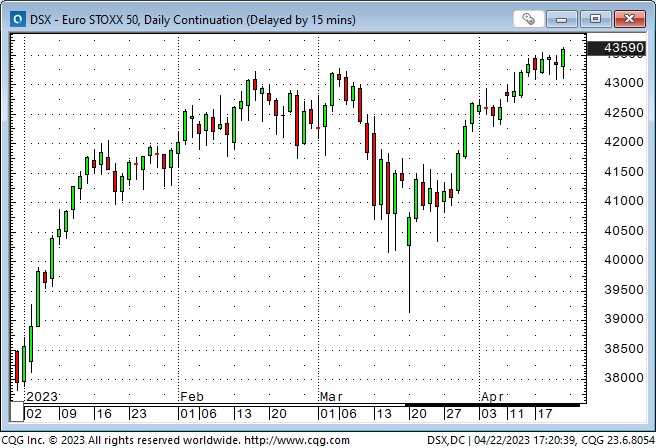

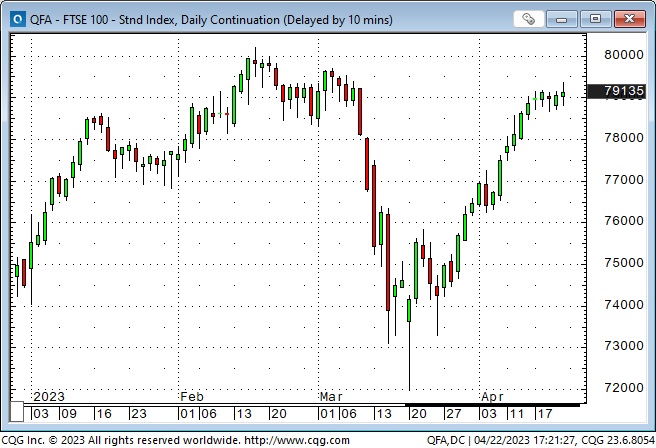

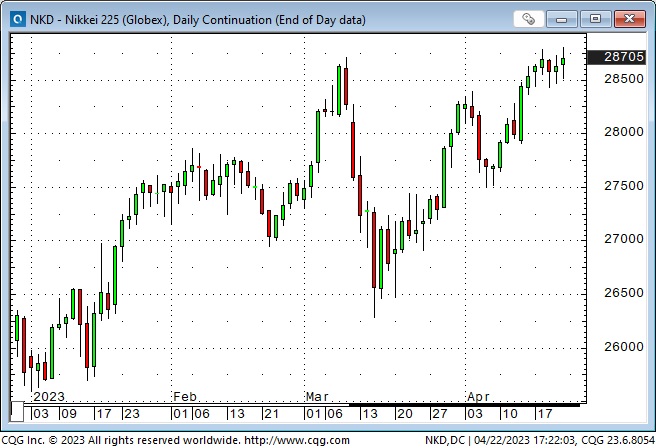

While American indices wander silently sidewards, European, Japanese as well as Canadian indices stay resilient.

Rising cost of living metrics in the U.S.A. as well as Canada show a conditioning pattern, however the core numbers are still well over reserve bank target prices.

Market sentiment/expectations seem well balanced in between an impending economic downturn (as well as therefore Fed cuts) as well as continual rising cost of living (with the Fed greater for longer). The wild card is an impending mix of an economic crisis, climbing joblessness and also continual rising cost of living (stagflation.)

The “equilibrium” of assumptions shown by the sideways rate activity of the premiere American supply indices is not likely to last; one side will certainly acquire the “advantage,” as well as costs will certainly burst out of the array.

Revenues period

75% of the business that have actually reported quarterly outcomes have actually defeated pre-report price quotes. This coming week will certainly see 42% (by cap weighting) of business in the coverage.

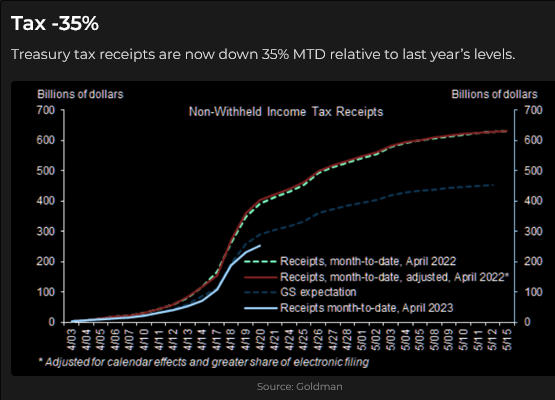

Tax obligation invoices dropping

Treasury Tax Obligation Invoices

Residence costs dropping

Meidan Residence List Prices

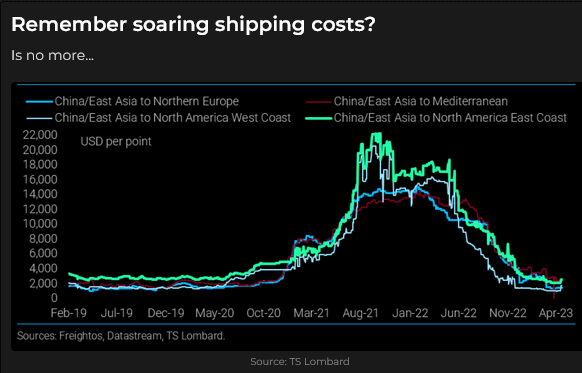

Products prices dropping

Delivering Prices

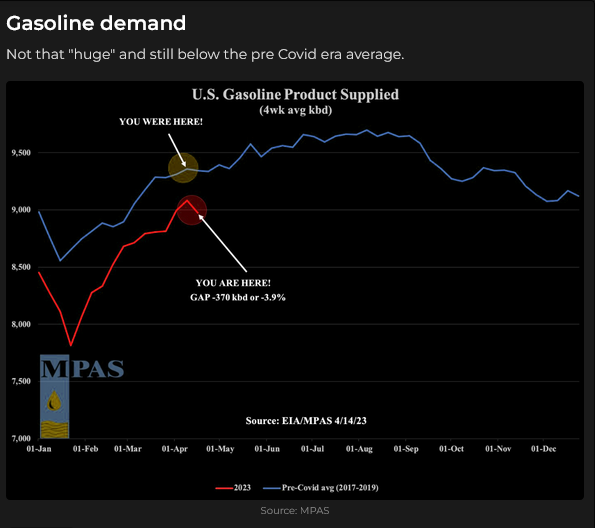

Gas costs dropping

Gas Need

Inflationary behavior

Individuals will certainly attempt to “maintain,” “capture up,” or “be successful” as they regard the costs they spend for points (products as well as solutions) are climbing faster than their revenue. They will certainly request for a raising, gave up to take a higher-paying task or go on strike. There are currently substantial strikes in Canada, the UK, France as well as Germany.

I bear in mind someone was constantly on strike in the 1970s, as well as I anticipate we will certainly see even more strikes in the future as employees respond to the discomfort of adverse genuine wage development.

The Fed believed rising cost of living would certainly be “temporal” since the “supply chain traffic jams” (bear in mind the fleet of container ships waiting off-shore Los Angles) would certainly dissipate (they did), as well as rising cost of living would certainly hang back in the direction of their 2% target (it really did not.)

Picture

Head Of State Gerald Ford advertised as well as used the “SUCCESS” switches throughout his presidency– from August 1974 to January 1977.

My traditional evaluation is that rising cost of living has actually been brought on by federal governments accepting budget deficit ( like never ever prior to), which decreases the value of the acquiring power of money, which is rising cost of living. Citizens will certainly not choose a federal government which promises to stabilize the budget plan (as well as define specifically what they will certainly do to accomplish that objective), so we have actually transitioned right into an age of “unlimited” deficiencies as well as rising cost of living. Individuals will certainly “scramble for placement” to attempt to “be successful” of rising cost of living, adding to a wage/price spiral, as well as “evil one take the hindmost” (individuals that do not have the leverage/opportunity to gain much more.)

” Deficiency administration” through rising cost of living is much more politically prudent than reducing federal government solutions or elevating tax obligations.

Markets

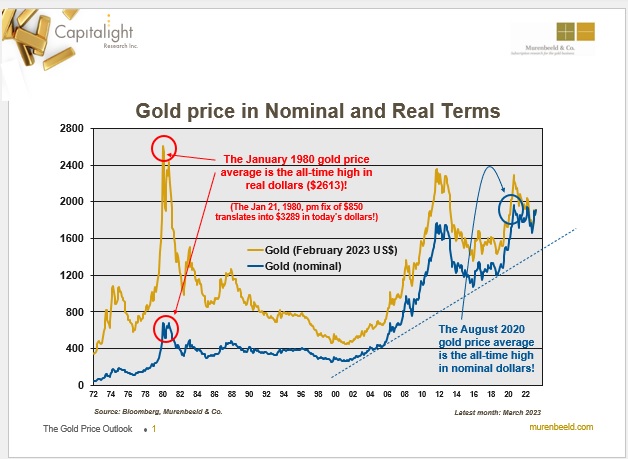

Gold ran too expensive as well quick as well as dropped back|$75 from recently’s highs.

Right Here’s a 50-year graph from my pal Martin Murenbeeld, revealing gold in small as well as genuine terms. It is an attractive expression of the decrease in the Buck’s acquiring power!

Gold Rate in Small as well as Actual Terms

I functioned as an asset broker at Conti in Vancouver when gold rose from|$450 in November 1979 to|$850 in January 1980– just to drop back to|$450 2 months later on. When you check out the rally in small terms (heaven line), it does not appear like such a “large offer,” however when you see it shared in genuine terms (the gold line), you can see why “GOLD” scorched a memorable memory right into the minds these days’s aging boomers!

The All-Time High (in today’s bucks) was made on January 21, 1980, at|$3,289 (Comex futures traded a high of $875 that day as well as a reduced of $679 the following day– that’s not a typo, gold went down|$200 over night as well as silver dropped|$13, From $50 to $37, when the Comex altered the regulations to restrict that can get silver.)

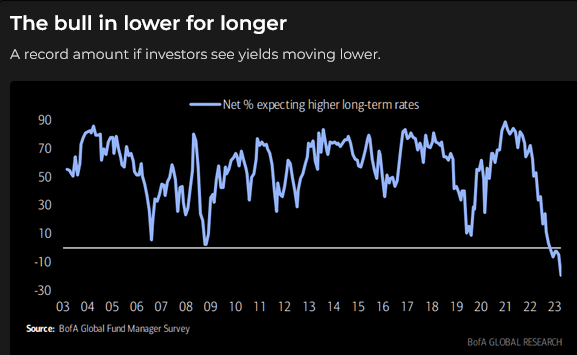

Bond costs dropped in February, a casualty of prevalent “greater for longer” believing, however after that rallied hard from the “financial dilemma” lows in mid-March (the Fed will certainly need to reduce to stay clear of a credit scores dilemma.) Costs wandered lower in April as stress over a credit scores dilemma discolored as well as ideas concerning a “impending economic downturn” were pressed better right into the future.

Return Graph

The temporary rate of interest ahead market is valuing in a 25 bps boost in Fed Finances at the Might 3 FOMC conference, adhered to by|50bps of cuts from the Fed by December 2023.

The rallied from recently’s short on Monday however went sidewards for the remainder of the week.

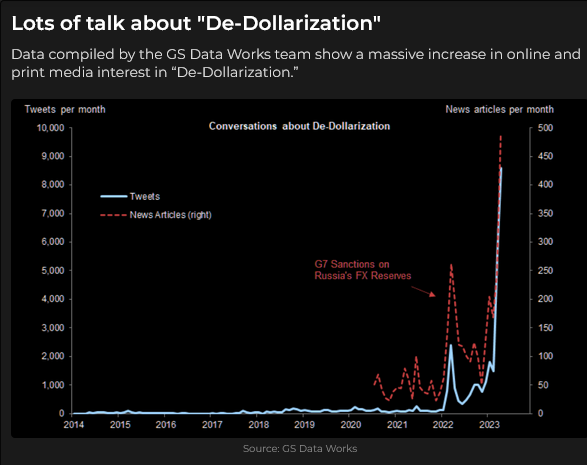

De-Dollarization

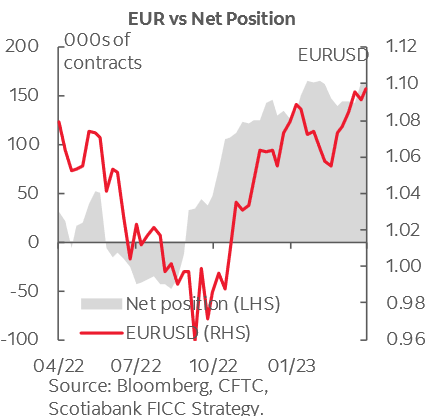

The Euro got to a 1-year high recently (up|15% from the 20-year lows struck in September) however dropped back a little bit today. I have actually lately called the Euro the Anti-Dollar since it appears to be the “picked” automobile for investors that intend to wager versus the USD. The April 18 Dedications Of Investors report for the money futures market reveals that web speculative positioning in all money besides the Euro is either near to level or web brief. Internet speculative positioning in the Euro is widely net-long.

EUR vs Internet Placement

Last Friday, the Canadian Buck struck a 2-month high however dropped as long as 1.5 cents from that high today. United States rates of interest stay over Canadian prices, which spread will likely expand as the Fed increases prices while the BoC stops briefly. The 150,000 federal government employees on strike might have likewise adversely affected the CAD.

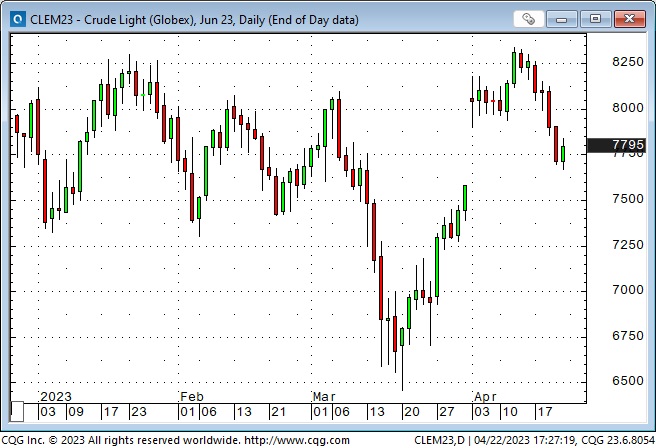

costs on the Nymex leapt greater adhering to the shock OPEC+ manufacturing cut however dropped back today by as long as|$7 from recently’s highs.

Ideas on trading

” Individuals assume they make (trading) choices based upon their evaluation, however they make (trading) choices based upon exactly how they really feel concerning their evaluation.

I uncovered Denise Shull on RTV a couple of years earlier as well as was really satisfied with exactly how she considered investors’ feelings, specifically are afraid. (The trading train Wendy Rhoades, in the television collection “Billions,” was imitated Denise.)

I saw (as well as suggest to my viewers) a number of free enterprise video clips published today by Hedgeye, consisting of one with Gio Valiante, an efficiency psycho therapist that has actually dealt with a number of specialist athletes as well as high-level investors. I had actually formerly seen Gio with Denise on RTV.

I suggest Denise as well as Gio since I think individuals, not information, step costs. A lot more exactly, individuals’s psychological response to information actions costs.

The day-to-day turn over in the worldwide forex market is approximated at|$7 Trillion daily. Over the previous couple of years, I have actually kept in mind that patterns in the money markets appear to go means better than makes any kind of feeling and after that they “transform on a penny” as well as go the various other method. I assume the reality that they “transform on a penny” enhances the concept that the pattern had actually gone means as well much.

FX investors utilized to recognize the term “leads as well as delays,” although you do not listen to that expression much any longer. It described exactly how individuals would certainly “time” their professions by exactly how they “really felt” concerning the marketplace. As an example, if a Canadian firm obtained USD from offering lumber to an American company, as well as the firm CFO “thought” that the CAD was trending reduced versus the USD, he would certainly postpone transforming the funds in the hopes that the pattern would certainly proceed. His firm would certainly obtain even more CAD as a result of waiting– he “delayed” the conversion choice based upon his solid sensation that the CAD drop would certainly proceed.

Additionally, expect the CFO “thought” that the CAD was trending greater versus the USD. Because situation, he could reserve a conversion price with his financial institution in expectancy of obtaining the USD funds at a later day– being afraid that if he waited till he obtained the cash, he would certainly obtain less CAD when he did the conversion– he “led” the conversion choice based upon his solid sensation that the CAD uptrend would certainly proceed.

Multiply the influence of these “timing” choices by the countless import/export offers being done on both sides of the Canada/US boundary, as well as you obtain a feeling of exactly how a ” pattern moving, remains in activity” as a result of individuals’ psychological response when they see a fad.

My temporary trading

I began today with a brief CAD placement developed Friday recently. I stuck with the profession, relocating my quit reduced to secure revenues in situation CAD rallies. I had latent gains of greater than one cent at Friday’s close.

I have actually been shorting the S&P the previous number of weeks in expectancy of the marketplace rolling over as well as dropping a minimum of 100+ factors. I have actually had some little success, small losses as well as a couple of breakeven professions, however the web outcome has actually been little losses. I shorted the S&P once again today: one minor loss, one breakeven, as well as I have actually entered into the weekend break brief with a little latent gain.

I have a (temporary) bearish prejudice on both the CAD as well as the S&P, as well as I have actually attempted to obtain brief near to the factor where I would certainly quit myself out — I have actually been offering what resembled loved one highs– to make sure that I’m taking the chance of really little cash about what I assume I can make on the profession.

I have actually had a temporary bearish prejudice on gold however have actually not attempted to obtain brief. I see it as the “exact same profession” as being brief CAD or S&P, as well as I intend to restrict my focus threat.

On my radar

I have a predisposition that the USD might rally. I’m currently brief CAD, however I’m “waiting as well as viewing” the Euro– the Antidollar– with a fairly significant net-long placement. I’m expecting the Euro to have a “failing to rally,” which may be a chance to obtain brief.

I’m likewise waiting as well as viewing the British Extra pound, which might have an extra bearish “history” than the Euro. Once again, I’m expecting a “failing to rally.”

Since I have a favorable USD prejudice, I’m expecting a chance to brief gold while likewise understanding focus threat.

With the S&P, my prejudice is that 4,200 is resistance. If the marketplace rallies via that degree, I’m incorrect to be bearish, however if it damages reduced, that enhances the 4,200 degree resistance. However it’s tough to offer the S&P reduced, provided the current “get the dip rallies.”