Chip shares confronted losses early this week, sparking volatility within the tech sector.

In the meantime, Bitcoin was on the rise after US Vice President Kamala Harris stated she plans to assist innovation within the cryptocurrency {industry}. Elsewhere, Google (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) signed nuclear energy offers.

Keep knowledgeable on the most recent developments within the tech world with the Investing Information Community’s round-up.

1. Bitcoin worth rises to almost US$70,000

The value of Bitcoin rose above its 200 day transferring common late on Sunday (October 13) night, reaching US$62,640 on the again of optimism over China’s lately introduced stimulus plan. The favored cryptocurrency’s positive aspects prolonged into Monday (October 14) morning, and it will definitely surpassed US$66,400 for the primary time since late July.

Information from CoinGlass exhibits over US$100 million in liquidated quick positions because of the sudden worth leap.

Chart through CoinGecko.

Bitcoin efficiency, October 12 to 18, 2024.

Open curiosity in Bitcoin futures has surged to an all-time high, indicating robust institutional participation and elevating expectations for a continued worth rally. Bitcoin exchange-traded funds additionally noticed report inflows of over US$250 million day by day this week, additional fueling bullish sentiment amongst sector contributors.

Crypto analyst Omkar Godbole has prompt that the current breakout could signal a big upswing. The US$70,000 mark is now being eyed as Bitcoin’s subsequent main resistance degree, whereas Ether’s subsequent hurdle lies at US$2,770.

Bitcoin closed the week at US$68,362, whereas Ether is at the moment priced at US$2,663.

US election hypothesis additionally impacted Bitcoin this week.

On Monday night, Harris pledged to support a regulatory framework for crypto, though the information was considerably dampened as she did not share an in depth plan. Even so, that didn’t cease Ripple Labs co-founder Chris Larsen from donating US$1 million worth of XRP tokens to Future Ahead, a brilliant PAC supporting Harris’ run.

2. Chip shares detect export cap stories

A Monday afternoon report from Bloomberg revealed that the US authorities is contemplating capping gross sales of superior synthetic intelligence (AI) chips from American corporations to sure nations.

Sources accustomed to the matter reported that the transfer could be made within the curiosity of nationwide safety and that officers are targeted on nations positioned within the Persian Gulf, together with the United Arab Emirates and Saudi Arabia.

Each nations have invested heavily in AI, together with important contributions from the United Arab Emirates’ Mubadala Funding Agency to Anthropic, and Saudi Arabia’s reported US$40 billion investment fund, which was established in partnership with Andreessen Horowitz.

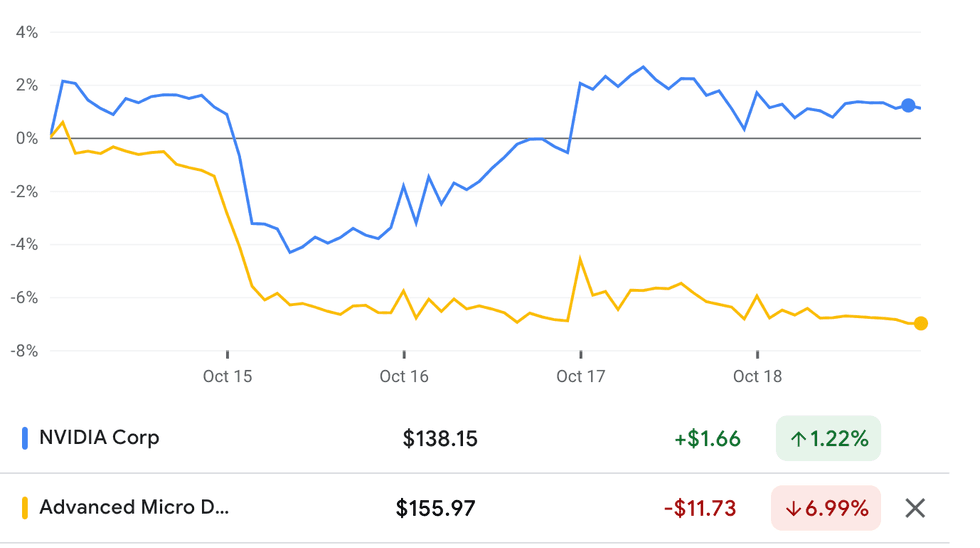

Chart through Google Finance.

NVIDIA and AMD efficiency, October 14 to 18, 2024.

Shares of NVIDIA (NASDAQ:NVDA) fell by over 4 p.c on Tuesday (October 15), the day after the report’s launch.

Solely someday earlier, the corporate reached its highest closing worth since June, pushed by constructive chip {industry} sentiment. Shares of AMD (NASDAQ:AMD), one in all NVIDIA’s prime rivals, additionally fell by over 4 p.c on Tuesday morning.

In line with Bloomberg, officers from the Bureau of Business and Safety, a spokesperson for the White Home Nationwide Safety Council and representatives from Intel, AMD and NVIDIA have all declined requests to remark.

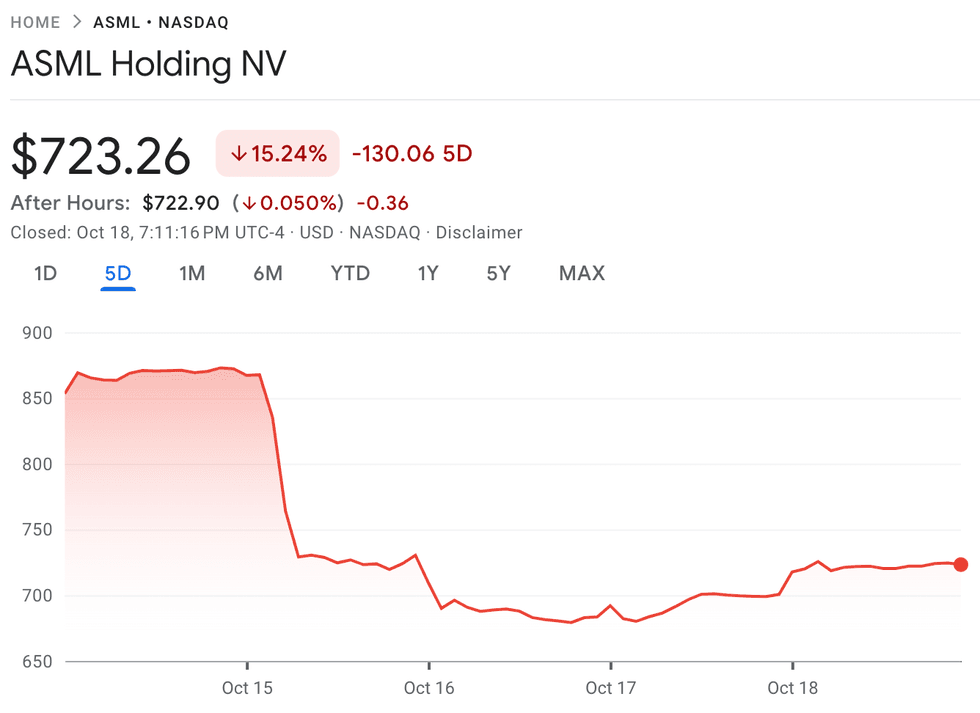

3. ASML’s Q3 outcomes fall flat

On Tuesday, ASML (NASDAQ:ASML) mistakenly its Q3 outcomes someday forward of schedule, revealing lowered gross sales expectations from round 40 billion euros to 35 billion in 2025.

The corporate additionally missed income expectations for the quarter by greater than half, prompting an almost 16 p.c decline in its share worth for the week and erasing roughly 50 billion euros from its market cap.

“Whereas there proceed to be robust developments and upside potential in AI, different market segments are taking longer to recuperate. It now seems the restoration is extra gradual than beforehand anticipated. That is anticipated to proceed in 2025, which is resulting in buyer cautiousness,” stated ASML CEO Christophe Fouquet in a press launch.

Chart through Google Finance.

ASML efficiency, October 14 to 18, 2024.

The impression of ASML’s outcomes despatched shockwaves by the semiconductor {industry}, as ASML is a key provider to most of the world’s largest chipmakers. Shares of ASML’s main buyer, TSMC, additionally fell about 3.3 p.c in early buying and selling on Tuesday, two days forward of the corporate’s personal third quarter launch. Intel (NASDAQ:INTC), which has already seen its market share dwindle this yr, and Samsung (KS:5930) additionally noticed their share costs fall by over two p.c every, contributing to an in depth 5.1 p.c decrease for the Philadelphia Semiconductor Index.

Analysts attributed ASML’s lowered gross sales expectations to a number of components, together with slower-than-expected demand for logic and reminiscence chips and potential export controls in China. “Logic foundries are ramping up new nodes at a slower tempo than anticipated, and ASML is seeing little capability additions in reminiscence up to now,” Morningstar analyst Javier Correonero wrote on October 16 chopping ASML’s honest worth estimate from 900 euros to 850 euros.

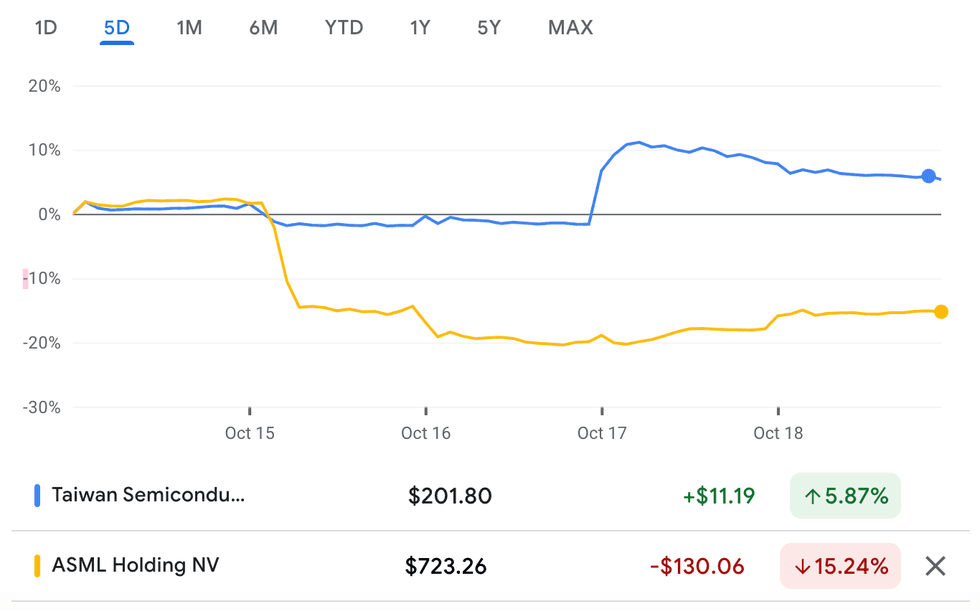

4. TSMC raises income progress goal

TSMC (NYSE:TSM) posted better-than-expected Q3 results on Thursday (October 17), elevating its goal for income progress to round US$26 billion from US$22.4 billion – US$23.2 billion as reported in Q2.

Third-quarter earnings elevated by 39 p.c year-on-year to roughly US$23.5 billion, representing progress of almost 13 p.c in comparison with the earlier quarter. Internet earnings additionally elevated by a formidable 31.2 p.c. Given the corporate’s robust income report for September, launched final week, the market anticipated a constructive report. Buyers despatched the corporate’s inventory worth above US$200 for the primary time this yr on Thursday morning forward of the discharge.

Chart through Google Finance.

TSMC and ASML efficiency, October 14 to 18, 2024.

“Our enterprise within the third quarter was supported by robust smartphone and AI-related demand for our industry-leading 3nm and 5nm applied sciences,” stated Wendell Huang, Senior VP and Chief Monetary Officer of TSMC.

“Shifting into (the) fourth quarter 2024, we count on our enterprise to proceed to be supported by robust demand for our modern course of applied sciences,” stated the corporate’s CFO and Senior vice chairman, Wendell Huang.

Shares of TSMC’s two largest prospects, NVIDIA and Apple, additionally acquired a lift following the discharge of the report. Apple’s (NASDAQ:AAPL) share worth opened 1.75 p.c greater when the markets opened on Friday (October 18) and is up 2.66 p.c for the week. NVIDIA, which suffered a setback at the beginning of the week after stories surfaced that the US authorities doubtlessly limiting exports of its GPUs to sure nations on the Persian Gulf, opened 2.63 p.c greater forward of the report’s launch on Thursday morning. NVIDIA’s share worth is up 1.11 p.c for the week.

5. Google, Amazon signal nuclear energy offers

Final month, Microsoft (NASDAQ:MSFT) announced plans to supply power for its knowledge facilities from nuclear energy, signing a multi-year buy settlement with Constellation Vitality (NASDAQ:CEG). Now, Google and Amazon are the most recent Large Tech corporations to look to nuclear power to fulfill their rising power wants.

On Monday, Google signed an agreement to buy nuclear power from a number of small modular reactors (SMRs) that shall be developed by Kairos Energy. The deal is a part of Google’s efforts to succeed in its formidable net-zero targets.

The primary SMR is about to return on-line by 2030, with extra deployments scheduled by 2035.

Amazon made a similar announcement on Wednesday (October 16), signing three agreements with Vitality Northwest, X-Vitality and Dominion Vitality (NYSE:D) to assist the buildout of SMRs in Virginia and Washington.

Do not forget to comply with us @INN_Technology for real-time information updates!

Securities Disclosure: I, Meagen Seatter, maintain no direct funding curiosity in any firm talked about on this article.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.