Like Icarus, the inventory market could also be flying too near the solar nowadays.

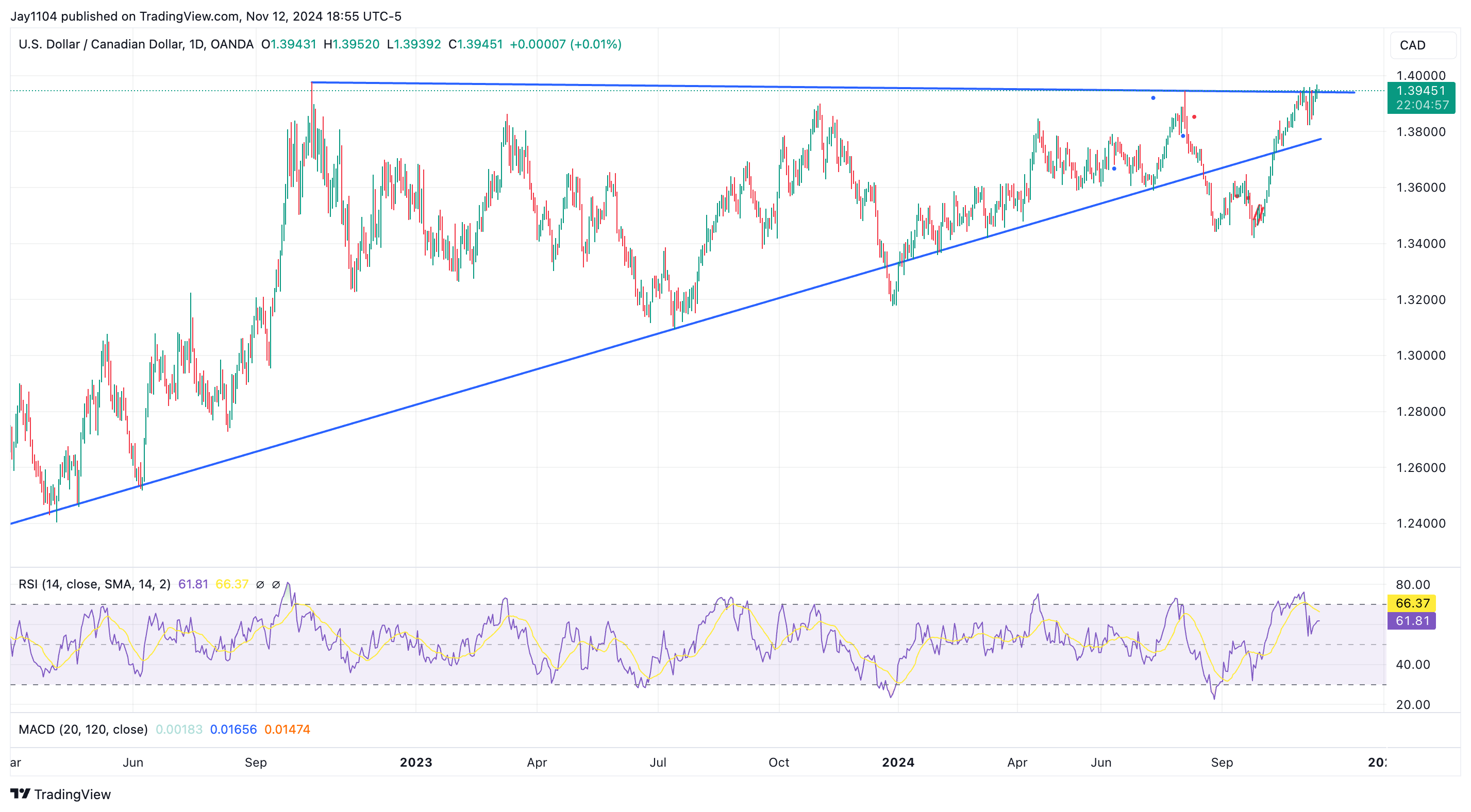

The temper appears euphoric, with many headlines calling for additional positive factors and analysts’ worth targets reaching absurd ranges. Nevertheless, because the temper continues to escalate, evidently the wax is beginning to soften, with rates of interest rising, the strengthening, and international markets faltering.

charges yesterday climbed one other ten bps to complete above 4.4%, a day earlier than the October , which rose by 2.6% on an annualized foundation final month, in comparison with 2.4% in September. The studying was in keeping with economists’ estimates.

The fairness market appears to ignore the CPI report, as famous by the low 1-day studying of round 10. Nevertheless, given the positioning of the 10-year Treasury, the inflation studies to observe later within the week could also be way more vital than they seem.

At this level, the 10-year price is now buying and selling round 4.43% and will rise a lot increased, particularly if the are hotter than anticipated. Actually, given the positioning heading into these studies, the remainder of the week may counsel that a fair greater transfer in charges is coming.

The identical might be mentioned of the , which has been at its weakest degree since October 2022. The present place seems to be essential.

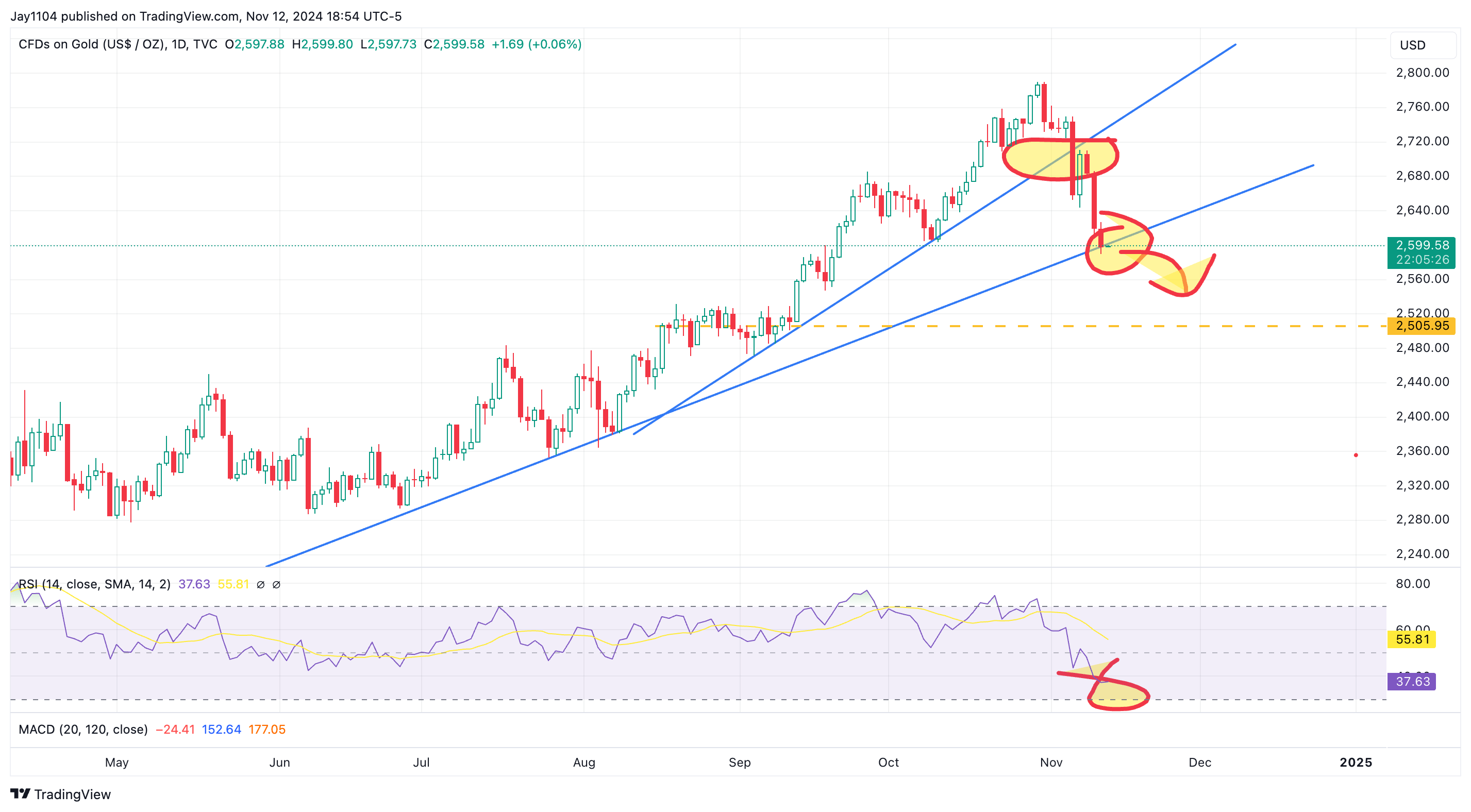

appears to be positioned equally.

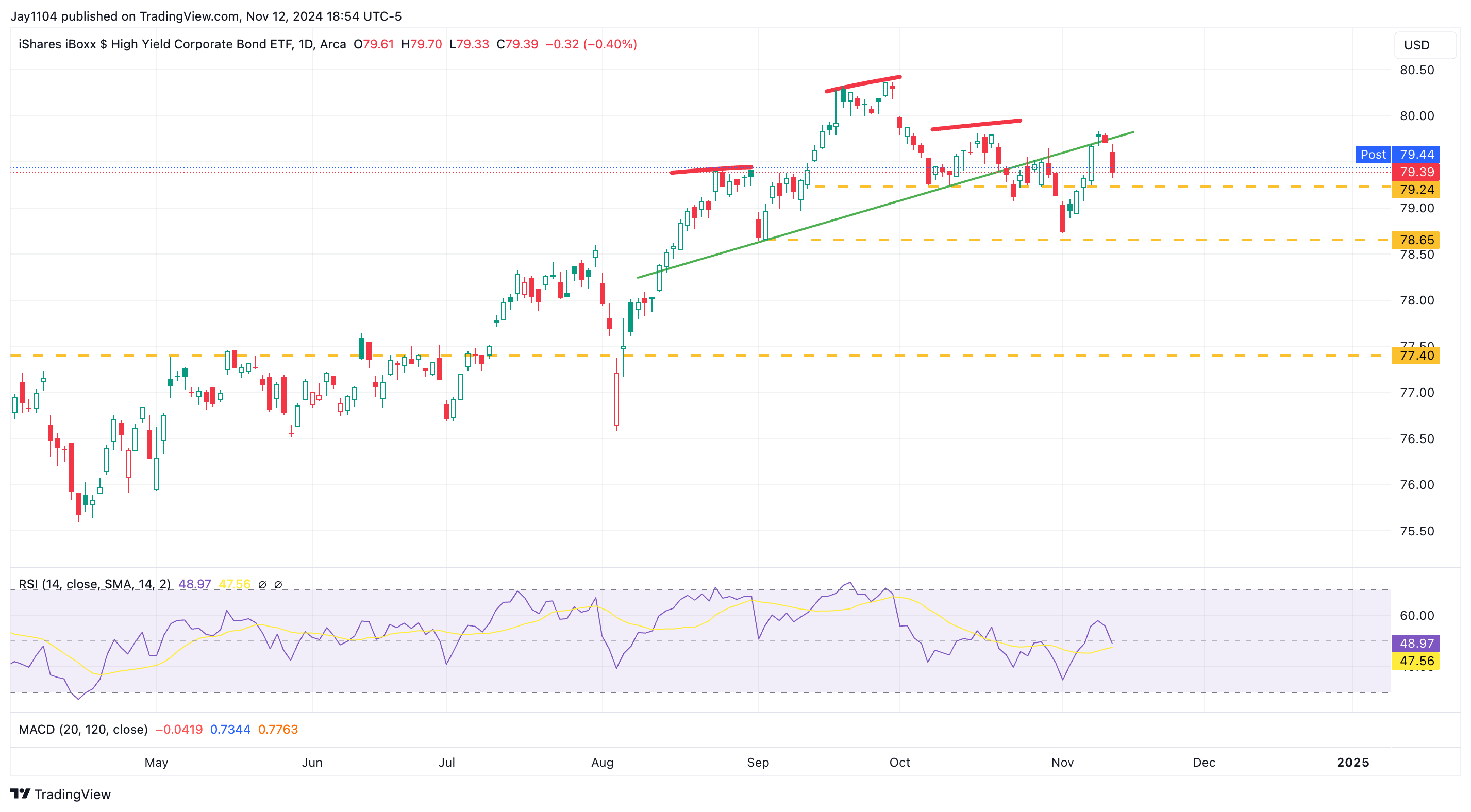

It appears additionally to be the identical for the iShares iBoxx $ Excessive Yield Company Bond ETF (NYSE:).

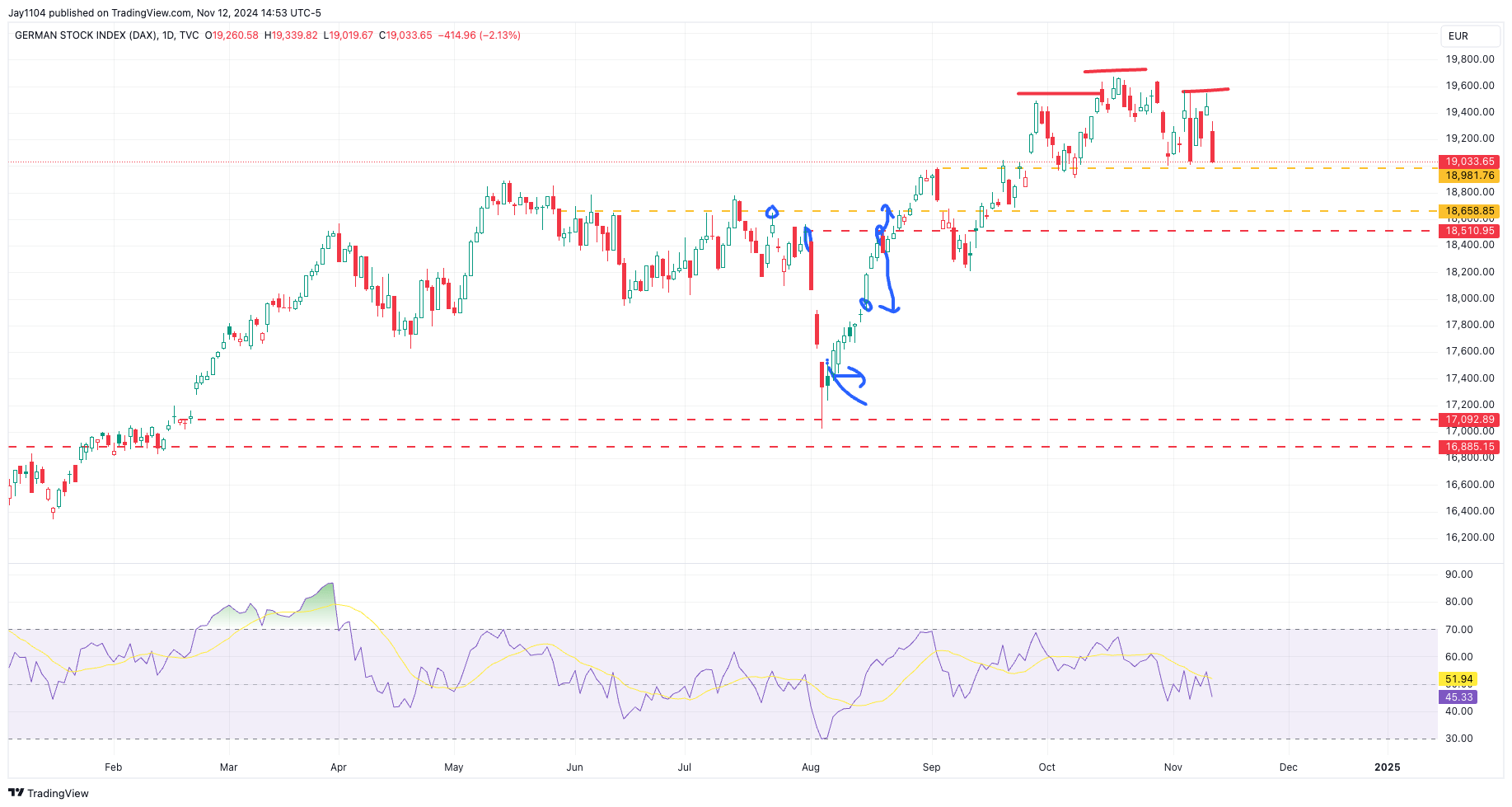

Moreover, there have been vital indicators of weak spot throughout each developed and rising markets. The German has seen a notable downturn over the previous couple of weeks and will arguably be forming a head-and-shoulders sample.

At this level, the indicators from different elements of the market definitely aren’t trying nice, and the query turns into how for much longer will probably be till the US markets begin to succumb to rising charges and the stronger greenback.

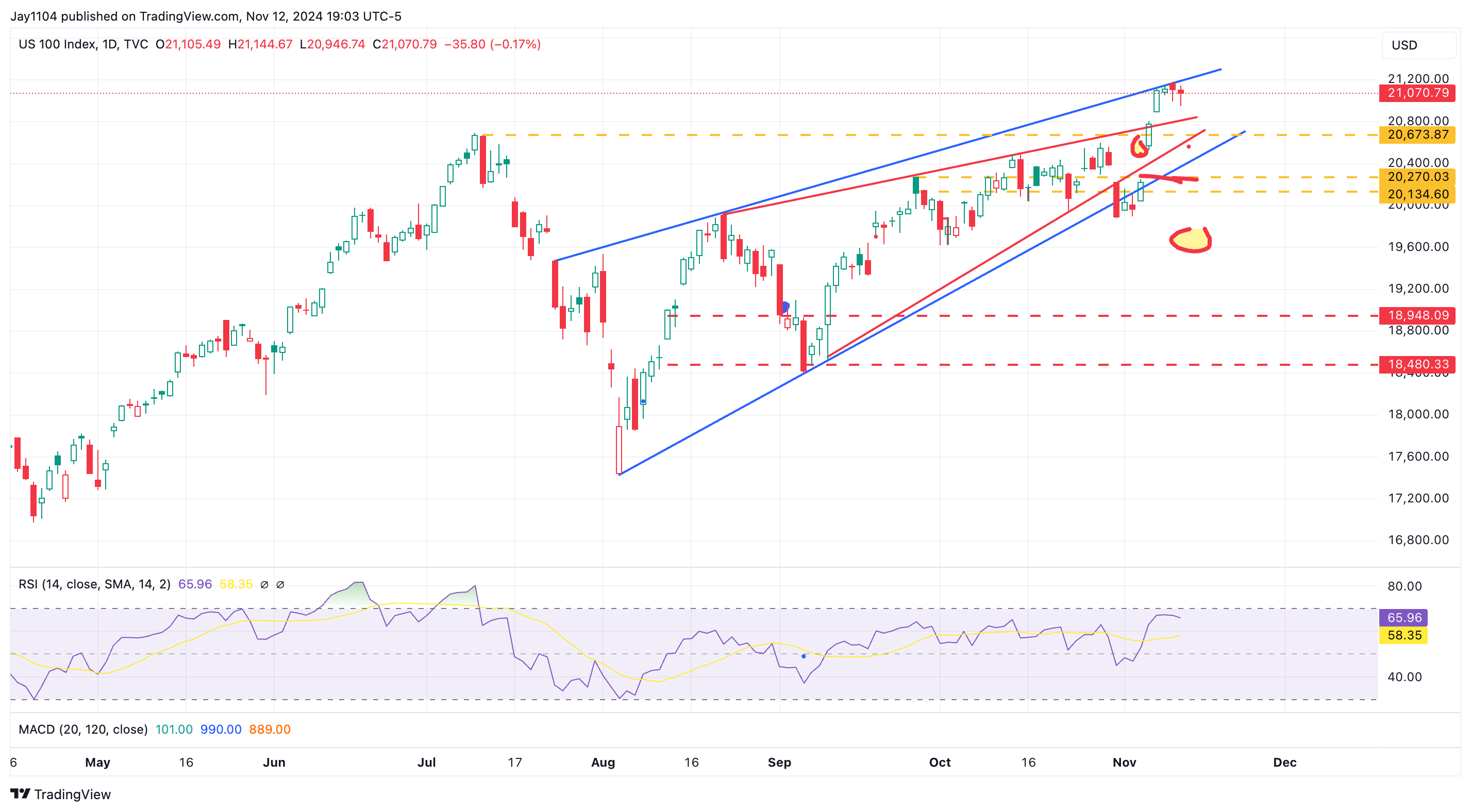

The has hit the higher finish of the rising wedge sample that has been in place since August. Primarily based on this chart, this sample has no extra rising wedges. There was a smaller wedge at one level, however that clearly failed to carry; now, the (blue) wedge is the one one left.

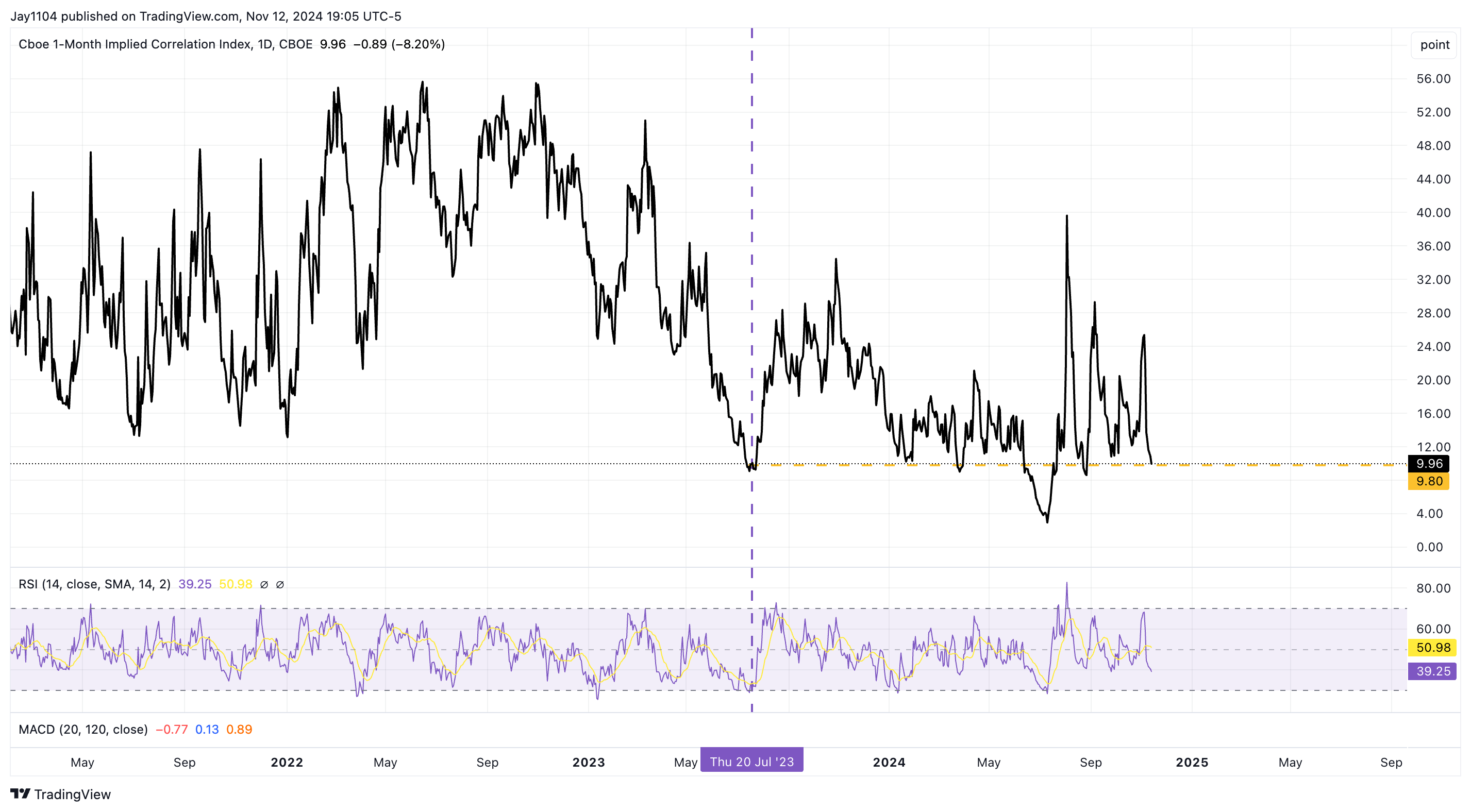

Within the meantime, the 1-month implied correlation fell under 10 yesterday, which is traditionally at a really low degree and tends to be across the decrease finish of the vary. Sometimes, when the 1-month implied correlation bottoms out, the inventory market tops.

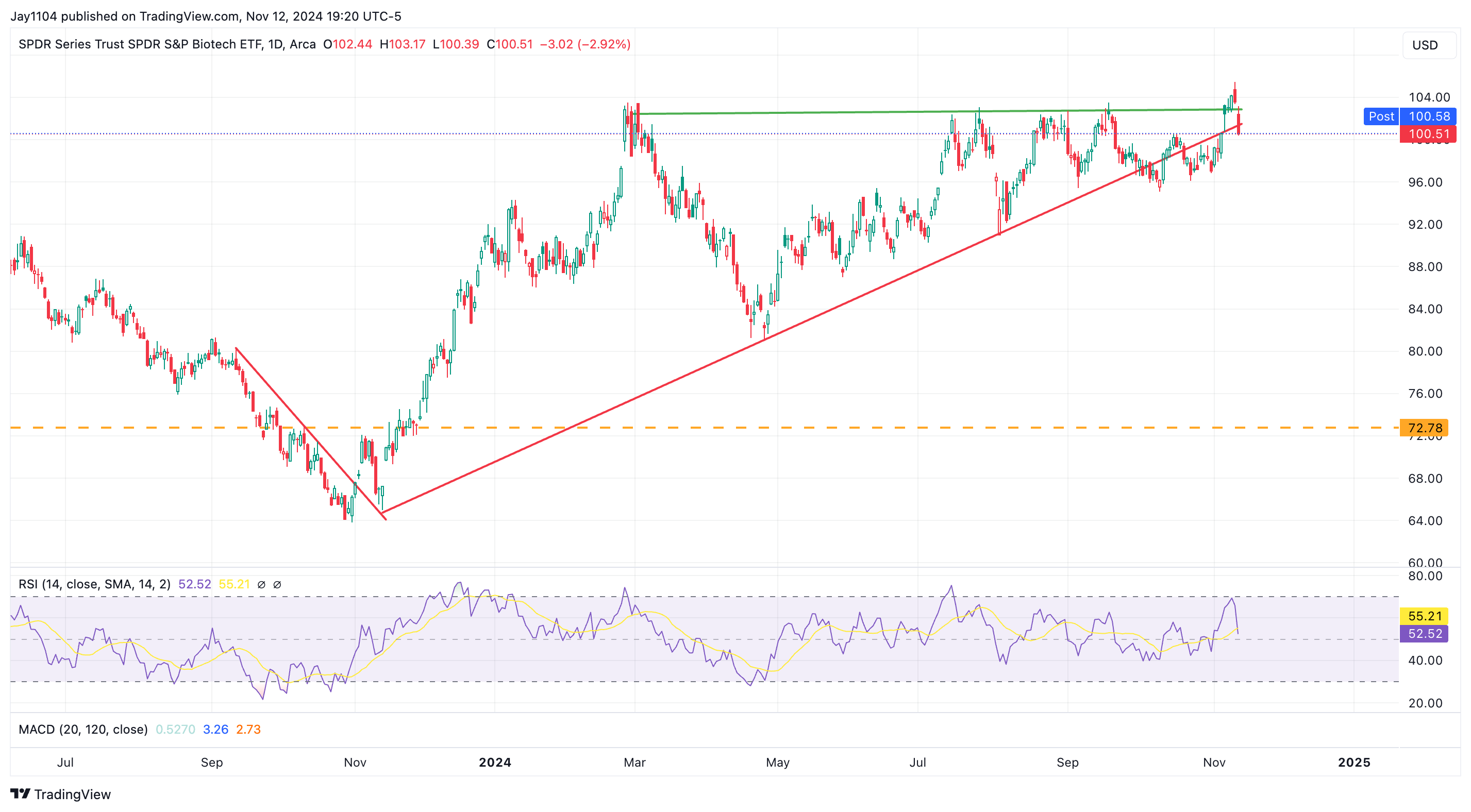

Control the Biotech . It has been consolidating in a triangle sample, and it had appeared to interrupt out, however now it has come again down and into the triangle, which might be a part of a throw-over sample. If it’s a throw-over, then we have to look ahead to a possible break decrease. The Biotechs are usually a superb proxy for the place charges are heading, and so if charges go increased from right here, biotechs possible do poorly.