Today makes sure to bring even more inquiries than responses, as well as nobody is obsequious any longer. Connecting the openings in the dam might be the preferred solution for numerous, yet not the long-lasting option. Perhaps, industrialism calls for vibrant minutes, some failings, as well as regrettably, occasionally sensations of mayhem. Regulative plans are not made to assure a smooth trip for financial problems. These plans can not absolutely safeguard the stability of the economic system as well as can also add to problems in the system. The truth is that as high as financiers, companies, as well as staff members desire policy to safeguard the total economic system from susceptability, occasionally typhoons can not be prevented (remember Jamie Dimon’s warning?). The concern is: what do we do when we are confronted with a storm? Hunch down as well as not do anything, or rearrange for the rebound? Keep in mind, industrialism continues to be the very best system. Do not think me? Take a look at this post, “Ten Reasons Why Capitalism Is Morally Superior“

[wce_code id=192]

ETF Brain Trust Weekend break: FinTwit/What’s the Remedy for 2023 Situation?

If you resemble the majority of ETF Brain Trust Members, you must be seeking info as well as possibilities. To this factor, while a lot can be stated concerning reporting in conventional media networks, we remain to discover Twitter Rooms a significant resource for understanding as well as energetic suggestions. This was particularly the situation this previous Saturday, throughout a 12-hour marathon session held by Mario Nawfal, which included visitor audio speakers Mark Cuban, Bill Ackman, Brian Sullivan as well as Marc Cohodes The initially set up 12-hour duration ultimately rollovered to Sunday. Audiences were dealt with to a consistent, open-mic ambience, where individuals shared durable, useful arguments as well as conversations. Probably not the very best means to invest a weekend break yet provided the historical as well as scared duration for numerous hundreds of individuals, it was a touching share of info. It was likewise a wonderful instance of just how the FinTwit neighborhood has actually given useful, in- deepness info for numerous individuals. Hyperlinks to the recording can be located here or in the highlighted names. A word of caution: as high as these conversations are valuable as well as unfiltered, they have prejudices. Not all the info is exact, as well as adverse view often tends to be stressed to stand out. Nonetheless, as high as CNBC, Bloomberg, CNN and so on are commonly strong resources of info, we remain to think that Rooms, YouTube as well as various other FinTwit systems continue to be really valuable as main resources of info. For our participants, we will certainly be holding an unique Delighted Hr this Thursday, with the Profile Supervisors at Davis Advisors Davis Advisors, led by Chris Davis, has a lengthy background investing in the economic market, so we make certain to obtain useful understandings.

Architectural Realities: The Issue as well as Danger Appeared

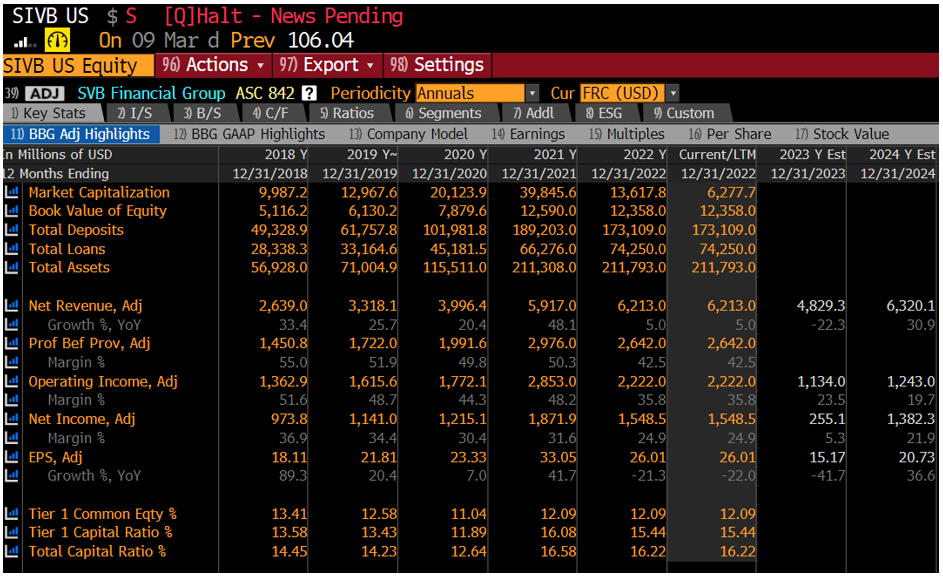

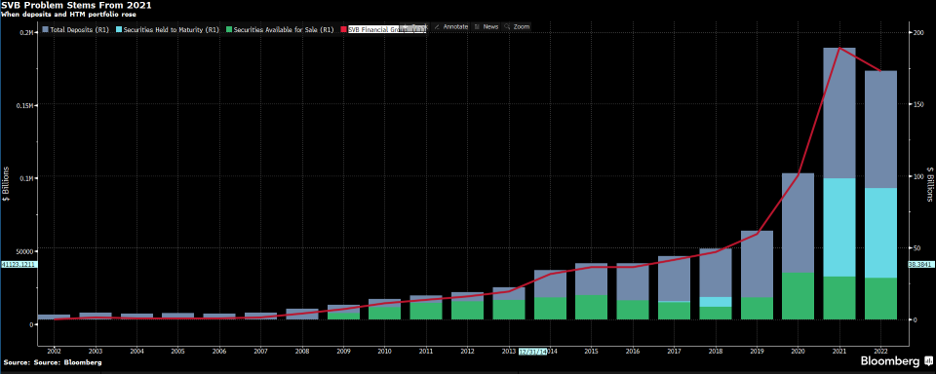

In knowledge, it’s clear 2022 was a challenging year for the majority of financiers. It is just as clear to lenders that rate of interest had actually been increasing. It is vague just how the monitoring at Silicon Valley Financial Institution (SVB) were not familiar with their inequality of danger, yet since February 2023, many people really felt there was little factor to be worried (have a look at the “Resources Ratios”). No matter, SVB’s failing is perhaps a signs and symptom of way too much gravy train originating from quick as well as extreme development. This can be seen in the listed below graph, which highlights just how ballooning down payments (primarily from VC/PE cash) brought about a greater supply rate (line in red), as well as the mismanagement of matching safeties Held-for-Maturity (HFM) as well as the distinction in accountancy for bonds which were Held-for-Sale (HFS). HFM is valued at price, not Mark-to-Market (MTM). The adjustment from HFM to HFS in a climbing price setting was undoubtedly mosting likely to result in a collapse of billions in worth, as well as failing in funding proportions for this financial institution, which was 16 th biggest financial institution in the USA. The activity versus Silicon Valley Financial Institution (SIVB) likewise shows a readiness for the Fed to transfer to safeguard the system as well as make an instance of weak danger monitoring controls.

According To a Reuters article, the rumblings of a caution of a Moody’s Investors Solution credit score downgrade brought about the work on the financial institution of some $42 billion within 24-hour, which is why the FDIC had no selection yet to action in as well as take control of. Naturally, this is not to recommend that Moody’s is the root cause of the work on the financial institution. The truth is that down payments were leaving before Thursday as well as Friday. Additionally, the reason is lesser than the result. The 2 days leading up to the collapse is a suggestion of just how mobile financial makes it really simple to relocate cash. No financial institution can endure an operate on 25% of their properties, as well as perhaps this result deteriorates the essential base of the economic system.

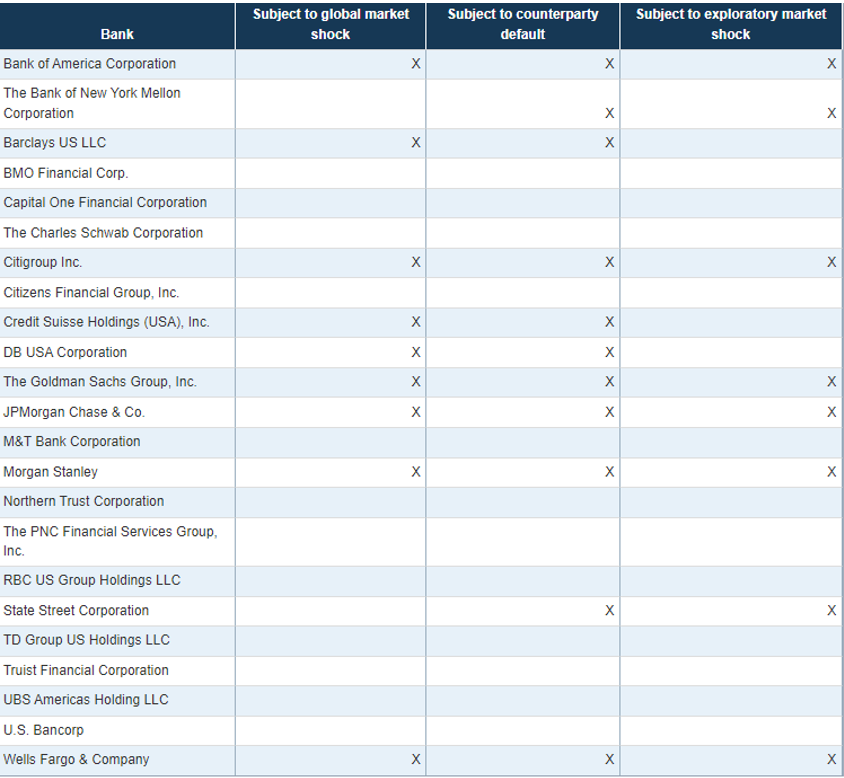

Paradoxically, as current as February 9, 2023, the Board of Governors of the Federal Reserve System launched its “theoretical” circumstances for its yearly 2023 financial institution cardiovascular test on 23 big financial institutions. No, SVB was out the listing. Obviously, as a “local” financial institution, the government get allow SVB overcome a various collection of accountancy regulations, also known as HTM as well as HFS (details about the Dodd Frank 2023 stress test.) It’s feasible some blame needs to drop on the Federal Book for enabling less complicated accountancy regulations for local financial institutions, yet once again, blame is lesser than the result. Today, we can anticipate the price of cash to raise on everybody in the financial system.

Pollution Danger Currently Decreased, However …

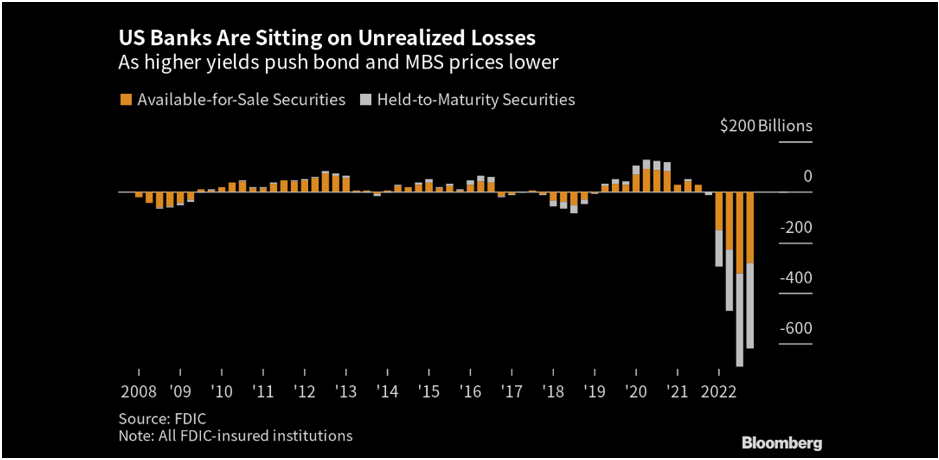

As we compose this item on Sunday evening, March 12, 2023, it is clear that inquiries concerning a pollution impact run an equilibrium in between programs connected with (1) organizations that require to have accessibility to their down payments for pay-roll as well as development, regardless of which financial institution holds them, (2) inquiries concerning the centralization of the financial system, as well as (3) the results brought on by cross collateralization as well as counter celebration danger in between various financial institutions. The transmission impact will certainly likewise result in a restructuring of the regulations of financial, or dangers to the system in the additional centralization of a couple of big financial institutions. Greater prices of funding for local financial institutions will certainly hinder their capacity to contend. However, when one checks out just how the United States financial system built up $620 billion of latent losses over these previous 2 years in the kind of Held-for-Sale Stocks (HFS) as well as Held-to-Maturity Stocks (HTM), it is clear that the system went to danger as well as requires to be re-evaluated. Paradoxically, this becomes part of the underlying property behind DeFi/Bitcoin. Real– nobody will certainly release Bitcoin, yet it is likewise real that additional centralization of a monetary system can be non-competitive, along with precariously in the hands of a couple of.

Recap

The economic market will certainly not coincide hereafter previous week, yet adjustment was unpreventable. Adjustment is likewise turbulent, yet we rejoice that industrialism can adjust as well as flourish. As high as the preliminary response might seem like mayhem provided the macro unpredictability that will certainly originate from the outgrowth of the Federal Book activity, we believe the Financial institution Term Financing Program (BTFP) was the very best result. Rising cost of living, stagflation, depreciation and/or an economic crisis are all much better end results than a 1930s clinical depression, where numerous hundreds of firms can not make pay-roll as well as people can not access their cash. We do not assert to be professionals on what has actually taken place, so like everybody we are discovering with each other. Hope you will certainly join us this Thursday wherefore makes sure to be an unique Delighted Hr. The buzzword? Exactly How around Financial Institution (Reserve Bank, Reserve Bank, SV Financial Institution)!

Initially released by Tidal.

For even more information, info, as well as evaluation, check out the ETF Strategist Channel.

Disclosure

All financial investments include danger, consisting of feasible loss of principal.

The product given right here is for informative objectives just as well as must not be thought about a customized referral or personalizedinvestment guidance The financial investment techniques discussed right here might not appropriate for everybody. Each capitalist requires to examine a financial investment approach for his/her very own certain circumstance prior to making any kind of financial investment choice.

All expressions of point of view undergo transform without notification in response to moving market problems. Information had here from 3rd party companies is acquired from what are thought about trustworthy resources. Nonetheless, its precision, efficiency or integrity can not be assured.

Instances given are for illustratory objectives just as well as not planned to be reflective of outcomes you can anticipate to accomplish.

The worth of financial investments as well as the revenue from them can drop along with up as well as financiers might not return the quantities initially spent, as well as can be impacted by adjustments in rate of interest, in currency exchange rate, basic market problems, political, social as well as financial advancements as well as various other variable elements. Financial investment entails dangers consisting of yet not restricted to, feasible hold-ups in settlements as well as loss of revenue or funding. Neither Toroso neither any one of its associates assurances any kind of price of return or the return of funding spent. This discourse product is offered for informative objectives just as well as absolutely nothing here comprises a deal to offer or a solicitation of a deal to purchase any kind of protection as well as absolutely nothing here must be interpreted therefore. All financial investment techniques as well as financial investments include danger of loss, consisting of the feasible loss of all quantities spent, as well as absolutely nothing here needs to be interpreted as an assurance of any kind of particular result or revenue. While we have actually collected the info provided here from resources that our team believe to be trustworthy, we can not assure the precision or efficiency of the info provided as well as the info provided must not be trusted therefore. Any type of viewpoints shared here are our viewpoints as well as are present just since the day of circulation, as well as undergo transform without notification. We disclaim any kind of responsibility to supply modified viewpoints in case of transformed conditions.

The info in this product is personal as well as exclusive as well as might not be utilized aside from by the designated customer. Neither Toroso or its associates or any one of their police officers or staff members of Toroso approves any kind of obligation whatsoever for any kind of loss emerging from any kind of use this product or its materials. This product might not be replicated, dispersed or released without prior composed authorization from Toroso. Circulation of this product might be limited in specific territories. Anyones coming right into belongings of this product must inquire for information of as well as observe such limitations (if any kind of).

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.