Fortunately is that Walt Disney‘s ( NYSE: DIS) streaming losses remain to reduce, greatly many thanks to set you back cuts. The problem is that its streaming customer development has actually vaporized– potentially since of these expense cuts. And also it’s unclear just how, when, or perhaps if the business’s streaming arm will certainly overcome the revenue bulge as it stands currently.

Disney’s brand-new streaming headwind isn’t brand-new

In its financial 2nd quarter, which finished April 1, Disney generated $21.8 billion in income, where it scheduled operating/non-GAAP incomes of $0.93 per share. Sales were up 13% year over year while earnings slid 14%. Both numbers were in-line with assumptions. Disney’s movie, TELEVISION, as well as amusement park companies remain to succeed because of creating operating revenue, although its straight television as well as media/entertainment arms endured decreasing profits last quarter.

The one genuine aching place? Its direct-to-consumer device– also known as, streaming. Greater registration rates assisted inflate that device’s income by 12% to $5.5 billion. However it still scheduled an operating loss of $659 million throughout the quarter.

Information resource: Walt Disney. Graph by writer. Profits numbers remain in billions of bucks. Running income/loss numbers remain in numerous bucks.

To Disney’s credit report, that’s much better than the $887 million loss that its streaming sector endured in financial Q2 2022. It was likewise its 2nd successive sequential decrease from financial Q4 2022’s loss of almost $1.5 billion. It was still a substantial loss, nevertheless, as well as this pattern of losses can linger for the direct future.

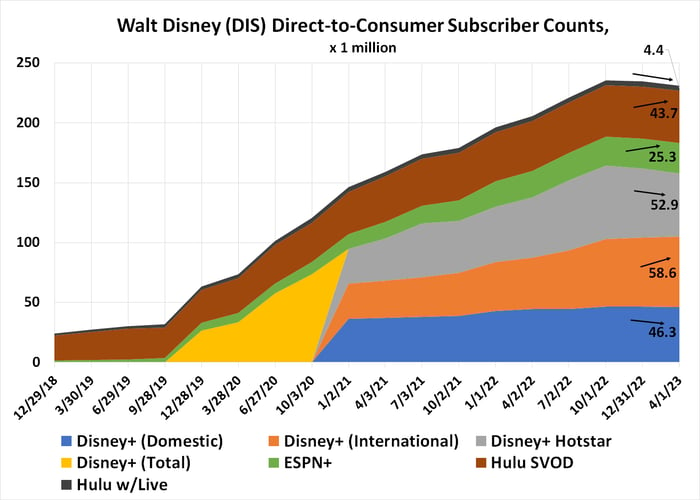

The graph listed below places points in viewpoint. Customer development for Disney+ in the united state as well as Canada has actually been decreasing for time, yet last quarter, the variety of clients in fact dropped by 300,000. The worldwide variation’s base expanded by a little much less than 1 million clients, while the Disney+ Hotstar solution (which offers India as well as Southeast Asia) endured a web of 4.6 million terminations. Hulu as well as ESPN+ likewise hardly progressed, getting a plain 600,000 internet brand-new clients in between them.

Information resource: Walt Disney. Graph by writer. All numbers remain in millions.

Greater rates likely have much to do with this. The residential variation of Disney+ currently drives regular monthly income of $7.14 per customer, versus an extra small $5.95 per customer simply at the end of in 2015. The worldwide variation sets you back approximately 6% even more.

Yet greater rates can not obtain all the blame. Individuals are just disliking Disney’s web content, along with streaming web content as a whole. Center Study’s latest record on the issue suggests that after 3 years of pandemic-enhanced development, the variety of various television home entertainment resources made use of by the ordinary customer in the united state is reducing. In 2014, individuals were routinely seeing approximately 7.4 various video clip home entertainment resources. Currently, they’re just using 6.4.

Photo resource: Center Study’s Best Bundle 2023 Record.

In a comparable blood vessel, viewership-ratings attire Nielsen reports that as just recently as November, Disney+ represented 2% of residential tv display time, while Hulu regulated 3.9%. In March, those numbers was available in at 1.8% as well as 3.3%, specifically. It’s not a massive problem in outright terms. In a congested streaming market versus a background of financial unpredictability, nevertheless, those are massive family member troubles that recommend the charm of Disney’s streaming web content is compromising.

That’s just the united state, yet if it’s occurring right here …

There’s excessive unpredictability behind Disney supply

Disney can invest extra on making excellent web content, yet it has no guarantee that the added costs will certainly spend for itself. It can remain to choose its streaming expenditures, yet that may make it harder to develop as well as advertise the streaming web content it requires to attract as well as maintain clients. It can elevate rates (once again), yet it does not show up Disney’s rates power is unrestricted. It’s feasible there is no pricing/content-spending formula that will certainly function to make Disney’s streaming procedure as we understand it sustainably lucrative.

chief executive officer Bob Iger recognizes every one of this, incidentally, as well as is steering. Hulu as well as Disney+ web content will certainly quickly appear in a mixed application. In the meanwhile, a number of formerly allocated web content will not be obtaining made nevertheless. One More price increase for the residential ad-free rate of Disney+ is likewise in the help later on this year. Iger really feels great concerning it as well. The reality that the customer losses coming from the last rate walking were small “leads us to think that we, as a matter of fact, have rates flexibility,” he claimed throughout Wednesday’s incomes telephone call.

That can be precariously hopeful reasoning, however. Customer development was currently reducing prior to last quarter as contending solutions remained to win market share.

In the meanwhile, while cost-cutting typically appears fantastic externally, it risks of threatening a procedure that’s in fact fairly crucial to an organization.

It’s not impossible that Disney’s streaming service will certainly never ever generate a purposeful revenue– or any type of earnings. Besides, most various other media companies’ streaming arms likewise continue to be at a loss, consisting of those of Paramount Global, Comcast, as well as Detector Bros. Exploration This service isn’t simply very affordable. It’s extremely costly.

Streaming is still a moderate component of the business’s income mix. However offered just how it’s likewise a huge prime focus that might never in fact supply under line in the manner in which was anticipated, financiers might wish to believe lengthy as well as tough concerning having this supply. Disney’s streaming service should not be encountering this sort of difficulty at this phase of the video game. That it is might show a lot larger defects in the entire streaming service design.

10 supplies we such as much better than Walt Disney

When our expert group has a supply pointer, it can pay to pay attention. Besides, the e-newsletter they have actually competed over a years, Supply Expert, has actually tripled the marketplace. *

They simply exposed what they think are the ten best stocks for financiers to purchase today … as well as Walt Disney had not been among them! That’s right– they believe these 10 supplies are also much better gets.

* Supply Expert returns since May 8, 2023

James Brumley has settings in Detector Bros. Exploration. The has settings in as well as suggests Walt Disney as well as Detector Bros. Exploration. The suggests Comcast as well as suggests the adhering to choices: lengthy January 2024 $145 contact Walt Disney as well as brief January 2024 $155 contact Walt Disney. The has a disclosure policy.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.