Final week’s market motion was bookended by bearish information shocks in two of the bull’s delicate areas – AI capital prices and tariffs. The outcome was a revealing week of worth motion that concluded with bearish patterns in a number of key indexes.

Keith covers the technical help for the bullish and bearish arguments of the market’s well being utilizing all the symptoms in Huge View in his weekly market evaluation video.

Should you’re a discretionary dealer, the market’s worth motion relative to the information movement was very revealing with respect to which segments of the market are bullish vs. fragile.

Moreover, the shut of the primary month of the yr is likely one of the most generally adopted, however hardly ever do traders reap the benefits of January’s capacity to assist handle threat and establish buying and selling entry factors as we’ll cowl under.

Now think about the truth that earnings season is in full swing, and there’s quite a bit for traders to digest.

Hold It Easy

Right here’s what you’ll hear from the usual “so goes January” evaluation, and we might agree…

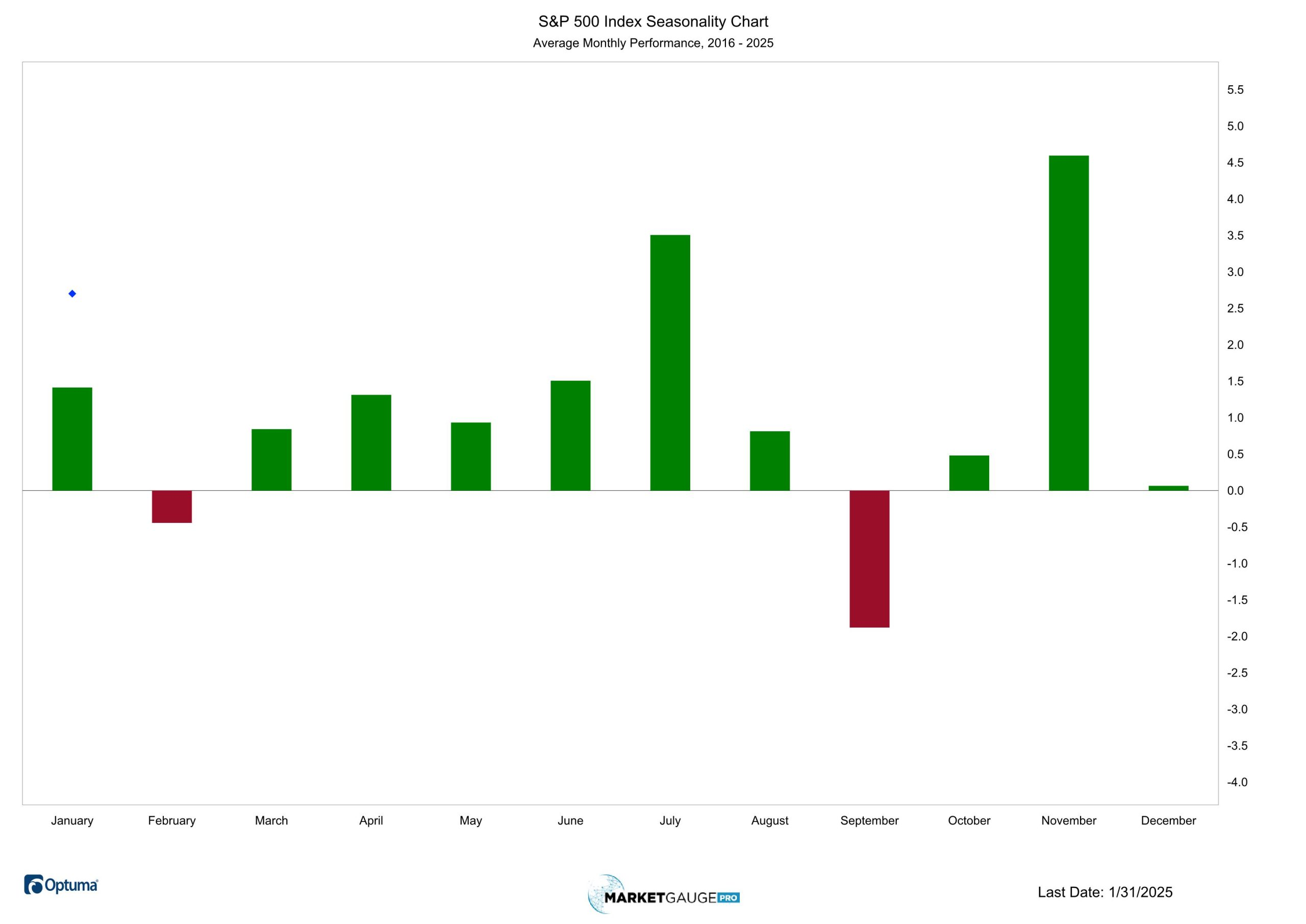

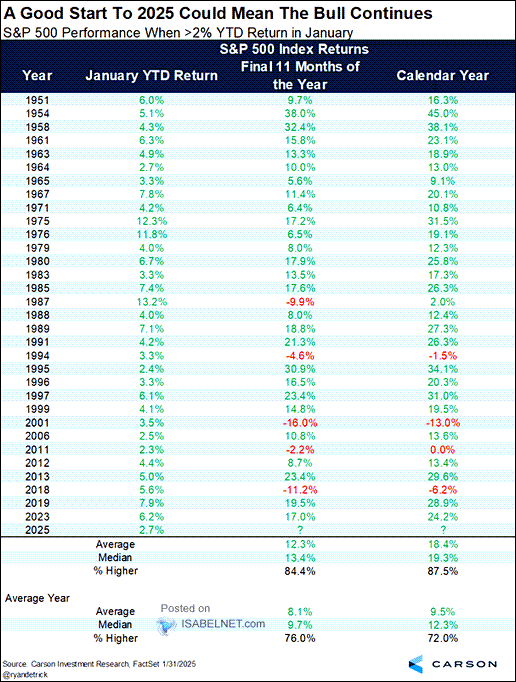

When January is constructive, the yr tends to be constructive. The chart under does an excellent job of illustrating not solely that statistic but in addition the facility of a pattern.

Beneath you’ll see extra detailed and date-specific knowledge to help the identical “January is an indicator for the yr”.

Easy And Exact

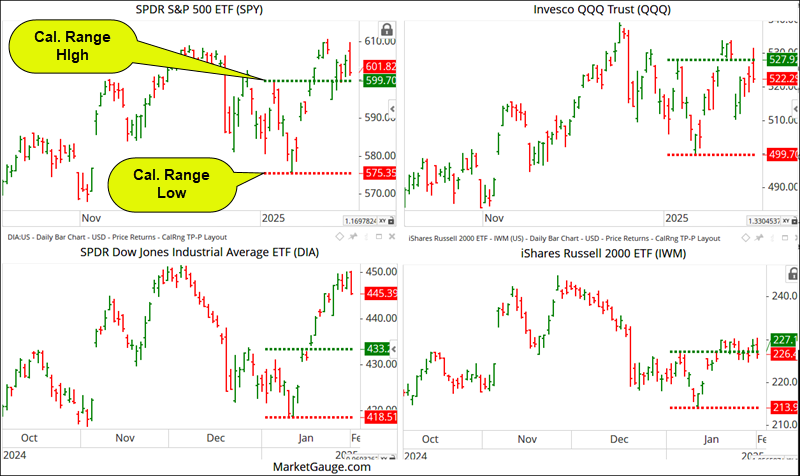

We’d counsel, as we’ve been demonstrating over the past month, that slightly than assume the market will proceed greater, use our January Calendar Vary and even the entire month’s vary to outline the inflection factors at which you think about the market to be really trending greater (or decrease for the yr).

This can be a good suggestion just because February is likely one of the market’s least bullish months of the yr. As you’ll be able to see within the chart under, over the past 10 years, the typical return has been damaging. The identical sample exists over the past 50 years. Should you’re a premium Huge View member, you’ll find seasonal charts like this in Huge View’s Seasonality part.

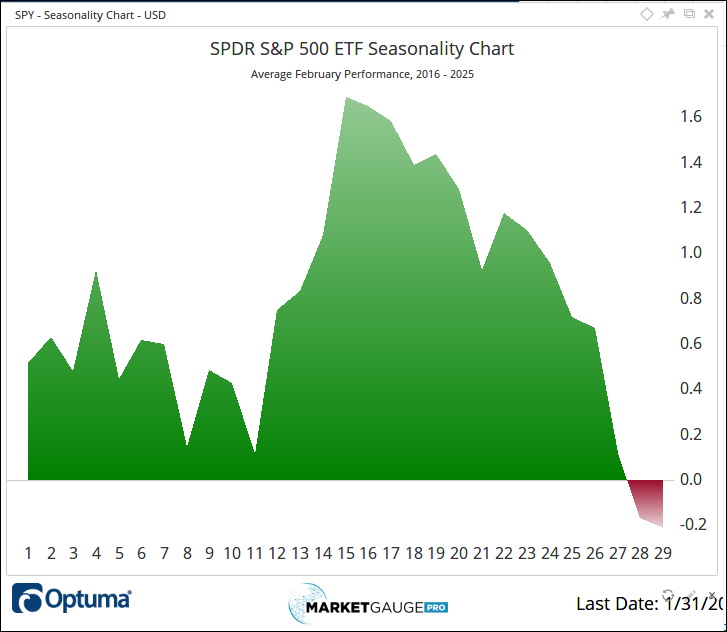

For what it’s value, the primary half of the month has a bullish monitor document. As you’ll be able to see within the chart of intra-month day by day efficiency throughout February under. The final half of the month is chargeable for the month’s weak efficiency.

Should you’ve been following our use of the January Calendar Vary in Mish’s Every day or right here (), then you must know there are a number of easy buying and selling ways primarily based on the vary that was outlined by the month’s excessive and low main as much as Jan seventeenth.

January Calendar Ranges

Beneath you’ll see the January Calendar Ranges on the most important indexes.

Notice that and haven’t been capable of affirm a breakout and are nonetheless beneath the vary excessive. If strikes decrease, it’s going to even be beneath its Calendar Vary excessive.

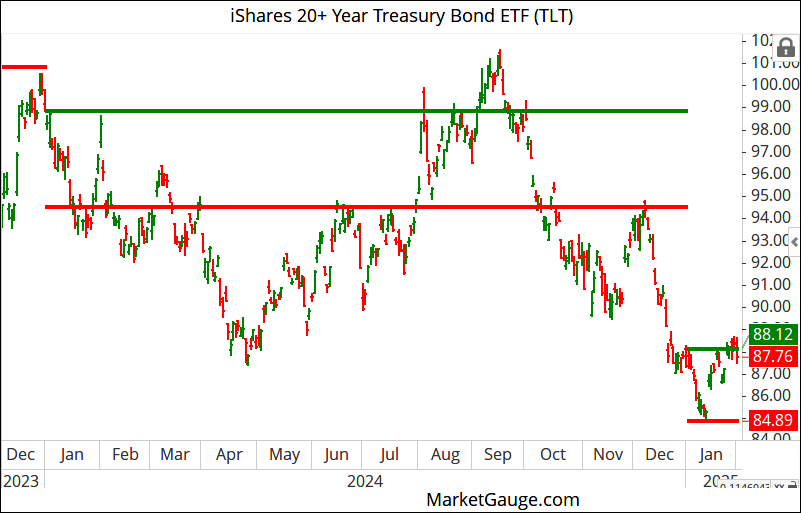

iShares 20+ Yr Treasury Bond ETF (NASDAQ:), proven under, has additionally tried and failed to interrupt out of its January Calendar Vary.

Discover within the chart above how pivotal the purple and inexperienced January Calendar Ranges had been in TLT in 2024.

January is off to a really robust begin, and as you’ll be able to see within the desk under, when the has been up over 2% in January, 84% of the time it has closed the yr greater with a median achieve from its January shut of over 12%.

The DeepSeek Plunge Revealed The Market’s Power

The markets plunged on Monday in worry that the Chinese language AI firm had demonstrated that U.S. massive tech, semiconductor-related, and utility corporations with AI publicity may be overspending on AI cap-x, be much less aggressive, and extra.

When markets have damaging outsized reactions to industry-specific information, the information occasion day’s vary creates a possibility to let the market establish the sectors and shares that traders are bullish on.

Monday’s vary can now be used because the vary for a lot of shares and sectors that may outline a bullish bias above the vary and a bearish bias under it.

Monday’s weak point additionally demonstrated a broadening power available in the market by the truth that the equal-weighted S&P 500 Index () closed greater for the day.

Nonetheless, similar to a Calendar Vary, the message of the market is within the follow-through. Shares or sectors that commerce greater than their Monday vary have a bullish edge, whereas shares buying and selling under their Monday low could also be suggesting they’re headed decrease.

Mish coated this idea in her Mish’s Every day on Monday and we additionally coated it in our weekly video on Monday.

The low of Monday turned out to be the low for the week for the indexes and plenty of sectors, so this stage can be utilized as a possible bearish inflection level.

That is significantly true in NVIDIA (NASDAQ:) and VanEck Semiconductor ETF (NASDAQ:) as a result of a break of final week’s low would even be essentially the most important break under the 50-week transferring common since 2023.

What Can We Study From Tariff Information

Similar to the DeepSeek market response, there’s an instantaneous response after which a follow-through or reversal. Friday afternoon, many indexes, sectors, and shares had been buying and selling close to their day by day and weekly highs when the White Home confirmed that 25% tariffs for Canada and Mexico, and a ten% tariff for China, would start tomorrow.

The market’s sell-off in each shares and bonds was constant and decisive for the remainder of the day. That is clearly a bearish, however was it an overreaction?

Monday’s worth motion would be the follow-through transfer (if down) or a reversal. It could be troublesome to find out the affect of tariffs vs. the potential significance of PMI knowledge and earnings experiences.

Earnings Season

With 36% of the S&P 500 having reported earnings, the outcomes are the very best year-over-year earnings progress fee for This fall 2024 in three years.

This week 131 of the S&P 500 corporations will report earnings (together with 5 parts), so that is prone to transfer markets.

Nonetheless, the month-to-month Unemployment report on Friday is prone to get essentially the most consideration.

Hold your eyes on the necessary ranges within the indexes, sectors and bonds. Be affected person if there’s weak point.