Since its IPO roadshow greater than a decade in the past, electrical automobile pioneer and kingpin Tesla (TSLA) has been one of the vital controversial, dramatic, and unstable shares on Wall Road. Earlier than the corporate went public, monetary TV character Jim Cramer had already solid doubt on the EV-maker. To Jim’s protection, there had not been a extremely profitable U.S. auto start-up in a century, not to mention an EV-maker. Worse, Tesla was unprofitable, and the economic system was nonetheless reeling from the worst monetary disaster since The Nice Despair.

However, Tesla has defied the skeptics and has gained greater than 17,000% since its inception. The meteoric long-term inventory efficiency has propelled Tesla to have the most important market cap forward of worldwide automaker juggernauts like Toyota (TM), Ferrari (RACE), Normal Motors (GM), and Ford (F). Nonetheless, when evaluating main automakers primarily based on income, Tesla falls to the eleventh spot. In the meantime, the inventory has retreated considerably since reaching a split-adjusted all-time excessive of $414.50 in November 2021. Are Tesla’s greatest days behind it, or is the correction a chance?

To reply that query, let’s take a look at the important thing catalysts and knowledge factors:

Tesla Valuation

Essentially the most distinguished bearish argument for TSLA has been and continues to be, its valuation. Bears could ask, “Why ought to Tesla have the most important market cap when it generates nowhere close to the most important income?”

I attribute two causes to the premium on Tesla shares:

1. TSLA EPS Progress and Profitability: Traders are prepared to pay a premium for a corporation that’s rising quickly and is predicted to sooner or later. For instance, GM earned a gross revenue of ~19 billion in 2023 after being in enterprise for 115 years. In the meantime, TSLA’s gross revenue of $13.4 billion was not far behind GM. In different phrases, Tesla has proven the flexibility to develop quicker than its rivals and steal market share.

Picture Supply: Zacks Funding Analysis

2. Tesla is greater than a Automobile Firm: Tesla skeptics usually overlook the truth that Tesla has its fingers in a number of fast-growing companies, reminiscent of photo voltaic and clear power, EV charging ports, and its Full-Self-Driving (FSD) know-how. All else equal, tech firms take pleasure in larger valuations than automakers – TSLA has each.

Robotaxi and FSD Will Decide Tesla’s Success

Tesla skeptics say that Elon Musk blows scorching air into the market, pumps his inventory, and doesn’t again up his phrases. Nonetheless, utilizing historical past as a precedent, I’d push again on that assumption. CEO Elon Musk has defied the naysayers each step of the way in which, from the success of the Mannequin S to the low-cost Mannequin 3. On the identical time, Elon’s ambitions have usually appeared like pipedreams. However, it’s not possible to argue that he has not produced immense shareholder worth.

Although Elon Musk has produced outcomes, these outcomes are usually not all the time in sync along with his timelines. Walter Isaacson’s “Elon Musk” biography offers many examples of this phenomenon. The most recent instance is the extremely anticipated Robotaxi occasion, which has been pushed again twice thus far. Lastly, it seems Musk and the Tesla staff will unveil the Robotaxi on the Warner Brothers campus on October 10th.

How groundbreaking is Tesla’s Full-Self Driving (FSD) Robotaxi?

Elon Musk has stated that he’s betting the corporate on it and TSLA shares could possibly be price $5 trillion by 2030. Robotaxis may make the corporate and its vehicles extraordinarily invaluable as a result of TSLA house owners may flip their vehicles into ridesharing mediums like Uber (UBER) without having to be within the automotive Tesla would seize a chunk of this income. Although Tesla is locked in a troublesome battle for Robotaxi supremacy with Alphabet (GOOGL) owned Waymo, there may be possible room out there for each firms to prosper. Moreover, a research by ARK Make investments discovered that Tesla’s FSD know-how is 18x safer than the common U.S. automotive.

Picture Supply: ARK Make investments

Decrease Curiosity Charges: A Bullish Catalyst for Tesla

Elon Musk has criticized the Federal Reserve for not chopping rates of interest sooner. That stated, late final month Fed Chair Jerome Powell confirmed price cuts for the upcoming September FOMC. Decrease charges cut back the price of borrowing, making it cheaper for customers to finance high-priced purchases like EVs.

Cybertruck in Manufacturing

Late final yr, Tesla’s futuristic area ship-like Cybertruck started to be delivered to shoppers in North America. I’ve already seen quite a few Cybertrucks in my house of Miami, however as the corporate will increase and attains extra environment friendly manufacturing, Cybertruck will change into extra prevalent all through North America. In the meantime, Tesla has a Cybertruck tour deliberate for Asia, which suggests the corporate will ultimately develop its gross sales areas.

Tesla Gross sales Present Indicators of a China Restoration

China is the most important market on the earth, accounting for greater than 50% of worldwide EV gross sales. Although Tesla has a presence in China, its gross sales have lagged just lately as a result of robust competitors and a weak Chinese language economic system. However, Tesla’s August gross sales would possibly mark the turning level for its Chinese language enterprise. Its greater than 60,000 gross sales for August trounced July gross sales by 37% and marked the strongest month of 2024.

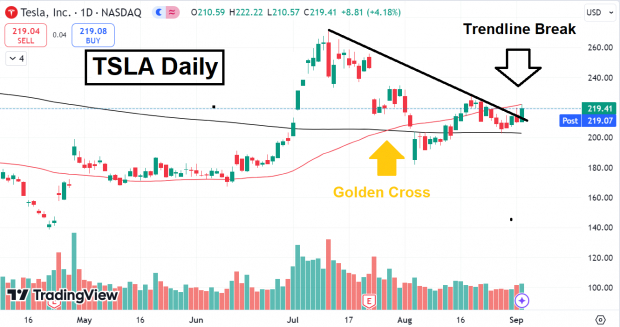

Tesla Technical Evaluation

TSLA shares have just lately triggered two very bullish indicators. First, TSLA cleared a downtrend line courting again to July. Second, the 50-day crossed above the 200-day shifting common, triggering a “Golden Cross.”

Picture Supply: TradingView

Conclusion

Because the Tesla IPO, Elon Musk and his staff have defied the chances and proved the skeptics flawed. Although Tesla has gone by way of a tough patch just lately, a number of indicators that recommend TSLA can be a prime performer into 2025.

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to realize +100% or extra in 2024. Whereas not all picks will be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

Many of the shares on this report are flying beneath Wall Road radar, which offers an important alternative to get in on the bottom ground.

Today, See These 5 Potential Home Runs >>

Ford Motor Company (F) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Ferrari N.V. (RACE) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.