- The securities market encounters an important examination following week, which will certainly assist figure out the Fed’s following plan step.

- There will certainly be a great deal on the line when the most recent core PCE consumer price index appears.

- Financial institution dilemma growths will certainly likewise remain in emphasis amidst sticking around worries over the wellness of united state local financial institutions.

Following week will certainly assist establish what the Federal Get’s following step will certainly be as the united state reserve bank encounters an uphill struggle of harmonizing in between its recurring fight versus and also expanding indicators of economic instability.

Since Friday early morning, markets are valuing in a 72.1% opportunity of the Fed stopping its price walkings at its following conference in May, contrasted to a 27.9% opportunity of a 25-basis factor boost, according to Investing.com‘s.

Resource: Investing.com

The reserve bank elevated its benchmark funds price by 0.25% in an extensively anticipated proceed Wednesday, yet its plan declaration went down language regarding “recurring boosts” would likely be proper and also changed it with “some added” firm may be feasible.

Fed Chair Jerome Powell stated in his post-meeting press conference that the reserve bank was still bent on dealing with rising cost of living while likewise checking the level to which current chaos in the financial field influences the economic situation.

My individual take is that Powell managed the scenario very well. He articulated his decision to lower sticky rising cost of living, while modifying his expectation to an extra careful position because of stress and anxiety in the financial system. Nonetheless, as I pointed out recently, the Fed goes to danger of devoting a if it begins to alleviate plan prematurely, which might see inflationary stress start to reaccelerate.

With financiers expanding progressively specific that the Fed’s financial tightening up project might be nearing completion, a great deal will certainly get on the line following week.

Will the Fed’s Preferred Rising cost of living Metric Maintain Dropping?

With Chairman Powell repeating that his major goal is to bring rising cost of living back controlled, following week’s– which is the Fed’s recommended rising cost of living scale– tackles added significance.

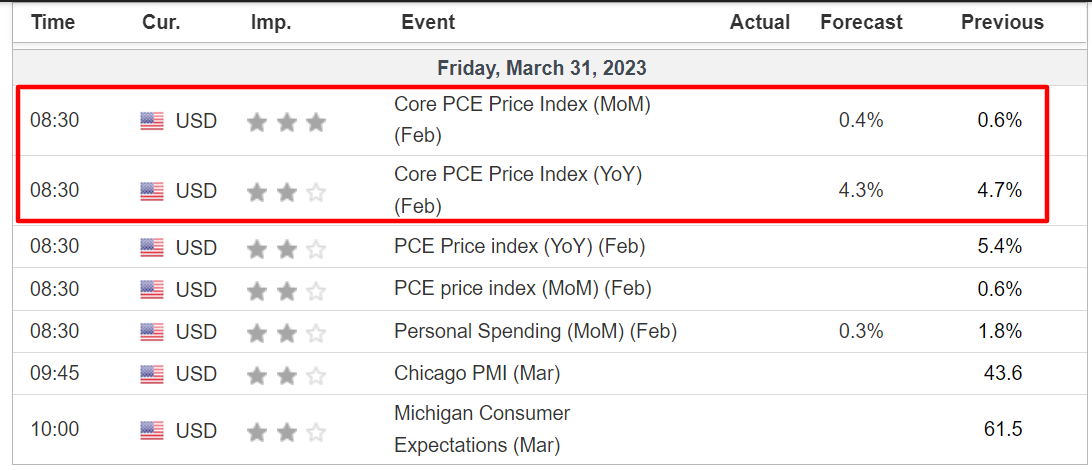

The united state federal government will certainly launch the February record on Friday, March 31, at 8:30 AM ET. According to Investing.com, the core PCE consumer price index is anticipated to climb 0.4% m/m, cooling down from January’s 0.6% boost. The annualized price is seen climbing up 4.3%, contrasted to a 4.7% yearly speed in the previous month.

Resource: Investing.com

While experts anticipate both the month-over-month and also year-over-year prices to regulate from January’s analyses, the numbers will likely reveal that core PCE rates are not dropping quick sufficient for the Fed to reduce its inflation-fighting initiatives this year.

The core PCE consumer price index makes it less complicated to see the underlying rising cost of living fad by omitting the unstable food and also power elements. Therefore, it is very closely enjoyed by Fed authorities that think it offers an extra exact evaluation of the future instructions of rising cost of living.

- Forecast: I think the PCE cost information will certainly highlight just how little progression the Fed is making in its initiative to bring rising cost of living pull back to affordable degrees. A remarkably greater analysis, in which the heading can be found in at 4.5% or above, will certainly maintain the stress on the Fed to preserve its battle versus rising cost of living.

Exactly How Durable Are United State Regional Banks?

Beyond the rising cost of living dramatization, market individuals will certainly remain to be obsessed on sticking around unpredictabilities around the wellness of united state local lending institutions, where worries of a transmittable operate on financial institution down payments stay a large danger.

Shares of small-and-midsized local financial institutions have actually remained in chaos for the previous 3 weeks as financiers responded to the speedy closures of Silicon Valley Financial Institution and also Trademark Financial institution, the second-and third-largest failings in united state background.

That has actually triggered bother with various other ticking bombs in the field.

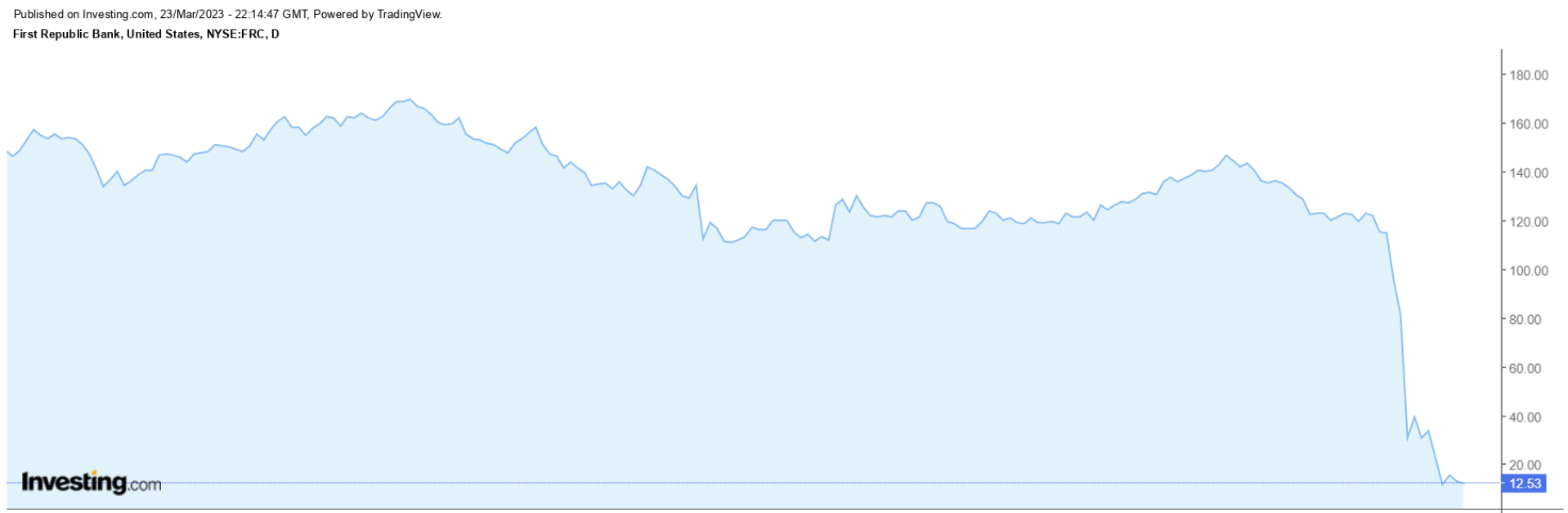

The emphasis is currently mostly on San Francisco-based First Republic Financial Institution (NYSE:-RRB-, which has actually remained in continual talks with various other lending institutions and also investment company regarding resources mixtures. FRC supply has actually shed approximately 90% of its worth this month, making it the worst-performing name amongst the participants of the SPDR S&P Regional Financial ETF (NYSE:-RRB-, which has actually dropped 31.4% over the very same duration.

Talking in an Us senate hearing on Wednesday, Treasury Assistant Janet Yellen informed legislators that she had actually ruled out or checked out the opportunity of developing “covering insurance policy” to protect without insurance down payments in distressed local lending institutions, stimulating an additional selloff in the field.

She showed up to change her sight rather on Thursday, exposing the possibility that the Treasury might still take future emergency situation activities in order to protect against more comprehensive virus in the financial field. “We have actually utilized vital devices to act swiftly to avoid virus. And also they are devices we might make use of once again,” Yellen stated in created statement prior to a Home Appropriations subcommittee.

Recently, Yellen stated without insurance down payments would just be ensured in case it would certainly develop systemic danger and also substantial financial and also economic effects.

- Forecast: An intensifying liquidity dilemma in the financial field would certainly underscore the sight that the Fed will likely stop rates of interest walkings for the time being as policymakers examine the present scenario.

Nonetheless, indicators that the current chaos is being had to simply a couple of financial institutions without significant spillover result to various other embattled local lending institutions would certainly recommend that maybe the most awful lags us. If that held true, after that the marketplace will certainly be compelled to reprice price assumptions to show added firm by the end of summertime.

***

If you’re seeking even more workable profession suggestions to browse the present volatility on Wall surface St., I’ll be holding a cost-free webinar on Wednesday, March 29 at 10:00 AM ET highlighting where to spend now utilizing the recommendations of billionaire capitalist Warren Buffett.

Disclosure: At the time of creating, I am long on the S&P 500, and also the by means of the SPDR S&P 500 ETF (SPY), and also the Invesco QQQ Count On ETF (QQQ). I am likewise long on the Innovation Select Market SPDR ETF (NYSE:-RRB-.

I routinely rebalance my profile of private supplies and also ETFs based upon recurring danger evaluation of both the macroeconomic atmosphere and also business’ financials.

The sights reviewed in this short article are only the viewpoint of the writer and also must not be taken as financial investment recommendations.