Each Taiwan Semiconductor Manufacturing (NYSE: TSM) and ASML (NASDAQ: ASML) play essential roles within the semiconductor business. Taiwan Semiconductor, or TSMC for brief, is the world’s main semiconductor contract producer. Given the fee to construct manufacturing amenities (known as fabs or foundries), the excessive capability utilization wanted for foundries to run profitably, and the technological experience wanted, most semiconductor firms desire to only design chips and rent a 3rd get together to fabricate them. That is the place TSMC matches in.

ASML, in the meantime, makes the tools that firms like TSMC use to fabricate semiconductors. Whereas it has rivals, it’s thought-about to have a close to monopoly on excessive ultraviolet (EUV) lithography, that are extremely complicated machines used to create superior chips.

The place to take a position $1,000 proper now? Our analyst staff simply revealed what they imagine are the 10 finest shares to purchase proper now. See the 10 stocks »

This yr, TSMC’s inventory has been the clear winner, up greater than 90% as of this writing. ASML’s inventory, in the meantime, has fallen about 5% in 2024. Let’s take a look at which inventory may very well be set to outperform in 2025.

Each shares are using the chip increase

TSMC has been an enormous beneficiary of the general proliferation of chips in addition to the artificial intelligence (AI) infrastructure increase. The corporate’s technological experience has vaulted it to the forefront of superior chip manufacturing. As such, the largest chipmakers on the planet, together with Apple, Nvidia, and Broadcom, depend on it to fabricate their most superior chips.

Surprisingly, the AI chip increase has not helped all chip producers, as TSMC’s largest rivals, Intel and Samsung, have struggled. This has allowed the corporate not solely to achieve share, but additionally to exert sturdy pricing energy. In flip, this led to a powerful gross margin for TSMC.

TSMC noticed sturdy development this yr, together with seeing its third-quarter income bounce 36% yr over yr to $23.5 billion. In the meantime, its gross margin improved by 460 foundation factors sequentially to 57.8%, which helped result in a 50% year-over-year enhance in its earnings per American depositary receipt (ADR).

2025 can be setting as much as be one other good yr for the corporate. In line with Morgan Stanley, the corporate is about to properly enhance costs in 2025. In the meantime, given the demand for AI and different chips, TSMC has been increasing to attempt to assist firms like Nvidia sustain with demand. It additionally simply introduced its new fab in Japan had began mass chip manufacturing.

TSMC’s growth ought to presumably assist ASML, as it’s considered one of its huge three clients together with Samsung and Intel for its newer expertise. However the firm has known as 2024 a transition yr because it strikes to its next-generation high-NA EUV expertise. This transition seems to have slowed some orders. TSMC, in the meantime, has additionally balked on the excessive worth of the brand new ASML machines (costs vary from $350 million to $380 million per machine), however it’s now anticipated to obtain a machine by year-end. Nevertheless, it has mentioned it does not want the expertise for producing present high-end chips, and it seems prefer it will not use the machines for mass manufacturing till at the very least 2030.

Intel has been the corporate most receptive to ASML’s new expertise, being the primary to get a brand new high-NA EUV expertise machine, however its foundry enterprise has struggled. Income fell for the section final quarter, whereas losses have been mounting. The corporate is now in a little bit of disarray following the retirement of its CEO in early December and reviews it’s seeking to spin off its foundry enterprise. As considered one of its huge three clients, ASML may very well be affected.

Almost half of ASML’s income in 2024, in the meantime, has come from China. That is even if the corporate is prohibited from promoting its newer chipmaking expertise to the nation. It is a huge shift from current years, as China was simply 9% of its income within the fourth quarter of 2022. This may very well be the results of Chinese language firms speeding to get tools on fears that export bans may broaden to even older expertise.

Whereas all this has led to some uncertainty surrounding ASML, the corporate continues to be mainly a monopoly for high-end semiconductor tools, and as chip manufacturing continues to develop, it ought to ultimately profit.

Picture supply: Getty Pictures.

Valuation and verdict

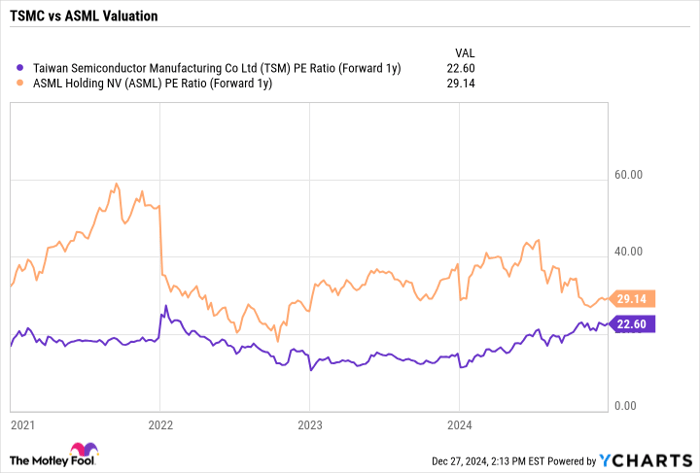

From a valuation standpoint, TSMC is the cheaper inventory buying and selling at a forward price-to-earnings (P/E) ratio of round 22, whereas ASML’s ahead P/E at the moment sits at 29. TSMC has additionally been rising its income extra shortly, up 36% final quarter versus 12% development for ASML.

TSM PE Ratio (Forward 1y) information by YCharts

Whereas TSMC is the cheaper inventory rising extra shortly, I would not rely ASML out. The semiconductor tools enterprise is usually a bit lumpy, however this can be a firm with a digital monopoly on high-end chipmaking machines in a market that’s seeing continued growing demand for superior AI chips. Over the long run, it’s set to be a winner.

That mentioned, for subsequent yr, TSMC edges it out as my choose. Fortuitously, traders do not have to select one or the opposite and might really feel comfy shopping for each for 2025.

Don’t miss this second probability at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? You then’ll wish to hear this.

On uncommon events, our knowledgeable staff of analysts points a “Double Down” stock advice for firms that they suppose are about to pop. In case you’re frightened you’ve already missed your probability to take a position, now’s the very best time to purchase earlier than it’s too late. And the numbers converse for themselves:

- Nvidia: in case you invested $1,000 after we doubled down in 2009, you’d have $355,269!*

- Apple: in case you invested $1,000 after we doubled down in 2008, you’d have $48,404!*

- Netflix: in case you invested $1,000 after we doubled down in 2004, you’d have $489,434!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable firms, and there might not be one other probability like this anytime quickly.

*Inventory Advisor returns as of December 23, 2024

Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends ASML, Apple, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom and recommends the next choices: quick February 2025 $27 calls on Intel. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.