Earnings season continues to roll alongside, with the interval primarily reflecting positivity.

And all through the interval, a number of firms, together with Netflix NFLX, Palantir PLTR, and Royal Caribbean RCL, have knocked it out of the park, with the outcomes of every notably bullish and inflicting share spikes post-earnings.

Let’s take a more in-depth take a look at the outcomes for these seeking to trip the momentum.

Netflix Subs Preserve Rising

Netflix shares have been scorching over the previous yr on the again of sturdy quarterly outcomes, gaining 80% in comparison with the S&P 500’s 23% acquire. Its newest set of outcomes added to the positivity, with continued person development and tailwinds from ad-supported memberships pleasing buyers.

Regarding key metrics within the print, Paid Internet Membership Additions all through the interval reached a large 18.9 million, crushing our consensus estimate of 9.1 million handily. As proven under, subscriber additions for Netflix have remained rock-solid, exceeding our consensus estimate in seven consecutive releases.

The favorable reads on subscriber additions have fueled the inventory’s bullish run over the previous yr, with margin enlargement additionally brightening its profitability image.

Picture Supply: Zacks Funding Analysis

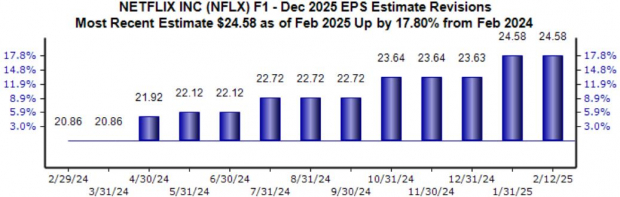

The inventory at present sports activities a good Zacks Rank #2 (Purchase), with the revisions pattern for its present fiscal yr shifting larger following its newest outcomes. EPS is forecasted to soar 25% in its present fiscal yr.

Picture Supply: Zacks Funding Analysis

Royal Caribbean Sees Document Bookings

Royal Caribbean Cruises is a cruise firm that owns and operates three world manufacturers: Royal Caribbean Worldwide, Movie star Cruises, and Azamara Membership Cruises. Its current set of outcomes have been underpinned by continued energy in client demand, a longtime pattern over the previous few years general.

Regarding headline figures within the launch, adjusted EPS of $1.63 exceeded the corporate’s prior steering, whereas gross sales of $3.8 billion grew 11% year-over-year. RCL’s gross sales development has been stellar post-pandemic, as we are able to see within the annual chart under.

Picture Supply: Zacks Funding Analysis

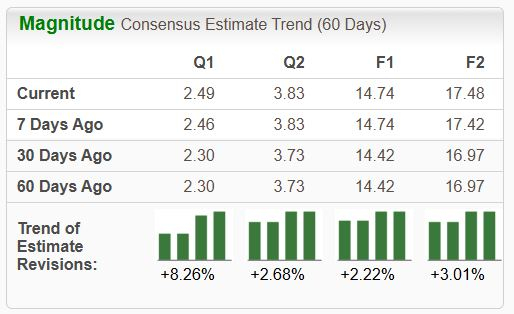

The corporate supplied optimistic steering for its FY25, with WAVE season bookings off to a file begin. Analysts have already dialed their earnings estimates larger following the favorable print, touchdown the inventory right into a bullish Zacks Rank #2 (Purchase).

Picture Supply: Zacks Funding Analysis

Palantir Once more Posts Strong Outcomes

Palantir’s outcomes got here in sturdy but once more, exceeding headline expectations and posting severe development. Gross sales of $828 million shot 36% year-over-year and, extra impressively, 14% sequentially. The sturdy gross sales development was headlined by a 43% transfer larger in Buyer rely, reflecting the snowballing demand the corporate has been witnessing.

Palantir additionally closed a record-setting $803 million of U.S. business complete contract worth (TCV), which shot 130% larger year-over-year and 170% sequentially. U.S. outcomes have been jam-packed with positivity, with Business and Authorities income rising by 64% and 45%, respectively.

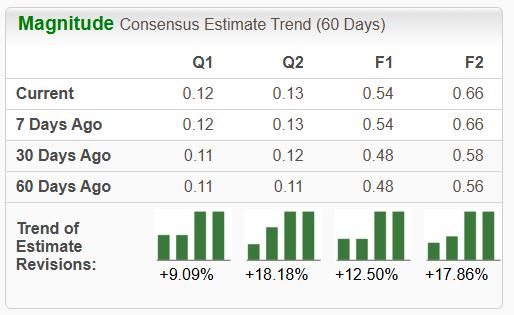

Continued sturdy outcomes have led shares to an impressive 365% acquire during the last yr, crushing the S&P 500. Given the persistently sturdy demand, it’s affordable to anticipate additional share momentum, with the inventory additionally sporting a good Zacks Rank #2 (Purchase).

Picture Supply: Zacks Funding Analysis

“Our enterprise outcomes proceed to astound, demonstrating our deepening place on the middle of the AI revolution. Our early insights surrounding the commoditization of enormous language fashions have advanced from idea to reality,” mentioned CEO and co-founder Alexander Karp.

Backside Line

The This fall reporting cycle continues to be considered one of positivity, with many firms exceeding expectations and offering favorable outlooks.

And all through the interval, all three firms above – Netflix NFLX, Palantir PLTR, and Royal Caribbean RCL – posted notably sturdy outcomes.

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our staff of consultants has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This high decide is among the many most revolutionary monetary corporations. With a fast-growing buyer base (already 50+ million) and a various set of innovative options, this inventory is poised for large beneficial properties. After all, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.