Everyone recognizes exactly how vital profits period is, with business lastly drawing back the drape as well as introduction what’s taken place behind shut doors.

We’re well right into the period, with the been afraid profits armageddon yet to show up.

And also in the coming weeks, a lot more are slated to report.

2 business, Lowe’s LOW as well as Builders FirstSource BLDR, are arranged to expose their quarterly outcomes today. BLDR will certainly report on February 28 th, whereas Lowe’s will certainly report on March 1 st, both prior to the marketplace open.

Exactly how do the business accumulate? We can utilize arise from a peer, Residence Depot HD, as a tiny scale. Allow’s take a more detailed look.

Residence Depot

Residence Depot published better-than-expected profits outcomes, going beyond the Zacks Agreement EPS Quote by 1%.

Quarterly income completed $35.8 billion, decently listed below assumptions yet expanding 0.3% year-over-year. Below is a graph showing the business’s income on a quarterly basis.

Photo Resource: Zacks Financial Investment Research Study

Additionally, there were a number of noteworthy highlights, consisting of–

HD revealed that its board of supervisors accepted a 10% boost in the business’s quarterly returns, with the returns currently producing $8.36 each year. Even more, the business revealed that it’s devoting $1 billion in annualized payment for per hour as well as frontline affiliates.

And also to cover it off, the business gave advice for FY23; HD anticipates sales as well as similar shop sales development to be level year-over-year contrasted to FY22 as well as watered down EPS to decrease by a mid-single-digit portion.

Currently, onto Lowe’s as well as Contractors FirstSource.

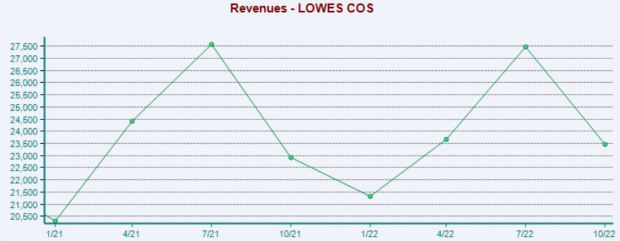

Lowe’s

Quarterly Quotes–

Experts have actually largely been bearish for LOW’s quarter to be reported, with 4 unfavorable profits quote alterations striking the tape over the last a number of months. The Zacks Agreement EPS Quote of $2.21 recommends a 24% enhancement within the lower line year-over-year.

Photo Resource: Zacks Financial Investment Research Study

Our agreement income quote perseveres at $22.8 billion, showing a favorable adjustment of almost 7% from the year-ago quarter.

Quarterly Efficiency–

Lowe’s has actually continually published better-than-expected profits outcomes, going beyond the Zacks Agreement EPS Quote in 14 successive quarters.

Income outcomes have actually additionally been largely favorable, with the merchant signing up 8 leading line defeats throughout its last 10 quarters.

Photo Resource: Zacks Financial Investment Research Study

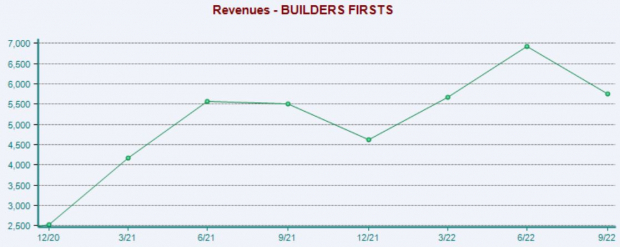

Builders FirstSource

Quarterly Quotes–

Experts have actually had combined responses for BLDR’s approaching quarter, with a single down as well as higher profits quote alteration being available in. The Zacks Agreement EPS Quote of $2.37 shows a 15% year-over-year pullback in profits.

Photo Resource: Zacks Financial Investment Research Study

Rotating to the leading line, the Zacks Agreement Sales Quote of $4.2 billion suggests an almost 9% pullback from year-ago income of $4.6 billion.

Quarterly Efficiency–

BLDR flaunts a solid profits record, going beyond both profits as well as income quotes in 7 successive quarters.

Simply in its most recent launch, the business signed up a large 47% EPS beat as well as reported income 10% over assumptions.

Photo Resource: Zacks Financial Investment Research Study

Placing Whatever With Each Other

Profits period remains to roll along, with capitalists lastly seeing what’s taken place behind shut doors.

We have actually obtained a lot of quarterly outcomes up until now, as well as quickly we’ll learn through Lowe’s LOW as well as Builders FirstSource BLDR.

A peer, Residence Depot HD, currently reported its quarterly outcomes, with the business uploading combined leading as well as profits outcomes yet upping its returns payment.

Heading right into their launches, Lowe’s as well as Contractors FirstSource are both a Zacks Ranking # 3 (Hold).

5 Supplies Ready To Dual

Each was handpicked by a Zacks specialist as the # 1 favored supply to get +100% or even more in 2021. Previous suggestions have actually risen +143.0%, +175.9%, +498.3% as well as +673.0%.

The majority of the supplies in this record are flying under Wall surface Road radar, which offers a terrific possibility to participate the first stage.

Today, See These 5 Potential Home Runs >>

Lowe’s Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.