The economic merchandise and fundamental supplies sectors noticed a pleasant spike immediately, significantly amongst U.S. shares as their overseas counterparts fell on information of President Trump’s plan to implement a 25% tariff on imported metal and aluminum.

Together with the probability of upper commodity costs, U.S. producers will profit from elevated demand for domestically produced metals with Trump’s tariffs making it costlier for overseas producers.

Nucor’s Market Dominance: As the most important metal producer in the US, Nucor’s NUE inventory has been a Wall Road darling at occasions and is actually value keeping track of. Nucor’s various metal manufacturing and profitability has made it a favourite amongst hedge funds and institutional traders as properly. Notably, Nucor’s annual earnings are at the moment anticipated to dip 11% this 12 months however are projected to rebound and soar 42% in fiscal 2026 to $11.18 per share.

Picture Supply: Zacks Funding Analysis

U.S. Metal Updates: Final Friday, President Trump suggested that Japanese metal producer Nippon Metal wouldn’t be allowed to accumulate U.S. Metal X however would be capable of put money into the corporate fairly than take direct possession. Vowing to guard and revitalize America’s metal business, Trump said U.S. Metal is in a chief place to learn from his tariff insurance policies because the nation’s second-largest metal producer.

Cleveland-Cliffs is a Darkish Horse: Being North America’s largest producer of iron ore, Cleveland-Cliffs CLF has made a number of makes an attempt to accumulate U.S. Metal together with a possible partnership with Nucor to take action. These makes an attempt have been deemed as “low-ball” presents and have been swiftly rejected however a extra favorable working setting will surely assist Cleveland-Cliffs broaden its metal manufacturing.

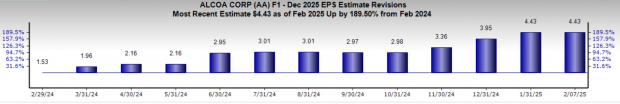

Alcoa’s Turnaround Might Acquire Extra Steam: The rebound in aluminum costs has fueled a formidable turnaround in Alcoa’s AA working effectivity and appears set to proceed at Trump’s orders. As proven under, the pattern of optimistic earnings estimate revisions has been compelling for Alcoa’s FY25 earnings outlook during the last 12 months and correlates with AA shares rising over +30% throughout this era.

Picture Supply: Zacks Funding Analysis

Different Shares to Watch

Two different noteworthy shares to look at are Metal Dynamics STLD and Kaiser Aluminum KALU. Metal Dynamic’s is among the many main metal producers and metallic recyclers within the U.S., with Kaiser Aluminum being a pacesetter in semi-fabricated specialty aluminum merchandise for industrial purposes, aerospace, common engineering, and automotive markets.

Simply Launched: Zacks Prime 10 Shares for 2025

Hurry – you possibly can nonetheless get in early on our 10 prime tickers for 2025. Handpicked by Zacks Director of Analysis Sheraz Mian, this portfolio has been stunningly and persistently profitable. From inception in 2012 by November, 2024, the Zacks Prime 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed by 4,400 corporations lined by the Zacks Rank and handpicked one of the best 10 to purchase and maintain in 2025. You may nonetheless be among the many first to see these just-released shares with monumental potential.

Alcoa (AA) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Cleveland-Cliffs Inc. (CLF) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Kaiser Aluminum Corporation (KALU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.