Is the US inventory market now in a blow-off stage, like in 1929?

If that’s the case, how will the approaching collapse have an effect on , , and mining shares?

These are questions that buyers must be asking. Right here’s a have a look at the going into 1929, and the following collapse.

The excellent news is that even when the inventory market goes to break down in 2025, there’ll possible be important rallies, simply as there have been within the tumble of 1929.

The weekly Dow chart. There may be important assist at 37,000. A collapse from someplace between the present value and 50,000 would possible halt in that 37,000 space, albeit briefly.

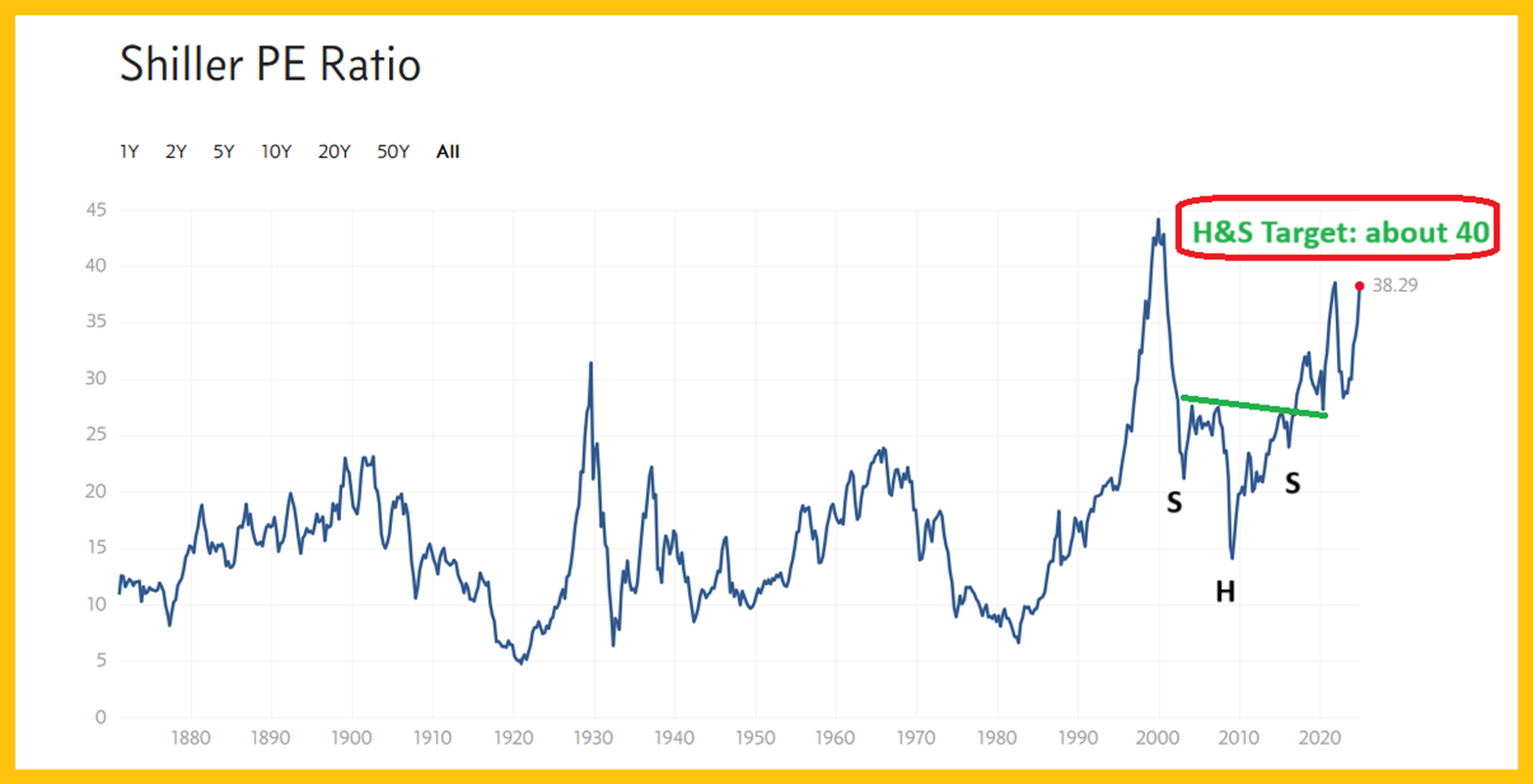

Simply how overvalued is the US inventory market? The Shiller inflation adjusted PE ratio is effectively above the highs of 1929. It may rise to 40 and even to the 44 space highs earlier than collapsing… and it vividly highlights simply how overbought the US inventory market really is.

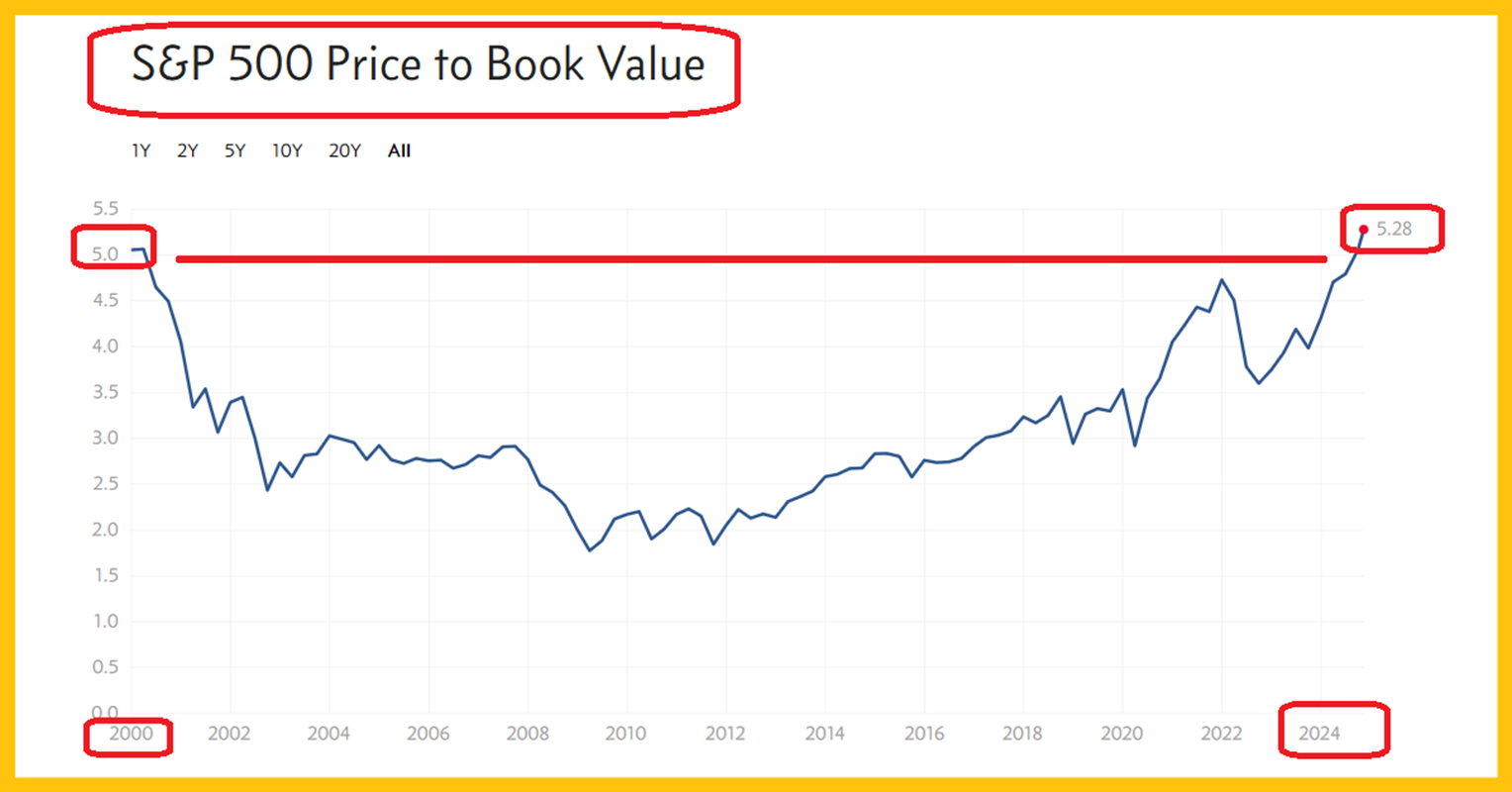

Extremely, the value to e-book worth (value to breakup) is now above the place it was on the peak of the outrageously overvalued market of 1999.

Does this US chart recommend that the inventory market is about to crash, and charges shall be lowered dramatically?

It’s definitely a state of affairs that buyers must be open to, particularly given the H&S high motion and the potential imminent drop from the neckline of the sample.

A have a look at gold. Gold has dropped right into a minor assist zone of $2600-$2590. There’s one other barely “meatier” one at $2530.

Having mentioned that, H&S high formation is in play, focusing on the a lot larger assist zone of $2450-$2300.

A have a look at that zone on the weekly chart. Ways? I recommend very mild shopping for of gold ETFs or totally paid futures contracts at $2600 and $2500.

If gold does attain the necessary $2450-$2300 zone, considerably extra gold will be purchased (ideally bodily gold) together with silver and mining shares… in anticipation of an enormous rally, not simply again to the $2790 space highs, however to $3000-$3300.

Silver ought to attain $40-$50 on that transfer, and GDX (NYSE:) may surge to $50-$60. From there, a extra important pullback may very well be anticipated, and it will possible correspond with the beginning of a multi-decade bear transfer for the US inventory market.

Silver may catch a pleasant bid from frightened small buyers as soon as the inventory market collapses however proper now it appears to be like a tad shaky. Stochastics is nearly oversold, however sadly the approaching rally might solely create the best shoulder of a second H&S high. Investor endurance is required.

The brand new US authorities (Trump 2.0) is probably going to answer a inventory market meltdown with much more aggressive cuts in authorities dimension than are deliberate proper now. New tariff taxes and “large GDP development” earnings tax cuts received’t generate wherever close to the quantity of capital that’s now wanted to handle the outrageous authorities debt. With the markets in meltdown mode, important measures of austerity shall be required.

Debt-funded “range” and different frivolous packages shall be eradicated. Sadly, however deservedly, a protracted reckoning lies forward for the debt and fiat obsessed residents of America… and for the federal government. If Trump lets Elon “Mister Chainsaw” Musk off his leash, the slashes in spending may look “different worldly”.

What in regards to the miners? I requested the open query, “Will GDX commerce at $36 if gold trades at $2600?”, and that’s what has occurred. Gamblers can purchase, however I recommend buyers be extra affected person and wait to see if gold trades at $2450, which “ought to” see VanEck Gold Miners ETF (NYSE:) commerce at about $33.

The CDNX is a real microcaps index, and quite a lot of the largest parts are within the gold and silver mining enterprise. It appears to be like stable right here.

Right here’s a have a look at it versus the GDX ETF. It’s mauling it.

For years, I’ve been adamant that to get an actual multi-decade bull run within the miners, CDNX should take the lead baton… and that’s clearly starting to happen.

Oil is slumping on a collapse in international development, particularly in China, and no new mid-East warfare that threatens the strait of Hormuz. Is it potential that the Trump-oriented inventory market rally that started together with his election turns into an inauguration day crash? Properly, he’s prone to wish to refill the SPR (Strategic Petroleum Reserve) and he has to purchase oil to try this.

Additionally, he’s pro-Israel and anti-Iranian authorities. The Israeli authorities may take his inauguration as an open invitation to devastate Iranian oil infrastructure, and whereas Trump may theoretically preserve home costs low by limiting exports, that plan would possible fail.

The underside line: An oil value low someday between now and inauguration day appears to be like more and more possible, and the following rally may trigger each inventory market chaos and a gold and silver value surge. It is a easy and long-overdue pullback of respectable dimension for the metals. I’ve clearly marked the important thing purchase zones for motion. Hopefully, all gold and silver bugs of the world are prepared to purchase.