Sweetgreen (NYSE: SG) is a salad restaurant chain that went public in 2021. At first of 2024, it was down practically 80% from its worth when it went public. It appeared that the investor group had zero urge for food for this salad inventory. However 2024 was a unique story solely. By November, the inventory had greater than tripled in 2024.

Sweetgreen inventory gave up some positive aspects to finish the 12 months. But it surely nonetheless had a formidable run. Furthermore, shares of Reddit (NYSE: RDDT) and IonQ (NYSE: IONQ) have had equally spectacular runs, with each of these shares greater than tripling in worth in 2024.

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

Here is why these three shares did so effectively in 2024 and which one which I consider will do one of the best in 2025.

Sweetgreen: up 184%

Sweetgreen was a high-growth enterprise when it went public, however its losses have been an excessive amount of for buyers’ liking. Administration started addressing this concern on the finish of 2023 by casting imaginative and prescient for its Infinite Kitchen mannequin. And buyers appear to be shopping for into that imaginative and prescient in 2024.

The Infinite Kitchen is all about automation. By kitchen tech, salad bowls will be principally ready by robotic machines. And this can be a large deal.

Take into account that via the primary three quarters of 2024, the corporate spent 28% of its income on labor and associated bills — its largest working expense. If robotics can decrease this expense, it will have a profound influence on income.

The Infinite Kitchen imaginative and prescient is barely simply now reaching an early inflection level. Sweetgreen began its third quarter with solely two restaurant areas out of 225 outfitted with the automation enhancements. However by the tip of the third quarter, it had 10 eating places with the Infinite Kitchen. As this scales up in 2025 and past, buyers are hopeful that income will rise, which is why the inventory jumped in 2024.

Income development is slowing as the corporate focuses on income — it is opening new eating places extra slowly. However its earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) are already going up, and the Infinite Kitchen tailwind hasn’t even actually began but.

SG operating revenue (quarterly YoY growth); knowledge by YCharts; TTM = trailing 12 months.

Reddit: up 224%

The 224% leap for Reddit inventory is especially spectacular contemplating it did not have the whole 12 months to work with — its initial public offering (IPO) was in March. However the firm’s financials are just too spectacular to disregard.

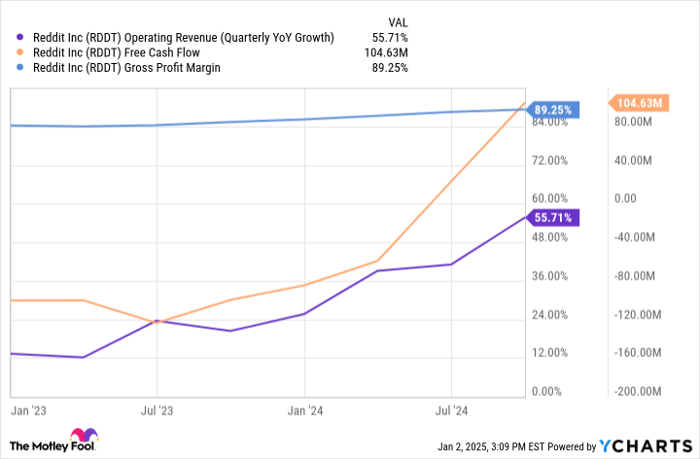

Over the previous two years, the social networking firm’s top-line development has been accelerating — that is a comparatively uncommon funding alternative. Within the third quarter, it grew income by 68% 12 months over 12 months to $348 million. Briefly, it is added hundreds of thousands of latest customers and promoting demand is up, resulting in the outsize development.

It is extra than simply top-line development. The already spectacular gross margin has additional improved and surpassed 90% within the third quarter. And with increased income and gross margins, the corporate’s free cash flow is equally surging, because the chart under reveals.

RDDT operating revenue (quarterly YoY growth) knowledge by YCharts. Chart does not replicate third-quarter outcomes.

One of many keys to Reddit’s development has been enlargement into worldwide markets. And the corporate is conducting this by making good use of artificial intelligence (AI) to translate present content material into different languages, driving adoption in these markets.

It is comparatively new. And with solely 49 million customers in worldwide markets, it is one thing that would preserve driving development for a while.

IonQ: up 237%

After a higher than 400% leap within the remaining three months of the 12 months, IonQ inventory tripled in worth throughout 2024, together with a number of different quantum computing stocks. On one hand, it is cheap to view IonQ inventory with some skepticism contemplating the whole area is scorching proper now. However then again, the corporate did have some optimistic developments of its personal in 2024.

The issue with a quantum computing inventory akin to IonQ is that few buyers are consultants within the area. Due to this fact, it is exhausting to know if the corporate’s merchandise are objectively value investing in. For instance, there are totally different approaches to quantum computing with related execs and cons — for its half, IonQ makes use of the trapped ion strategy.

When first-hand data is not enough to know which strategy is finest, it is useful to search for third-party validation. And IonQ has it.

For starters, its {hardware} is offered on the entire main cloud computing platforms, placing it in a category of its personal. Furthermore, the corporate’s merchandise have advocates, together with throughout the U.S. authorities. For instance, the Air Power Analysis Lab not too long ago signed a $55 million contract with IonQ to principally sort out a number of the sensible concerns of deploying quantum computer systems at scale.

As buyers scent a chance with quantum computing, IonQ has emerged as one of the most promising businesses in the space, due to this third-party validation.

And my choose for 2025 is…

Many analysts consider that the quantum computing business shall be valued within the lots of of billions of {dollars} sometime. If IonQ is really on the forefront of the revolution, then it may certainly nonetheless have substantial long-term upside.

For its half, Reddit is rising quick and has barely tapped potential customers in worldwide markets. In truth, with solely round 100 million energetic customers, it is definitely doable for that quantity to quintuple or extra in the long run.

I do not want to say that IonQ inventory or Reddit inventory haven’t got upside potential for 2025. However I consider that the trail to upside in 2025 is extra simple with Sweetgreen inventory resulting from valuation.

Buying and selling at 5 times sales, Sweetgreen is not essentially low-cost for a restaurant inventory with slowing development. That stated, the corporate’s development has slowed because it has positioned a higher emphasis on profitability. If its Infinite Kitchen mannequin improves its unit economics, administration will doubtless lean again into new openings, implementing its robotic automation. Briefly, I count on its outlook to enhance.

Prior to now, the corporate has indicated it may have 1,000 areas sometime as in contrast with fewer than 250 in the present day. The secret’s bringing down working bills to make the mannequin work, which it could possibly be near reaching. That is why Sweetgreen inventory is my prime inventory for 2025 of the three talked about right here.

Don’t miss this second probability at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? You then’ll wish to hear this.

On uncommon events, our knowledgeable staff of analysts points a “Double Down” stock advice for firms that they suppose are about to pop. In case you’re frightened you’ve already missed your probability to take a position, now’s one of the best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Nvidia: when you invested $1,000 once we doubled down in 2009, you’d have $374,613!*

- Apple: when you invested $1,000 once we doubled down in 2008, you’d have $46,088!*

- Netflix: when you invested $1,000 once we doubled down in 2004, you’d have $475,143!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable firms, and there will not be one other probability like this anytime quickly.

*Inventory Advisor returns as of December 30, 2024

Jon Quast has no place in any of the shares talked about. The Motley Idiot recommends Sweetgreen. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.