Nvidia’s NVDA quarterly outcomes had been glorious, with the chip big not solely beating estimates and elevating steerage but in addition reaching top- and bottom-line development charges which are sometimes related to start-up gamers.

Nvidia’s Q3 earnings elevated +106.3% from the year-earlier interval to $19.37 billion whereas revenues had been up +93.6% year-over-year to +35.08 billion.

To get a way of the market’s lukewarm response to those in any other case spectacular outcomes from Nvidia, check out the chart beneath that plots the inventory worth relative to how estimates consensus EPS estimates have developed over time.

Picture Supply: Zacks Funding Analysis

The chart’s gentle blue and purple traces symbolize the evolution of consensus EPS estimates for 2024 and 2025, respectively. The steepness of these traces exhibits how persistent the favorable revisions development has been, with analysts seemingly struggling to meet up with how sturdy underlying enterprise tendencies have been for Nvidia.

Nvidia’s inventory market momentum has made its market capitalization the best of the Magnificent 7 group at $3.59 trillion, surpassing Apple at $3.45 trillion and Microsoft at $3.07 trillion. Buyers’ lukewarm response means that they’ve turn out to be used to getting far larger steerage upgrades than what they obtained this time round. Nvidia’s upgraded steerage is strong, however comparatively underwhelming by the corporate’s personal requirements.

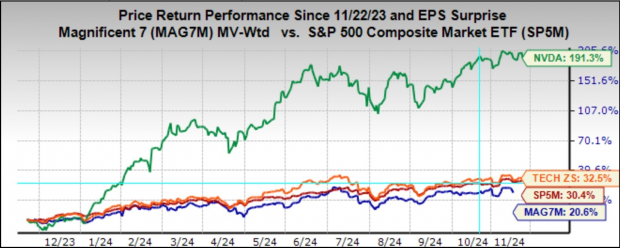

We don’t wish to come throughout as making too large of a deal of the inventory’s response to the quarterly outcomes. In spite of everything, Nvidia shares are up +191.3% over the previous 12 months and have handily outperformed the Zacks Tech sector (up +32.5%), the S&P 500 index (up +30.4%), and the Magazine 7 group (up +20.6%).

Picture Supply: Zacks Funding Analysis

Past Nvidia, the main target these days has been on the Retail sector, with a number of main standard operators popping out with quarterly outcomes. By means of Friday, November 22nd, now we have seen Q3 outcomes from 29 of the 34 Retail sector firms within the S&P 500 index.

Common readers know that Zacks has a devoted stand-alone financial sector for the retail area, which is in contrast to the location of the area within the Client Staples and Client Discretionary sectors within the Commonplace & Poor’s commonplace trade classification.

The Zacks Retail sector contains not solely Walmart, Dwelling Depot, and different conventional retailers, but in addition on-line distributors like Amazon AMZN and restaurant gamers.

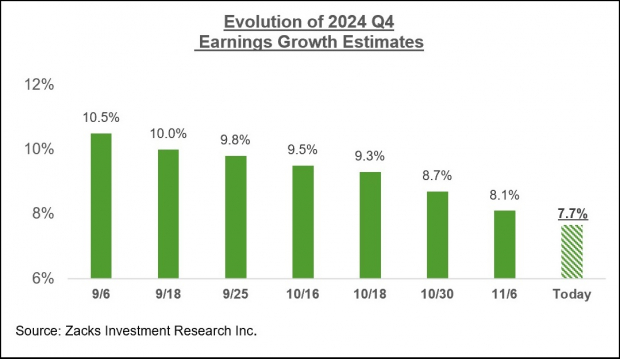

Complete Q3 earnings for these 29 retailers which have reported are up +12.8% from the identical interval final 12 months on +5.6% greater revenues, with 58.6% beating EPS estimates and solely 51.7% beating income estimates.

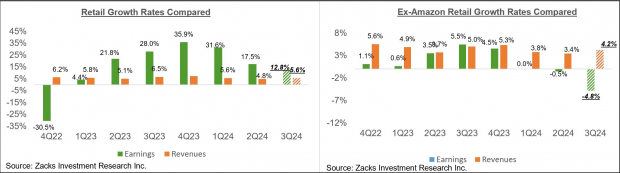

The comparability charts beneath put the Q3 beats percentages for these retailers in a historic context.

Picture Supply: Zacks Funding Analysis

As you’ll be able to see above, members of the Zacks Retail sector have struggled to beat estimates in Q3, with the development notably notable on the EPS beats entrance which are monitoring beneath the 20-quarter low at this stage.

In regards to the elevated earnings development fee at this stage, we like to point out the group’s efficiency with and with out Amazon, whose outcomes are among the many 24 firms which have reported already. As we all know, Amazon’s Q3 earnings had been up +71.6% on +11% greater revenues, because it beat EPS and top-line expectations.

As everyone knows, the digital and brick-and-mortar operators have been converging for a while now. Amazon is now a decent-sized brick-and-mortar operator after Complete Meals, and Walmart is now a rising on-line vendor. This long-standing development bought an enormous enhance from the Covid lockdowns.

The 2 comparability charts beneath present the Q3 earnings and income development relative to different latest intervals, each with Amazon’s outcomes (left facet chart) and with out Amazon’s numbers (proper facet chart).

Picture Supply: Zacks Funding Analysis

Q3 Earnings Season Scorecard

By means of Friday, November 22nd, now we have seen Q3 outcomes from 476 S&P 500 members, or 92.2% of the index’s whole membership. We have now one other 8 S&P 500 members on deck to report outcomes this holiday-shortened week, together with Dell, HP, Finest Purchase, and others.

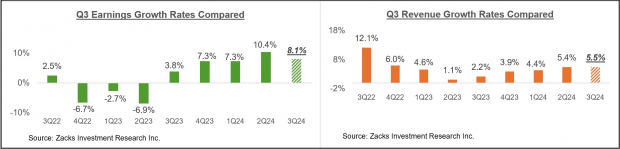

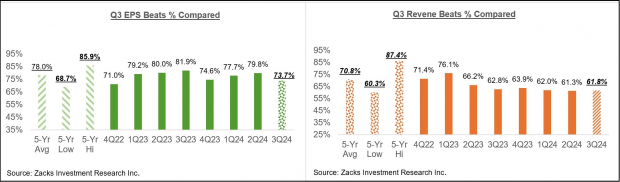

Complete earnings for these 476 firms which have reported are up +8.1% from the identical interval final 12 months on +5.5% greater revenues, with 73.7% of the businesses beating EPS estimates and 61.8% beating income estimates.

The proportion of those 476 index members beating each EPS and income estimates is 51.1%.

The comparability charts beneath put the Q3 earnings and income development charges and the EPS and income beats percentages in a historic context. The primary set of comparability charts present the earnings and income development charges.

Picture Supply: Zacks Funding Analysis

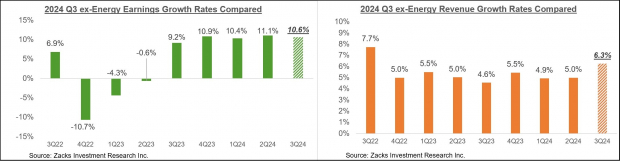

One vital drag on the combination development tempo has been the Power sector, whose Q3 earnings had been down -22.9% from the identical interval final 12 months on -2.7% decrease revenues. Q3 earnings for the index could be up +10.6% on +6.3% greater revenues had it not been for this Power sector drag. The comparability charts beneath present the ex-Power earnings and income development tempo throughout completely different intervals.

Picture Supply: Zacks Funding Analysis

The second set of comparability charts examine the Q3 EPS and income beats percentages in a historic context.

Picture Supply: Zacks Funding Analysis

The comparability charts beneath highlight the income efficiency and the blended beats proportion for this group of 476 index members.

Picture Supply: Zacks Funding Analysis

As you’ll be able to see above, the expansion development seems stable-to-positive, although fewer firms are beating consensus estimates relative to different latest intervals. Actually, each the EPS and income beats percentages are monitoring beneath the 20-quarter averages.

The Earnings Huge Image

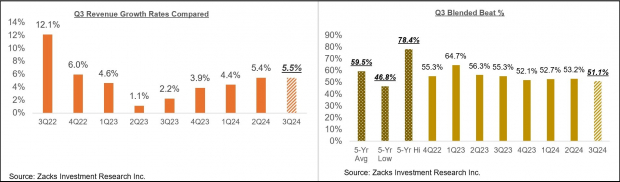

Taking a look at Q3 as an entire, combining the outcomes which have come out with estimates for the still-to-come firms, whole earnings for the S&P 500 index are anticipated to be up +8.1% from the identical interval final 12 months on +5.7% greater revenues.

The chart beneath exhibits the Q3 earnings and income development tempo within the context of the place development has been within the previous 4 quarters and what’s anticipated within the coming three quarters.

Picture Supply: Zacks Funding Analysis

The Power and Tech sectors are having the alternative results on the Q3 earnings development tempo, with the Power sector dragging it down and the Tech sector pushing it greater.

Had it not been for the Power sector drag, Q3 earnings for the S&P 500 index could be up +10.6% as an alternative of +8.1%. Excluding the Tech sector’s substantial contribution, Q3 earnings development for the remainder of the index could be up solely +2.9% as an alternative of +8.1%.

Excluding the contribution from the Magazine 7 group, Q3 earnings for the remainder of the 493 S&P 500 members could be up solely +2.4% as an alternative of +8.1%.

For the final quarter of the 12 months (2024 This autumn), whole S&P 500 earnings are anticipated to be up +7.7% from the identical interval final 12 months on +4.9% greater revenues.

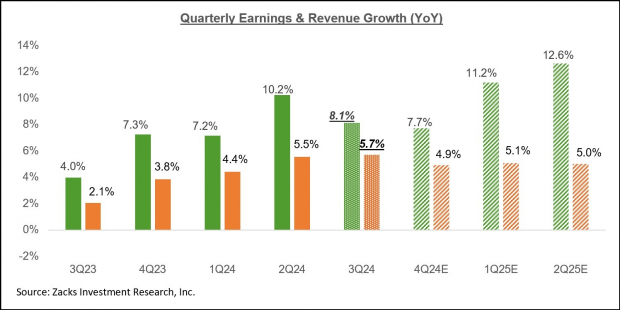

In contrast to the unusually excessive magnitude of estimate cuts that we had seen forward of the beginning of the Q3 earnings season, estimates for This autumn are holding up loads higher, because the chart beneath exhibits.

Picture Supply: Zacks Funding Analysis

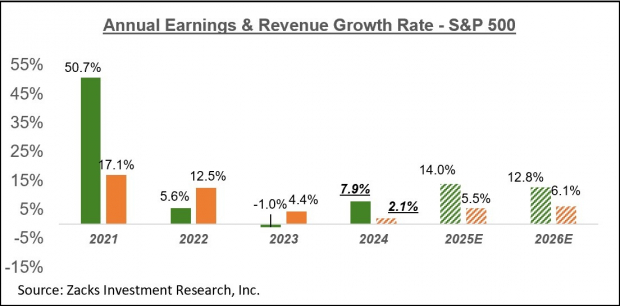

The chart beneath exhibits the general earnings image on a calendar-year foundation, with the +7.9% earnings development this 12 months adopted by double-digit positive aspects in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

Please notice that this 12 months’s +7.9% earnings development improves to +9.9% on an ex-Power foundation.

For an in depth take a look at the general earnings image, together with expectations for the approaching intervals, please take a look at our weekly Earnings Tendencies report >>>> Walmart and Target: A Closer Look at Retail Earnings

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to achieve +100% or extra in 2024. Whereas not all picks may be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying beneath Wall Avenue radar, which gives an awesome alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.