Earnings investing is a normal design in the marketplace, with market individuals intending to gain an easy revenue stream and also expand their financial investments with rate recognition.

And also when it concerns rewards, several have actually become aware of the Reward Aristocrats. It’s an elite club containing only business that are S&P 500 participants and also have actually boosted their returns payments for a minimum of 25 successive years.

Remarkably sufficient, a number of business– Qualcomm QCOM, Analog Tools ADI, and also W.R. Berkley WRB– are nearby from rupturing right into the club. Allow’s take a more detailed take a look at every one.

Qualcomm

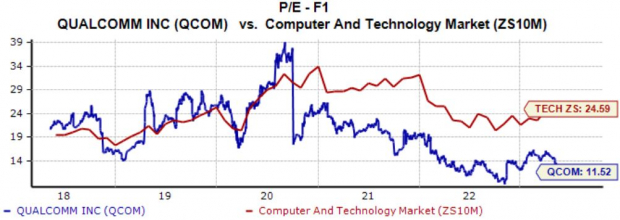

Qualcomm styles, produces, and also markets electronic cordless telecommunications product or services based upon the Code Department Several Gain Access To (CDMA) innovation. Presently, QCOM’s yearly returns returns 2.8%, greater than triple the Zacks Computer system and also Modern technology industry standard.

Picture Resource: Zacks Financial Investment Research Study

Furthermore, QCOM shares are economical on a family member basis, with the existing 11.5 X ahead revenues numerous resting no place near the 20.3 X five-year average and also the Zacks industry standard.

The supply currently brings a Design Rating of “B” for Worth.

Picture Resource: Zacks Financial Investment Research Study

Analog Instruments

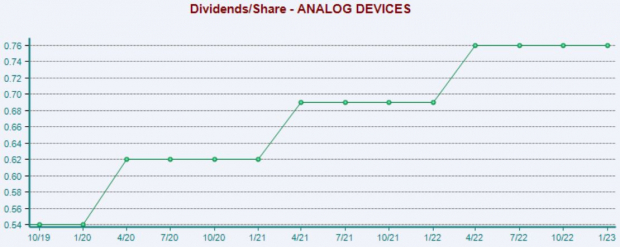

Analog Tools is an initial devices producer of semiconductor gadgets, particularly analog, mixed-signal, and also electronic signal-processing incorporated circuits. Remarkably, the business has actually expanded its payment by 12% over the last 5 years.

Picture Resource: Zacks Financial Investment Research Study

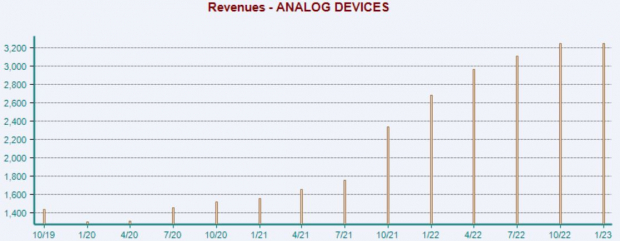

ADI flaunts an excellent revenues performance history, surpassing the Zacks Agreement EPS and also Sales quotes in 11 successive quarters. In its most current launch, the semiconductor gamer published a 3.5% EPS beat and also reported profits 3.5% in advance of assumptions.

Picture Resource: Zacks Financial Investment Research Study

W.R. Berkley

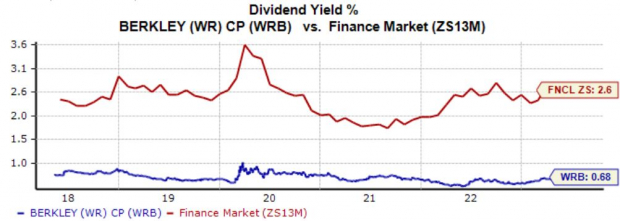

W.R. Berkley is a leader in industrial lines insurance coverage split right into 2 sections: Insurance coverage and also Reinsurance and also Monoline Excess. Presently, the business’s yearly returns returns 0.7%, certainly on the reduced end of the range.

Still, the business’s 10% five-year annualized returns development price aids get the slack in a large method.

Picture Resource: Zacks Financial Investment Research Study

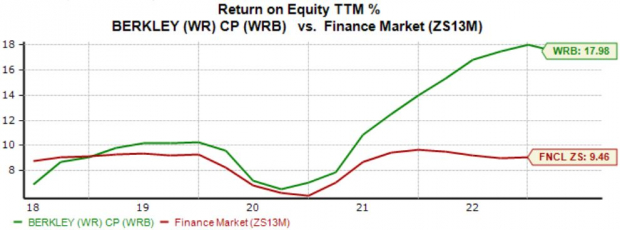

Furthermore, it’s difficult to overlook the business’s 18% trailing-twelve-month return on equity (ROE), showing a greater degree of producing benefit from existing possessions about the Zacks Financing industry standard.

Picture Resource: Zacks Financial Investment Research Study

Profits

Earnings financiers frequently target Reward Aristocrats, as these business have actually shown a dedication to significantly awarding their investors.

And also all 3 supplies above– Qualcomm QCOM, Analog Tools ADI, and also W.R. Berkley WRB– get on track to sign up with the elite club.

Free Record: Top EV Battery Supplies to Acquire Currently

Just-released record discloses 5 supplies to make money as countless EV batteries are made. Elon Musk tweeted that lithium costs have actually mosted likely to “ridiculous degrees,” and also they’re most likely to maintain climbing up. Consequently, a handful of lithium battery supplies are readied to escalate. Gain access to this record to find which battery supplies to purchase and also which to prevent.

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views revealed here are the sights and also point of views of the writer and also do not always show those of Nasdaq, Inc.