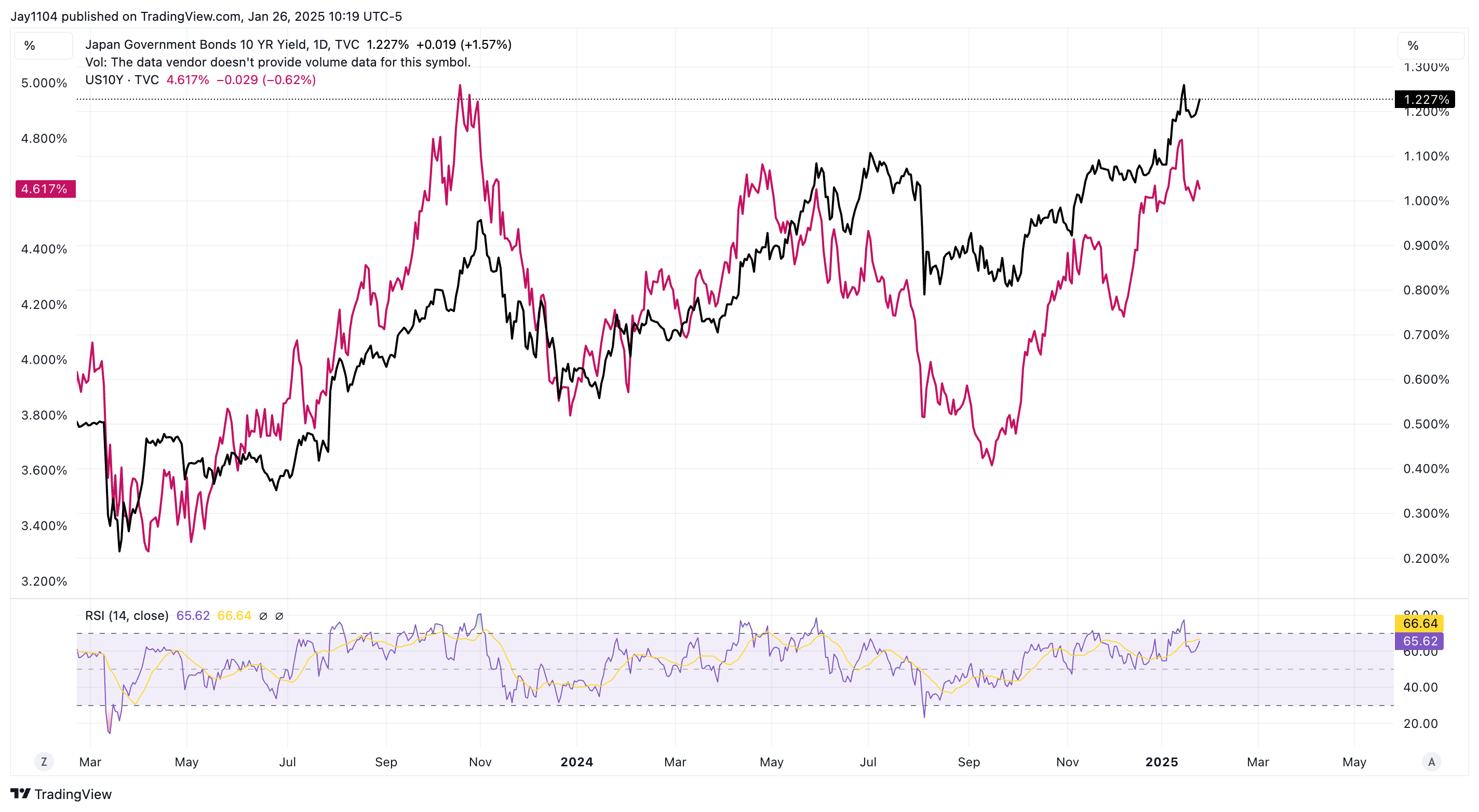

This week, we have now the assembly on Wednesday, adopted by the European Central Financial institution () assembly on Thursday. In the meantime, the Financial institution of Japan (BOJ) made waves final Friday by elevating its coverage price to 50 foundation factors, signaling that they’re removed from completed tightening.

This transfer is critical as a result of Japan has spent a long time in a deflationary atmosphere, and even small price will increase are a giant deal. BOJ Governor Kazuo Ueda has advised that Japan’s impartial price could be round 1%, which means we might see one other 50 foundation factors of hikes all through 2025. This marks a big shift for Japan, a world low-rate anchor.

The has weakened considerably towards the , , and different main currencies, which has traditionally supported carry trades and added liquidity to international markets. Nonetheless, the narrowing foundation swap spreads for USD/JPY counsel that this pattern could also be unwinding.

Rising charges in Japan might additionally put upward strain on international bond yields. Japan’s function because the world’s low-rate anchor is shifting, and if that base begins to raise, it might ripple by means of markets.

Week Forward Packed With Key Financial Information

We’ll see , , and the S&P CoreLogic House Worth Index on Monday. Tuesday brings information and the Richmond Fed survey at 10 AM. The massive occasion, nonetheless, will likely be Wednesday’s Federal Reserve assembly. Whereas the market isn’t anticipating any modifications to rates of interest, I consider the Fed could be clever to keep away from signaling any cuts within the close to time period.

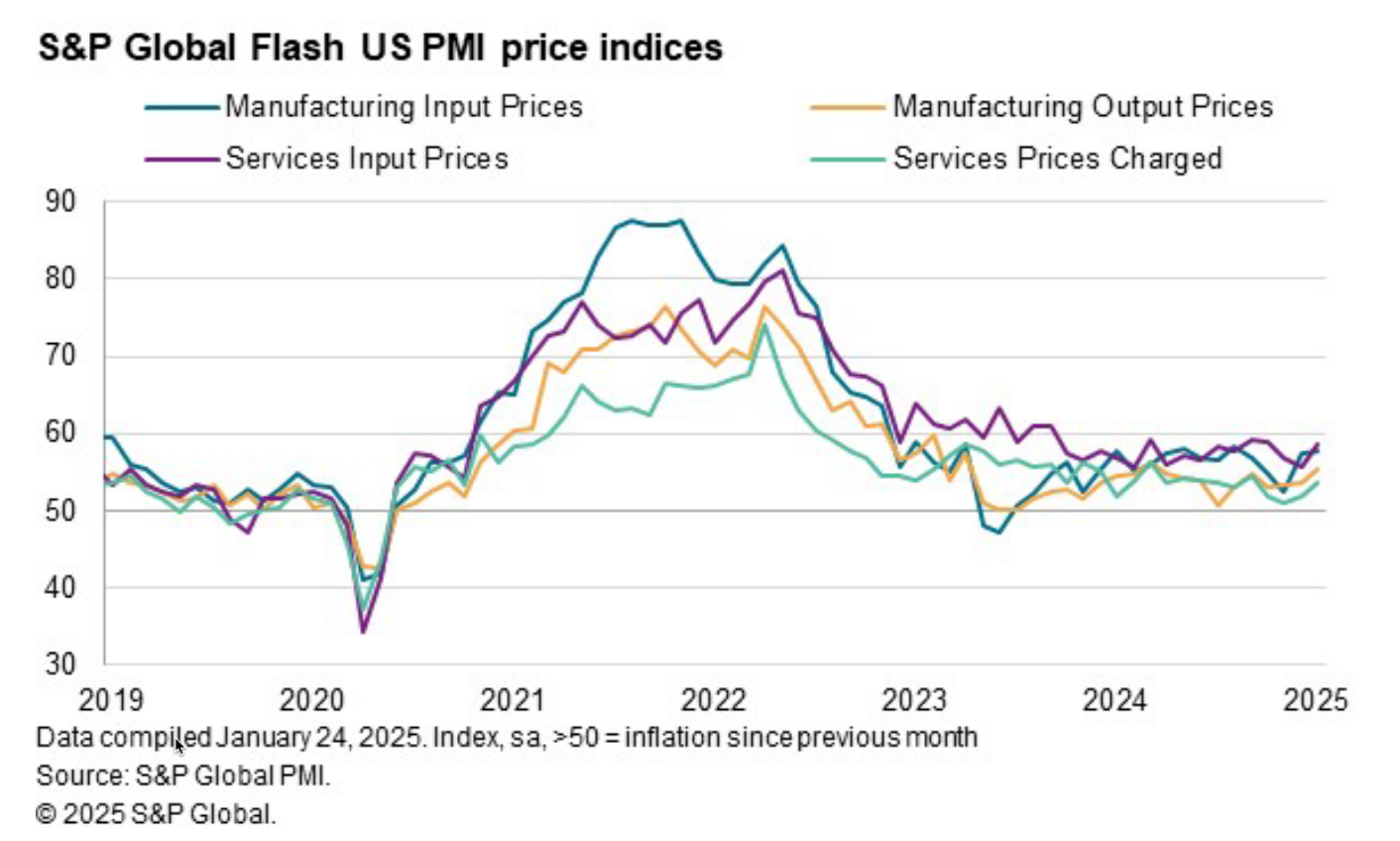

Inflation stays a priority, and up to date information counsel that it could speed up. For example, the S&P World report launched on Friday indicated a pickup in inflation and hiring exercise.

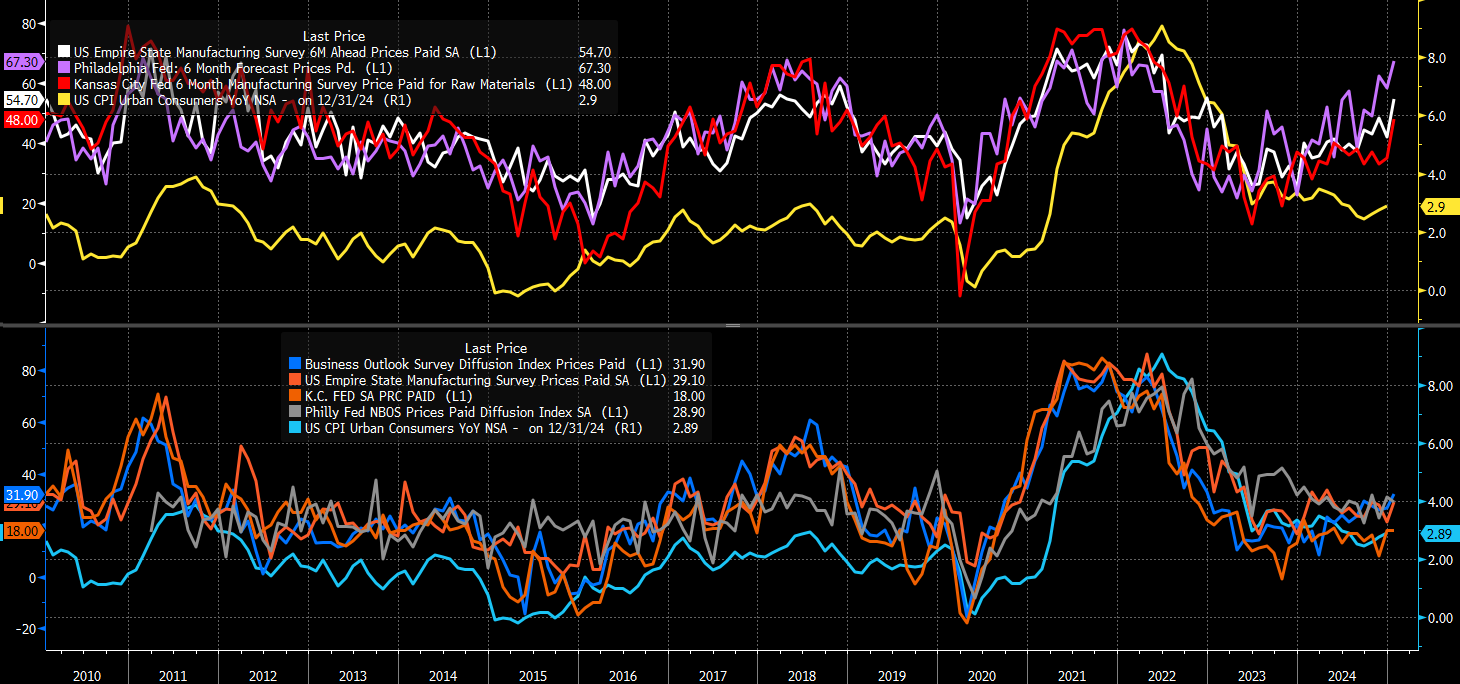

Many company surveys additionally level to rising inflation expectations over the following six months, a key indicator of the place the inflation could be headed.

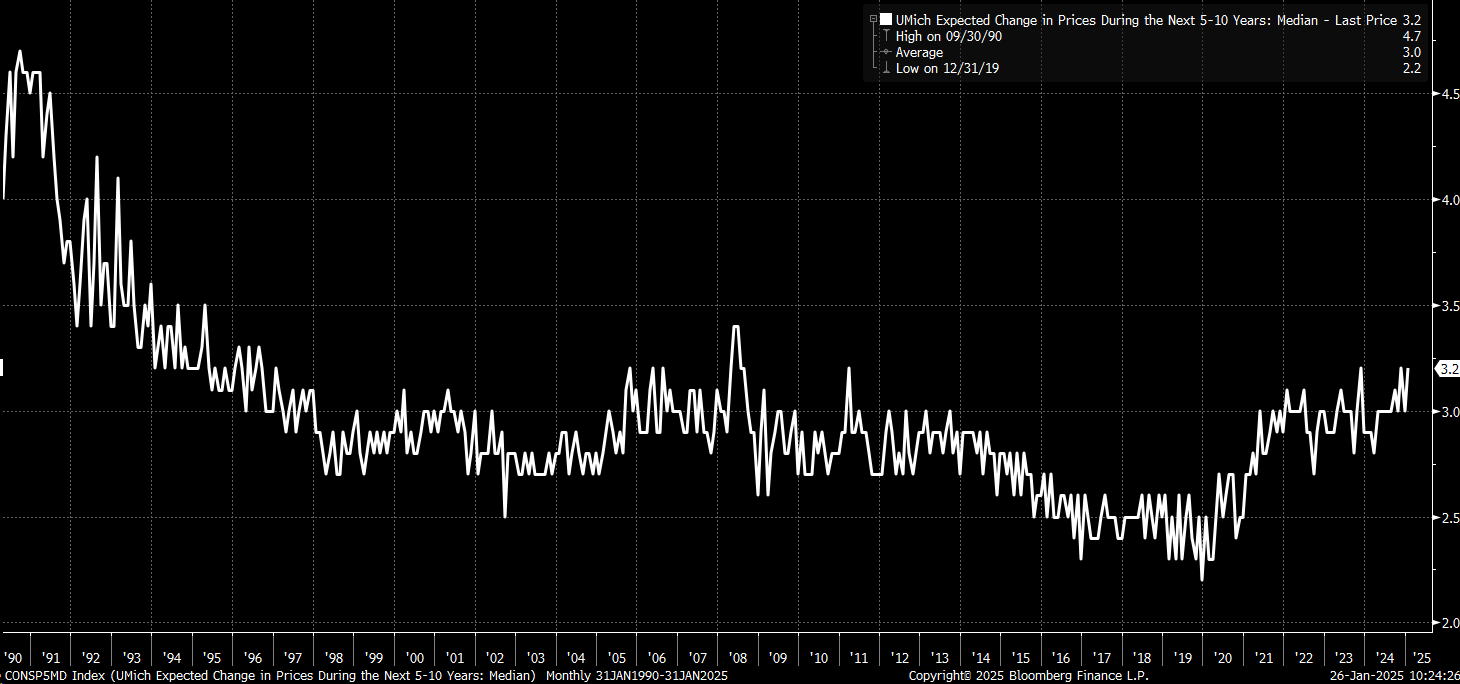

Even the College of Michigan’s five-to-ten-year outlook stays elevated at 3.2%, close to the upper finish of its historic vary. If I had been within the Fed’s sneakers, I’d view this as an uncomfortable place, because it alerts that inflation expectations haven’t absolutely stabilized.

Thursday will deliver the advance report, with the market anticipating 2.7% quarter-over-quarter development. is projected to develop by 3.2%, and the worth index is predicted to extend by 2.5%. Collectively, that signifies a powerful nominal development price of 5.2%. We’ll additionally get the worth index for This autumn, which previews Friday’s month-to-month PCE report. Whereas the quarterly and month-to-month figures are associated, they don’t at all times align completely, so any surprises on Thursday could not essentially translate into Friday’s numbers.

On Friday, we’ll see the Employment Price Index (ECI), anticipated to rise from 0.8% to 0.9%, reflecting accelerated wage development in This autumn. The month-to-month PCE inflation report may even be launched, with estimates pointing to a 0.3% month-over-month enhance, up from 0.1% within the prior month. The year-over-year core PCE is predicted to stay regular at 2.8%. Notably, market expectations for core PCE had been revised decrease following the latest CPI and PPI reviews. Nonetheless, the market has grow to be adept at predicting these figures primarily based on prior inflation information.

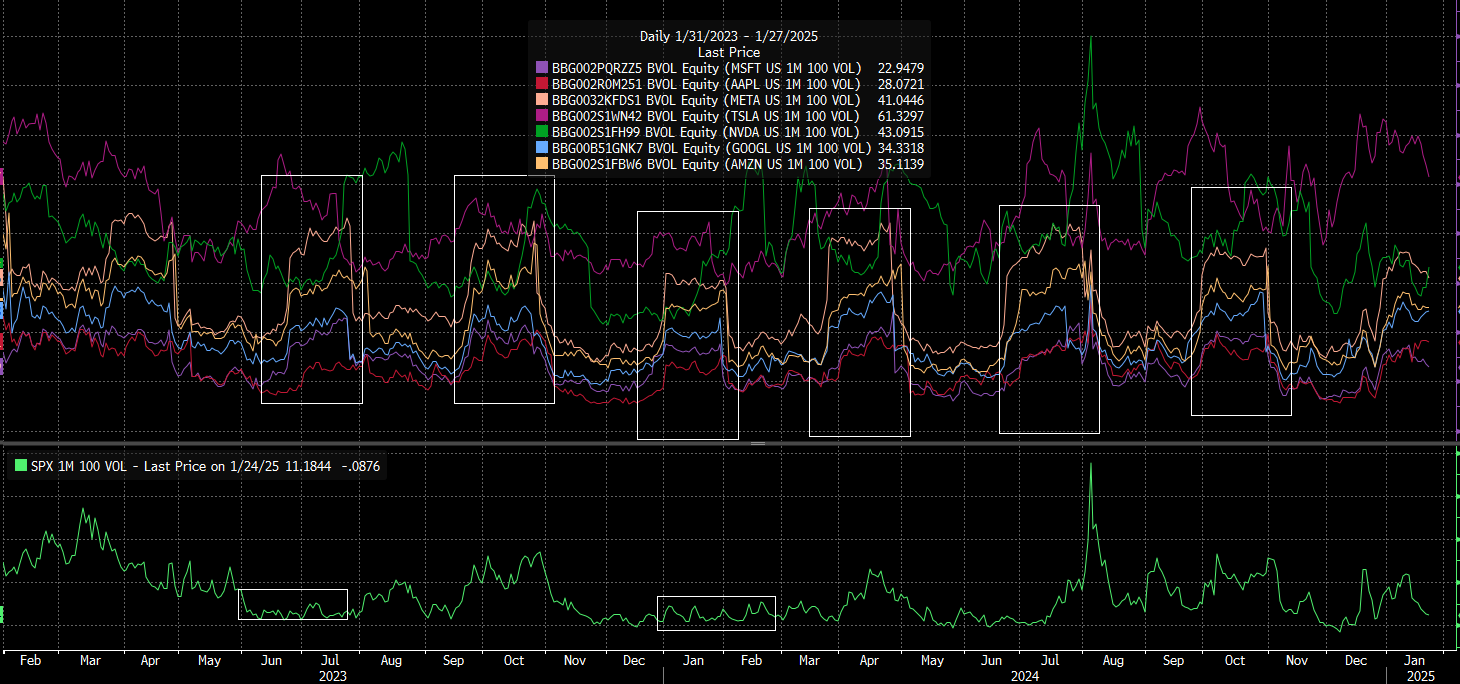

Earnings season additionally ramps up this week. Microsoft (NASDAQ:), Meta (NASDAQ:), Tesla (NASDAQ:), and Apple (NASDAQ:) are all reporting after the shut on January twenty ninth and thirtieth, whereas Alphabet (NASDAQ:) is scheduled for subsequent week.

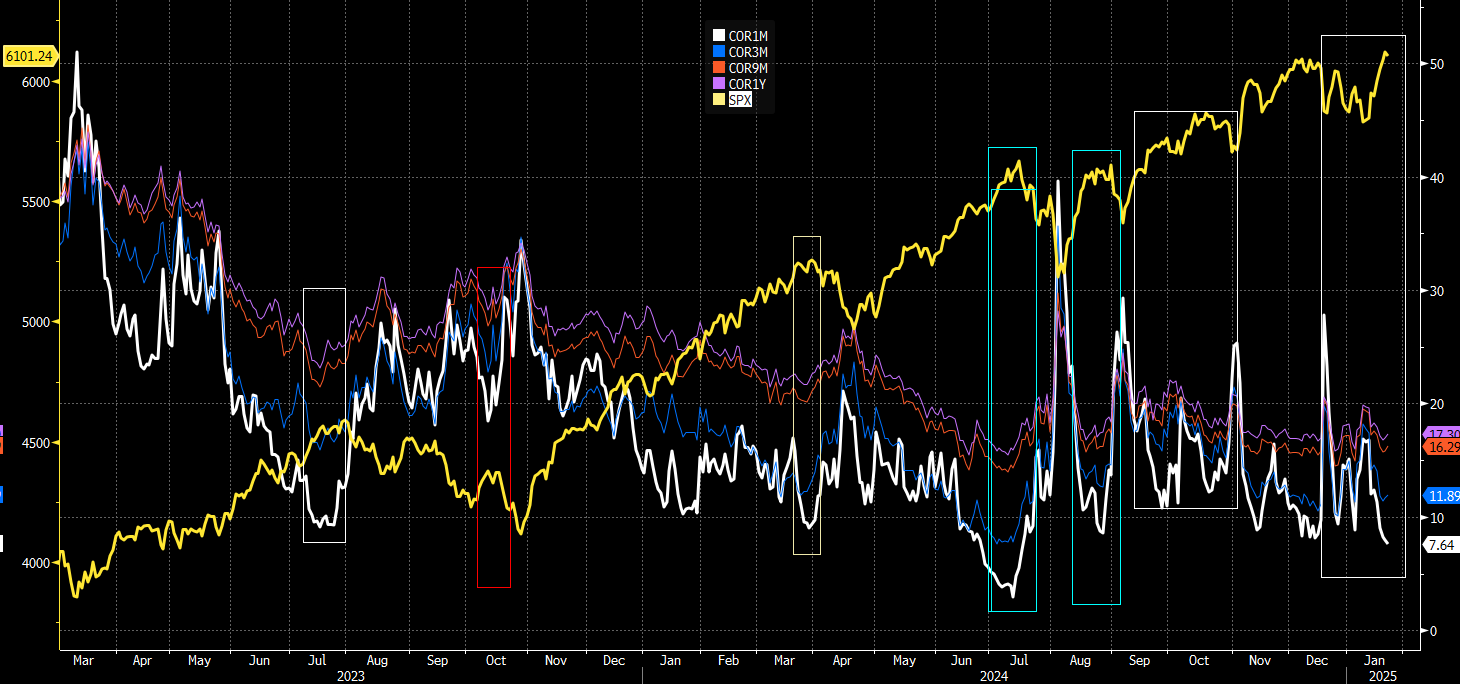

Implied correlations within the have been falling, with the one-month implied correlation index hitting 7.6 on Friday—the second-lowest degree ever recorded. This pattern aligns with earnings season, the place implied correlations sometimes drop as particular person inventory volatility rises forward of earnings bulletins. Nonetheless, as we exit earnings season, implied correlations are likely to rise, which might sign elevated market danger.

Traditionally, low implied correlations have coincided with market tops. As correlations rise and earnings season winds down, we might even see heightened market volatility, notably with the Fed assembly and key financial information releases on the horizon.

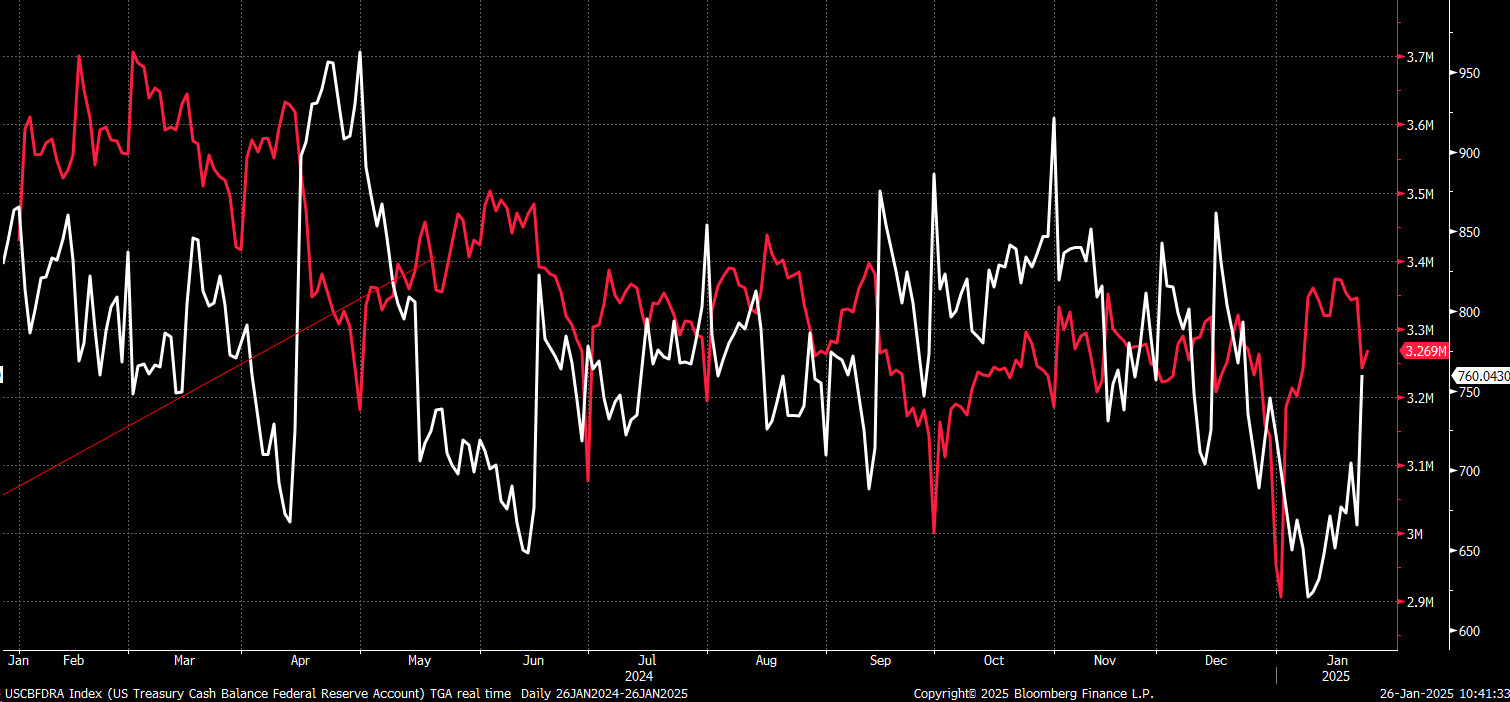

Moreover, the Treasury Common Account (TGA) has risen sharply in latest weeks, draining liquidity from the monetary system. Reserve balances have fallen because the TGA climbs to round $760 billion, including one other layer of potential strain on markets.

From a broader perspective, the risk-reward steadiness in equities seems skewed. With tightening liquidity, low implied correlations, and potential for a extra hawkish Fed outlook, the upside for equities appears restricted in comparison with the draw back dangers.

Ahead markets counsel that charges could rise barely over the following 12–18 months, opposite to expectations of cuts. This reinforces the concept the Fed is probably going not performed tightening and will shock markets later in 2025.