Sturdy money flows replicate monetary stability, permitting firms to pay down debt, pursue development alternatives, and shell out dividend funds.

These firms are additionally higher outfitted to climate an financial downturn, offering one other useful benefit for traders from a long-term standpoint.

And for these thinking about investing in robust money flows, three firms – Apple AAPL, Broadcom AVGO, and Visa V – are all cash-generating machines. Let’s take a more in-depth have a look at every.

Broadcom

Broadcom has rapidly risen to the highest regarding AI gamers, with its newest set of quarterly outcomes confirming strong demand. Its FY24 simply ended, with annual income of $51.6 billion reflecting a brand new file and rising 44% year-over-year on the again of robust demand for its options.

The inventory at present sports activities a positive Zacks Rank #2 (Purchase), with its earnings outlook shifting bullishly throughout the board following its newest set of robust quarterly outcomes. It reported free money movement of $5.5 billion all through its newest interval, exhibiting 15% development year-over-year.

Picture Supply: Zacks Funding Analysis

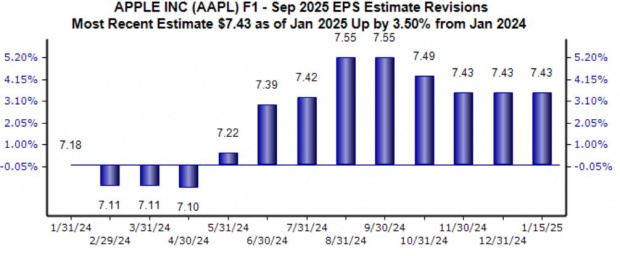

Apple

Apple has additionally been getting consideration through the AI frenzy due to Apple Intelligence, which has been carried out into the most recent iPhone fashions. The mega-cap titan posted free money movement of $16.5 billion in its newest launch, owing to its nickname of the ‘Money King’.

The EPS outlook for its present fiscal 12 months largely stays optimistic, with the $7.43 per share estimate suggesting 10% development year-over-year.

Picture Supply: Zacks Funding Analysis

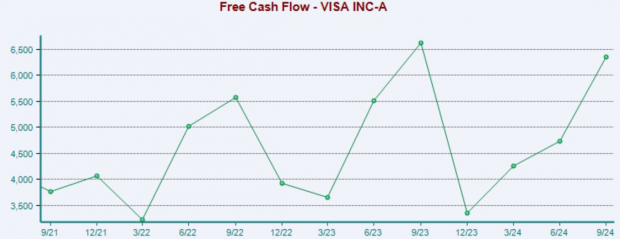

Visa

Funds titan Visa is equally recognized for its robust cash-generating skills, with the outlook for its present fiscal 12 months additionally reflecting positivity. The $11.23 per share estimate for its present fiscal 12 months suggests an 11% enchancment, persevering with a longtime pattern.

The monetary big posted free money movement of $6.3 billion in its newest quarterly launch, 34% larger year-over-year.

Picture Supply: Zacks Funding Analysis

Backside Line

Corporations boasting robust cash-generating skills will be nice investments, as they’ve loads of money to gas development, pay out dividends, and simply wipe out debt.

And as talked about above, these firms are higher outfitted to deal with an financial downturn, undeniably a optimistic.

For these searching for cash-generators, all three above – Apple AAPL, Broadcom AVGO, and Visa V – match the standards properly.

Zacks Names #1 Semiconductor Inventory

It is only one/9,000th the scale of NVIDIA which skyrocketed greater than +800% since we beneficial it. NVIDIA remains to be robust, however our new high chip inventory has far more room to increase.

With robust earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. International semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Apple Inc. (AAPL) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.