America’ forty seventh Presidential election concluded this week with the appointment of Donald Trump to his second time period within the White Home after a tumultuous race.

Fueled by the promise of decrease company taxes and the Federal Reserve’s resolution to slash rates of interest by one other 25 foundation factors, the inventory market soared, with each the S&P 500 and Nasdaq Composite indexes setting file highs.

Bitcoin additionally surged to a brand new file excessive above US$77,000, bolstered by the Republican occasion’s good points within the midterm elections. With the Senate secured and the Home of Representatives inside attain, the prospect of a extra favorable regulatory panorama for cryptocurrencies in 2025 has ignited investor enthusiasm.

Because the mud settles on the 2024 presidential election, the total extent of Trump’s insurance policies on the economic system stays to be seen.

1. Huge Tech reacts to Trump’s election win

The election of Trump to the White Home on November 6 has been perceived as a victory for CEOs, notably these within the tech business who’ve maintained shut ties with policymakers. With guarantees to decrease company taxes and loosen laws, the brand new administration may present a extra favorable enterprise setting.

That sentiment was mirrored within the inventory market this week, with a handful of tech firms witnessing development of properly over 5 %. After replacing Intel (NASDAQ:INTC) within the Dow Jones Industrial Common on November 1, NVIDIA (NASDAQ:NVDA) surpassed Apple (NASDAQ:APPL) to develop into the world’s most useful firm for the third time this yr.

It achieved a market capitalization of US$3.43 trillion in comparison with Apple’s US$3.38 trillion as markets wrapped on Tuesday (November 5) and reached a historic valuation of US$3.6 trillion on Wednesday (November 6). Its share worth is up 7.28 % for the week.

Along with NVIDIA’s good points, tech giants Broadcom (NASDAQ:AVGO) and Amazon (NASDAQ:AMZN) additionally skilled important share worth will increase of 8.29 % and 5.87 %, respectively. In the meantime, shares of Apple, Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META) and Taiwan Semiconductor (NYSE:TSM) noticed extra modest good points of two.63 %, 3.13 %, 4.47 % and three.87 %.

Traders could also be optimistic after a Reuters report suggested that Trump could also be planning to dial again antitrust measures enforced by the Biden administration and that he could even disrupt the proposed breakup of Google (NASDAQ:GOOGL), whose share worth is up 5.09 % for the week.

2. Bitcoin units new worth file

After a stoop early within the week, Bitcoin reached a brand new all-time excessive after Trump was elected because the forty seventh president of the US within the early hours of Wednesday.

In a presidential race initially thought of the closest in trendy US historical past, the Republican candidate took an early lead by securing votes in North Carolina, Georgia and Pennsylvania, three out of seven key swing states.

At 5:34 AM EST on November 6, the Associated Press reported that Trump had received over his fourth swing state, Wisconsin, securing sufficient electoral faculty votes to be declared the winner.

As People solid their ballots and Trump’s prospects improved, the value of Bitcoin rose in tandem. It went from round US$68,750 on the morning of November 5 to over $75,000 simply after 1:36 AM EST on November 6, surpassing its earlier file of $73,000 set in March 2024.

Chart by way of CoinGecko.

Bitcoin efficiency, October 10 to November 7, 2024.

On November 6 at 5:35 AM EST, after Trump declared victory, Bitcoin was buying and selling at round US$73,000. The worth continued to rise because the markets opened on Wednesday, briefly breaking previous US$76,000 earlier than retreating barely as Western markets closed. It traded within the US$74,000 vary in Asia and retook US$76,000 at round 11:00 AM EST.

Not like the short-lived rallies seen in latest weeks, Bitcoin has managed to keep up its good points to date. A Trump presidency is seen as helpful to the cryptocurrency business, as his marketing campaign promised to loosen laws and change regulators like US Securities and Trade Fee Chairman Gary Gensler, who has had a contentious relationship with the business’s main gamers.

Republicans additionally took a majority of the US Senate and are on observe to take the Home of Representatives, though the votes are nonetheless being tallied. With a extra “crypto-friendly” political panorama, business insiders are optimistic that innovation and adoptions will speed up.

Bitcoin closed the week over 10 % increased at US$76,739, barely under its weekly excessive of US$77,239 reached earlier on Friday (November 8).

3. Tesla shares hit year-to-date excessive

Subsequent to Bitcoin, Tesla (NASDAQ:TSLA) is the largest winner after Trump’s win this week.

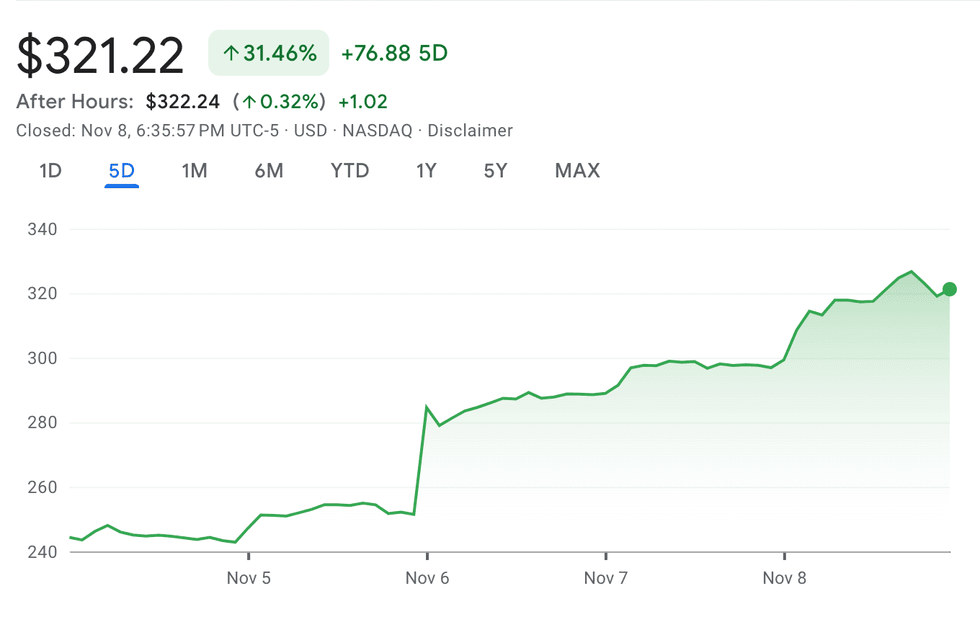

Its share worth gained over 13 % on Wednesday morning and is up over 31 % for the week, buying and selling at US$321.22, its highest stage year-to-date.

Chart by way of Google Finance.

Tesla efficiency, November 4 to eight, 2024.

Tesla CEO Elon Musk actively supported Trump within the weeks main as much as the election, contributing roughly US$130 million to his marketing campaign efforts. In September, Trump indicated his intention to supply Musk a job within the White Home, specializing in streamlining authorities operations and slicing federal spending.

To realize this, Musk has boldly predicted that he may eradicate no less than US$2 trillion of federal spending. Whereas he hasn’t specified precisely the place these cuts would come from, reports suggest that Musk and Trump could goal businesses chargeable for regulating industries by which Musk’s firms function. These businesses may embody the Federal Aviation Administration (FAA), the Federal Communications Fee (FCC) and environmental businesses.

Throughout his marketing campaign, Trump additionally expressed intentions to reverse tax incentives and rebates for electrical automobile (EV) purchases established throughout the Biden-Harris administration. Though this might sound counterproductive to Musk’s Tesla operations, the CEO could possibly be specializing in his different enterprise, SpaceX, which has cast robust ties with the federal authorities’s protection businesses.

In March it was reported that SpaceX had signed a contract value US$1.8 billion in 2021 to construct spy satellites with the Nationwide Reconnaissance Workplace, and the corporate won contracts for 9 launches beneath the Nationwide Safety Area Launch (NSSL) Part 3 Lane 1 program on October 18.

Nevertheless, points between the FAA and SpaceX — reminiscent of a US$633,009 fine imposed by the company in September for procedural violations associated to Falcon 9 launches in 2023 in addition to its resolution to delay the test launch of SpaceX’s Starship mega rocket — have created pressure between Musk and the company.

Musk could have a vested curiosity in lowering the FAA’s regulatory oversight of SpaceX’s operations, as diminishing the company’s funding may doubtlessly clear a path for expanded industrial area exploration.

4. Tremendous Micro shares audit replace, stories preliminary earnings

Tremendous Micro Laptop (SMCI) (NASDAQ:SMCI) introduced preliminary Q1 2025 results on Tuesday (November 5) with a renewed internet gross sales forecast of US$5.9 billion to US$6 billion, lacking analysts’ expectations of US$6.79 billion and barely under the corporate’s earlier steerage vary of US$6 billion to US$7 billion.

The corporate additionally offered Q2 steerage, projecting internet gross sales in a variety of US$5.5 billion to US$6.1 billion for the quarter ending on December 31, 2024. This information led to a share worth drop of over 24 % on Wednesday morning.

The corporate additionally shared an replace from an impartial Particular Committee fashioned to analyze considerations over the corporate’s accounting data initially raised by EY. In an announcement, the committee mentioned it discovered no proof of fraud or misconduct by administration or the Board of Administrators in its investigation, and really useful that SMCI conduct “a collection of remedial measures…to strengthen its inside governance and oversight operate.” A full report is anticipated subsequent week.

In the meantime, SMCI is working to file its delayed Kind 10-Okay and regain compliance with Nasdaq itemizing necessities. After being issued a discover of noncompliance, firms have 60 days to both file the Kind 10-Okay or submit a plan to regain compliance. If SMCI fails to do both and is delisted from the Nasdaq, it faces potential early repayment of as much as US$1.725 billion in March 2029 of convertible notes.

5. Arm stumbles on Q2 income development

Arm Holdings (NASDAQ:ARM) launched its Q2 FYE25 results on November 6 (Wednesday), exhibiting that income development slowed to only 5 % within the September quarter, down from 39 % within the earlier quarter.

This slowdown in income development was primarily attributed to a decline in licensing income, the charges that Arm receives from firms that use its IP to develop their very own chips. Licensing income was US$330 million in Q2, in comparison with US$472 million in Q1, a distinction of 43 %.

Chart by way of Google Finance.

Arm Holdings efficiency, November 4 to eight, 2024.

Nevertheless, the decline was partially offset by royalty income, which elevated by over 10 % to US$514 million. Royalty income refers back to the charges that Arm receives from firms that use its IP in merchandise which might be bought to finish shoppers.

Whereas Arm’s share worth initially dipped following the report, it rebounded strongly, up practically 10 % noon on Thursday (November 7). This optimistic shift probably displays investor confidence in Arm’s robust place inside the tech business. The corporate collaborates with main tech gamers like Apple, Samsung (KS:5930) and NVIDIA, and its chips are important parts in a variety of shopper and industrial electronics. The corporate concluded the week with its share worth rising by 5.16 %.

Do not forget to observe us @INN_Technology for real-time information updates!

Securities Disclosure: I, Meagen Seatter, maintain no direct funding curiosity in any firm talked about on this article.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.